Fed Chairman Powell is worried about growing US Debt

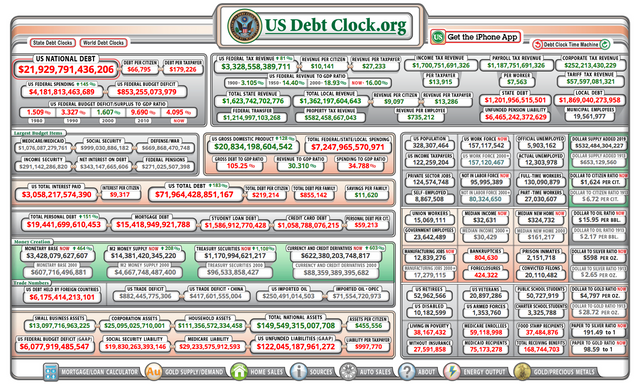

Really dude!!! You're a little late as there are $22 Trillion reasons to worry (that the government admits) and the Fed is the sole enabler of politicians spending money they don't have.

Seriously, politicians get all the blame for coming up with the plans but the Federal Reserve (which is not Federal and has no reserves) finances the whole game. All of this pre debt ceiling trial ballon news clips just put me into a head banging stupor.

To invest in Mene24k Gold Jewerly click Here

To open your own BitShares account, click Here

To open your own Binance account, click Here

To open your own Coinbase account, click Here

Despite his statement, I'm sure that Chairman Powell isn't actually worried about the national debt. As measured in gold, the national debt peaked in 2001 and has declined by about 25% since then. Although it ends in 2015, this chart shows some of the decline: http://pricedingold.com/us-federal-debt/. I've also done some research that implies it has fallen even further since then.

The national debt is a problem for Treasury bond holders and people who have cash sitting in a bank account. Those people suffer when the gold-value of the national debt declines. But because the government does not suffer any negative consequences when it devalues the national debt, it has no incentive to ever stop. So I don't believe Powell when he says he is concerned about it.

He is basically just trying to convince Treasury bond holders not to sell. That way, he and the rest of the US Government can continue to transfer the wealth of these people to the government to spend buying votes. This is nonsense.

I doubt the US has as much Gold in storage as they say they do. I'm guessing a lot of it has been leased out.

Could be. But there is not much gold leasing going on these days. With interest rates at 2-3%, gold miners don't want to hedge...which means there is no one to take the other side of the trade. Bullion banks used to lease gold from central banks, sell it into the spot market, and then buy a futures contract from the miners to cover the lease when it came due. The miners would charge the gold basis to perform this trade, which was always almost equal to the difference between the gold lease rate and the USD interest rate. This allowed miners to be profitable even if the cost of production was higher than the spot price. They were essentially being paid to hold the gold in the ground.

But this is a time when USD interest rates were above 5%. At that rate, miners were willing to do the deal, but when Greenspan pushed rates down to 1% in the early 2000's, the global hedgebook collapsed. Just about nobody wants to hedge now.

So yeah, it could be that the US Government has leased out at least some of its gold. But I'm skeptical of the idea that it is all gone.

But who knows? The bottom line is, holding Treasuries or cash at a time like this is a very risky proposition. Whatever the government is going to do, it's not going to be in the interest of the people who loan it money.

Thank you for your continued support of SteemSilverGold

Yes. And let's go ahead and ask the Pentagon to account for their "missing" TRILLION$ after they failed their audit.

LMAO...talk about being behind the curve.

Posted using Partiko iOS