The $415 Million Elephant In the Room (OKex Futures Unfilled BTCUSD Liquidation)

The $415 Million Elephant In the Room (OKex Futures Unfilled BTCUSD Liquidation)

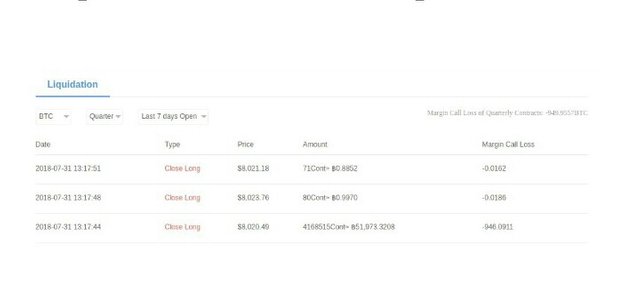

The past couple days, everyone in the bitcoin Futures market has been following the trials and tribulations of Mr. OKex #1 Top Contract Holder, who accumulated a $460 Million Long position on BTCUSD Quarterly Futures before getting liquidated.

My man RJ from Whalepool documented the rise of the $460 Million position https://twitter.com/RobertJandeJong/status/1024180713686491136

…and the fall https://twitter.com/RobertJandeJong/status/1024278308672946176

Great laughs, big dumb rich guy gets rekt being wreckless…

…the only problem is that this liquidation did not get filled in the market, and theres now a $420 Million overhang in this weekly settlement period that impacts all three maturities on BTCUSD Futures: https://twitter.com/whalepool/status/1024366915001769987!

At current prices (~$7850) this will cause -950 BTC in “system losses” (in Futures, the shorts pay the profits of longs and vice versa, so if a bankrupt trader is forced out of position in a low liquidity market, their counterparty is earning profit from a corpse).

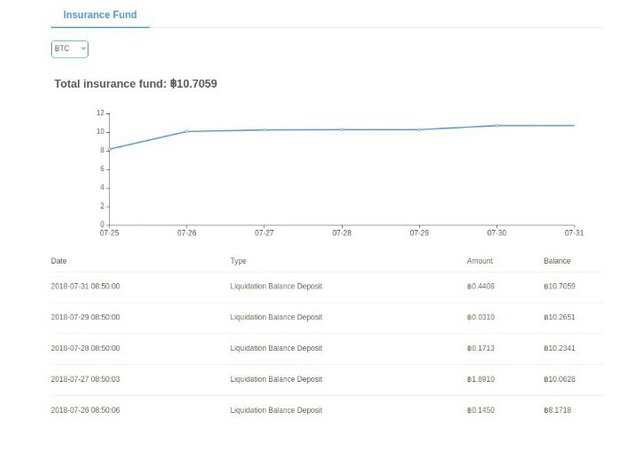

But have no fear, the OKex insurance fund is backing the system as a safeguard, right?

Wrong. The insurance fund (consisting of the maintenance margin salvaged from liquidated traders) has a whopping 10 BTC, which is not quite enough to cover the tab.

As a result, if the price stays at this level, the profitable traders since last Friday until this Friday will have their gains dented by 940 BTC (950 loss minus the 10 BTC of insurance coverage), as per their socialized loss clawback system https://support.okex.com/hc/en-us/articles/360000139652-Forced-Liquidation

This is catastrophic. The open interest of the Quarterly contract is $800 Million now, and more than half of this amount in Short positions has PNL that goes uncovered due to this bankrupt #1 Contract Holder trader. While it is not clear how much profit or loss has been exchanged in this period thus far (plenty of people could open, close positions and earn profit which goes unsettled until Friday), this massive Loss could end up causing the largest clawback in history.

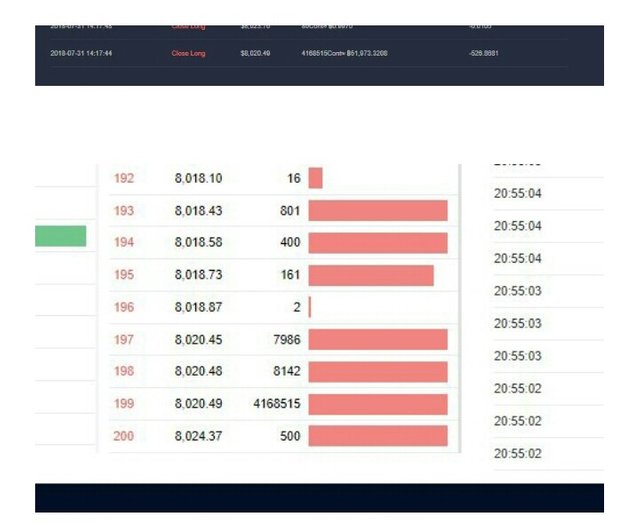

If the market recovers before Friday’s settlement (2018–08–03 16:00:00 Hong Kong Time), then the 4,160,000 Contract Sell wall at $8020.49 (representing the unfilled liquidation) may get filled, which would make the system whole, i.e., 0% clawback. But if the market continues to drop, the loss on the unfilled order will continue to get worse, moving the clawback rate higher and higher (as bad as 40–50% potentially)

In the past, OKCoin (as they were called back then) would make special cases in periods like this to provide some form of a backstop to maintain the integrity of the markets (see example https://np.reddit.com/r/BitcoinMarkets/comments/3snqiq/okcoin_adds_extra_100_btc_into_insurance_fund/

Will they allow a potential huge clawback to occur, and replenish the Insurance Fund to start fresh (and potentially losing lots of traders) or intervene to rectify this specific case?

Finance

Coins mentioned in post: