Bitcoin Mining Pools 101

Bitcoin solo mining has become infeasible many years ago — for individual miners, it’s nearly impossible to concentrate enough hash power at their homes to be able to ever mine at least one block. But if you still want to mine Bitcoin, there is a solution — join a mining pool, a large group of miners who put their computing power together to compete for a mining reward. Whenever a pool mines a block, the reward is distributed proportionally across all participants of the group.

Recently, we published an article on the basics of crypto mining: what’s worth taking in mind before you start, how to calculate profitability, what software and hardware there are, and so on. If you’re new to mining, we recommend you look into that text first.

In the current article, we will cover how mining pools work, what their payout models are, and what large pools deserve your attention.

What Is Bitcoin Mining?

In Bitcoin mining, the latest transactions are put together into blocks, confirmed, and added to the blockchain, while miners are getting rewards for doing this. To get such a right, they have to find a proper block hash, which is a mathematical problem that needs gigantic computing power. The one who finds the valid hash first will receive a 6.25 BTC block reward and transaction fees paid by their senders.

Why Join a Bitcoin Mining Pool?

Separate miners organize into mining pools to merge their computing power and raise the chance of finding a proper hash. If they succeed to mine a block, the pool receives 6.25 BTC and distributes it across users proportionally according to their contribution. Although the reward is shared, the profit for miners in a pool is more predictable than in solo mining — a pool always has a good chance of mining a block and getting the reward, unlike individual miners.

But why does mining a block require so many resources? Bitcoin was built the way that mining difficulty correlates with the network size. In the earliest days of Bitcoin, when it was served by a small network of nodes, a few trials and errors were enough to find a valid block hash. But as the network grew, mining difficulty rose either, and today, mining a single block requires trillions of hashing trials. There is no other way to find a proper hash than trying to hash the block again and again, and that’s why equipment like ASICs emerged to optimize the computational process. However, even single powerful devices like ASICs can’t ensure necessary hashing speed, so miners started to group themselves into pools.

What Are the Payout Models in Crypto Mining Pools?

Mining pools apply different models of distributing rewards and transaction fees among their participants. They have different approaches to paying for shares — an array of hashing solutions that you as a miner submit to the pool. In all models, your reward will among other things depend on how many shares you’ve submitted.

Pay-Per-Share (PPS)

PPS pools pay you for shares as soon as you’ve contributed some — irrespective of whether the pool mines the block or not, so you’ll get rewarded in either case. This makes payouts in the PPS model predictable; however, it’s rarely used in Bitcoin mining.

Pay-Per-Last-N-Shares (PPLNS)

The PPLNS model rewards miners only after a pool finds a block. After the block is mined, the pool looks back and rewards you for the number of shares that you’ve submitted. Payouts in this model are harder to predict: they can fluctuate by 30% for a share depending on how many blocks the pool has found in a given period. However, according to statistics, PPLNS is 5% more lucrative than the predictable PPS and FPPS in the long run.

Pay-Per-Share + (PPS+)

This is a hybrid model of PPS and PPLNS: the block reward is paid like in PPS, whereas transaction fees are spread like in PPLNS. PPS+ works well if the mining pool is large enough and it finds blocks consistently.

FPPS (Full Pay Per Share)

This mode calculates standard block rewards and transaction fees within a certain period of time and distributes them to the participants according to how much computing power they’ve contributed to the pool. FPPS is the most predictable model of payouts and is preferred by miners who don’t like to take too many risks.

Top 8 Mining Pools

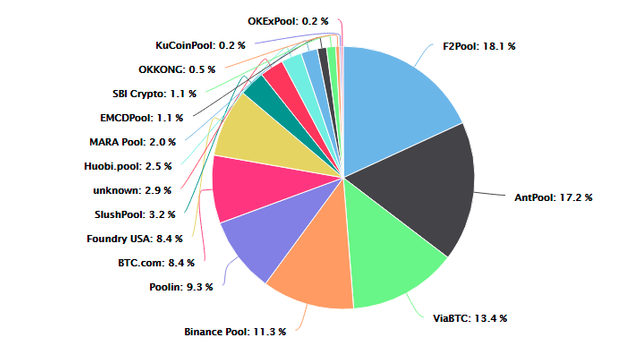

On the BTC.com Pool Stats page, you can find the list of Bitcoin mining pools and the table of their performance. Here’s a chart showing the top pool distribution calculated blocks mined over the past 3 days (as of mid-October, 2021):

1. F2Pool (18.1%)

F2Pool is holding its leadership despite China’s recent crackdown on Bitcoin pools that caused a mass migration of mining facilities from the country. Launched in 2013, this pool boasts a 25.7 EH/s hashrate which allows it to control 18% of the overall Bitcoin network 141.7 EH/s hashrate.

The light interface of F2Pool that is available in a few languages will fit well for beginner miners. The pool offers PPS+ payouts, so rewards are stable and predictable. F2Pool has established itself as a transparent and secure tool for miners.

2. AntPool (17.2%)

Launched in September 2016, AntPool is operated by Bitmain — the world’s largest Bitcoin mining hardware manufacturer, the first one to introduce ASICs. This pool is easy to use, it allows you to choose between PPLNS and PPS payout systems. However, AntPool is known for its lack of transparency and some controversies in the past. As of October 2021, AntPool’s hashrate is 24.4 EH/s, which is a 17.2% share.

3. ViaBTC.com (13.4%)

A relatively young pool launched in 2016, ViaBTC.com has grown significantly over a short period of time. In 2020, it introduced a Bitcoin cloud mining pool that allowed it to raise its user base even more. ViaBTC.com operates in 50 countries, it’s user-friendly, secure, and demonstrates the results of miners’ work in a transparent manner. The pool has a 19 EH/s hashrate (13.4%). The payout models available are PPS+ and PPLNS, which allows users to choose between predictability and risk.

4. Binance Pool (11.3%)

This pool launched in 2020 is a part of the robust Binance ecosystem. Although the exchange’s founder originates from China, Binance Pool was the biggest non-China-based pool. Rather, its headquarters are located in Malta. Binance Pool offers an FPPS payout model, which means block rewards and transaction fees are paid according to the miner’s contribution irrespective of the actual performance of the pool. Binance Pool’s hashrate equals 16.1 EH/s, which gives it an 11.3% share.

5. Poolin (9.3%)

Poolin was launched by the founders of BTC.com in 2017. Today, it’s the world’s fifth-largest pool with a 13.2 EH/s hashrate (9.3%). Its interface is available in multiple languages, gives detailed mining statistics, and is accessible via a mobile app. Poolin offers its users to leverage the FPPS payout model.

6. BTC.com (8.4%)

BTC.com was launched in 2016 by the same founders as Poolin. The pool has a hashrate of 11.9 EH/s. Besides the pool, BTC.com is an ecosystem of products including a wallet where you can buy crypto with fiat, and more.

7. Foundry (8.4%)

Foundry USA was founded only in October 2020 and is the biggest originally American pool on this list. In just 6 months since its launch, it gained control over 8.4% of Bitcoin’s hashrate with 11.9 EH/s. Foundry works with the FPPS payout system and has quickly become popular among Americans and all those who want to challenge China’s dominance in the domain of Bitcoin mining.

8. Slush Pool (3.2%)

Slush Pool controls 3.2% of Bitcoin’s hashrate with 4.5 EH/s, and it is the oldest Bitcoin mining pool launched in November 2010. Despite its small size, the pool is considered by many as the best one — it’s easy to set up (which makes it accessible for beginners) and operates on its own rewards system called SCORE, one of the most lucrative ones. The model offers a proportional reward, but it is weighed by the time when shares were submitted. Each one is worth more in the function of time since the start of the current round.

Tips for Choosing a Mining Pool

We only named 8 of the few dozen Bitcoin mining pools: in total, there are 23 pools that have mined at least 100 blocks during the last year, and 32 polls overall. Choosing between them may be hard for a beginner, so here are some criteria that will help you decide:

- Reputation. Google reviews on the pool, see what seasoned miners say. Thematic channels and groups on Twitter and Reddit will bring you insights into how well a pool operates.

- Transparency. The pool should be open on how it distributes the rewards and if it treats all participants equally.

- Compatibility. Make sure your PC, its operating system, and mining equipment are compatible with the pool and its software.

- Supported assets. If you ever decide to mine other coins than BTC, it will be more convenient if your pool has support for that coins so you don’t have to look for new services.

- Geographic location. The closer to the pool’s server you are, the lower your ping time (network latency) will be.

- Reliability and stable performance. Encrypted connection and protection from hackers are a must for a mining pool.

- Payout options. Make sure the pool of your choice pays rewards according to the model you prefer.

- Size. In large pools, incomes are more frequent as the chance to mine a block is higher, but in small pools, the reward is higher as there are fewer participants to share it.

- Fees. Some of the pools charge mining commissions for boosting their growth and incentivizing developers. Make sure you clearly realize the size of this fee in a given pool.

Environmental Concerns in Mining

One of the main criticisms of Bitcoin is its environmental impact. Bitcoin consumes more energy per year than the whole of Argentina, which raises concerns regarding the price that Bitcoin users pay to enjoy its benefits.

In February 2021, Tesla announced it would accept Bitcoin as payment — but then reversed its decision as critics pointed to the huge carbon footprint that the first cryptocurrency produced. Tesla’s rejection of Bitcoin was one of the reasons for the crypto market collapse this spring.

The Bitcoin adoption pace hints that the environmental impact is only going to rise. Whereas adoption raises demand for Bitcoin and hence its price, the profitability of mining BTC will stay high in the years to come, which will push new miners to participate and install new mining rigs.

However, the world is becoming (or at least is trying to become) greener. In October 2021, El Salvador mined its first Bitcoin on a mining farm drawing its energy from a volcano. After China’s crackdown on crypto, mining is seeking a new home across multiple countries — and there is a chance that this evolutionary process will make mining greener throughout the world.