Proof of Work vs Proof of Stake: Basic Mining Guide

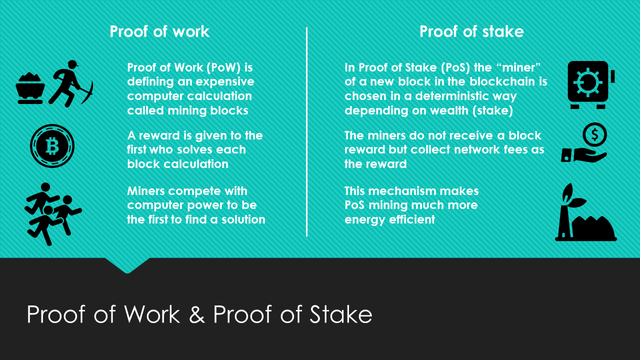

As of late you may have found out about the plan to move from an Ethereum consensus in view of the Proof of Work (PoW) framework to one in view of the alleged Proof of Stake.

In this article, I will disclose to you the fundamental contrasts between Proof of Work versus Proof of Stake and I will give you a meaning of mining, or the procedure new advanced monetary forms are discharged through the system.

Likewise, what will change with respect to mining methods if the Ethereum people group chooses to do the progress from "work" to "stake"?

What is the Proof of work?

Above all else, we should begin with essential definitions.

Evidence of work is a convention that has the primary objective of dissuading digital assaults, for example, an appropriated foreswearing of-benefit assault (DDoS) which has the motivation behind debilitating the assets of a PC framework by sending various phony solicitations.

The Proof of work idea existed even before bitcoin, however Satoshi Nakamoto connected this method to his/her – despite everything we don't know who Nakamoto truly is – computerized money altering the way conventional exchanges are set. Truth be told, PoW thought was initially distributed by Cynthia Dwork and Moni Naor in 1993, however the expression "confirmation of work" was instituted by Markus Jakobsson and Ari Juels in a record distributed in 1999. In any case, coming back to date, Proof of work is perhaps the greatest thought behind the Nakamoto's Bitcoin white paper – distributed in 2008 – in light of the fact that it permits trustless and disseminated agreement.

What's trustless and appropriated agreement?

A trustless and appropriated agreement framework implies that on the off chance that you need to send as well as get cash from somebody you don't have to confide in outsider administrations.

When you utilize customary techniques for installment, you have to confide in an outsider to set your exchange (e.g. Visa, Mastercard, PayPal, banks). They keep their own particular private enroll which stores exchanges history and equalizations of each record.

The basic case to better clarify this conduct is the accompanying: if Alice sent Bob $100, the trusted outsider administration would charge Alice's record and credit Bob's one, so they both host to believe this third-get-together is to going make the best decision. With bitcoin and a couple of other computerized monetary standards, everybody has a duplicate of the record (blockchain), so nobody hosts to confide in third gatherings, since anybody can specifically check the data composed.

Proof of work and mining

Going further, confirmation of work is a necessity to characterize a costly PC estimation, additionally called mining, that should be performed keeping in mind the end goal to make another gathering of trustless exchanges (the purported hinder) on a dispersed record called blockchain.

Mining fills in as two purposes:

1.To check the authenticity of an exchange, or dodging the purported twofold spending;

2.To make new computerized monetary forms by compensating diggers for playing out the past undertaking.

When you need to set an exchange this is the thing that occurs off camera:

*Exchanges are packaged together into what we call a square;

*Diggers check that exchanges inside each square are authentic;

*To do as such, mineworkers ought to comprehend a scientific astound known as confirmation of-work issue;

*A reward is given to the primary digger who takes care of every piece issue;

*Verified transactions are put away in people in general blockchain

This "numerical baffle" has a key element: asymmetry. The work, indeed, must be respectably hard on the requester side yet simple to check for the system. This thought is otherwise called a CPU cost work, customer confuse, computational perplex or CPU valuing capacity.

All the system mineworkers contend to be the first to discover an answer for the numerical issue that worries the hopeful piece, an issue that can't be explained in different courses than through beast constrain with the goal that basically requires countless. At the point when a digger at long last finds the correct arrangement, he/she declares it to the entire system in the meantime, accepting a digital currency prize (the reward) gave by the convention.

From a specialized perspective, mining process is an operation of converse hashing: it decides a number (nonce), so the cryptographic hash calculation of square information brings about not as much as a given edge. This limit, called trouble, is the thing that decides the aggressive idea of mining: all the more registering power is added to the system, the higher this parameter increments, expanding likewise the normal number of counts expected to make another square. This strategy additionally expands the cost of the piece creation, driving diggers to enhance the proficiency of their mining frameworks to keep up a positive financial adjust. This parameter refresh ought to happen roughly every 14 days, and another square is produced like clockwork.

Confirmation of work isn't just utilized by the bitcoin blockchain yet additionally by ethereum and numerous different blockchains. A few elements of the evidence of work framework are diverse in light of the fact that made particularly for each blockchain, yet now I would prefer not to mistake your thoughts for excessively specialized information. The imperative thing you have to comprehend is that now Ethereum designers need to turn the tables, utilizing another agreement framework called evidence of stake.

What is a proof of stake?

Verification of stake is an alternate approach to approve exchanges based and accomplish the conveyed accord.

It is as yet a calculation, and the reason for existing is the same of the confirmation of work, yet the procedure to achieve the objective is very extraordinary. Proof of stake first thought was proposed on the bitcointalk gathering in 2011, yet the principal computerized money to utilize this strategy was Peercoin in 2012, together with ShadowCash, Nxt, BlackCoin, NuShares/NuBits, Qora and Nav Coin. Not at all like the confirmation of-Work, where the calculation rewards mineworkers who take care of numerical issues with the objective of approving exchanges and making new pieces, with the evidence of stake, the maker of another square is picked deterministically, contingent upon its riches, additionally characterized as stake.

No block reward

Likewise, all the computerized monetary forms are beforehand made first and foremost, and their number never shows signs of change. This implies in the PoS framework there is no piece remunerate, along these lines, the excavators take the exchange charges.

This is the reason, actually, in this PoS framework diggers are called counterfeiters.

Why Ethereum needs to utilize PoS?

The Ethereum people group and its maker, Vitalik Buterin, are wanting to do a hard fork to make a progress from verification of work to evidence of stake.

Be that as it may, why they need to change from one to the next?

In a circulated accord in light of the confirmation of Work, diggers require a considerable measure of vitality. One Bitcoin exchange required an indistinguishable measure of power from controlling 1.57 American families for one day (information from 2015).

What's more, these vitality costs are paid with fiat monetary forms, prompting a consistent descending weight on the computerized cash esteem.

In a current research, specialists contended that bitcoin exchanges may devour as much power as Denmark by 2020.

Engineers are entirely stressed over this issue, and the Ethereum people group needs to abuse the verification of stake strategy for a more greener and less expensive disseminated type of accord.

Likewise, rewards for the making of another square are unique: with Proof-of-Work, the excavator may possibly possess none of the advanced cash he/she is mining.

In Proof-of-Stake, counterfeiters are dependably the individuals who claim the coins printed.

How are falsifiers chosen?

In the event that Casper (the new evidence of stake accord convention) will be actualized, there will exist a validator pool. Clients can join this pool to be chosen as the falsifier. This procedure will be accessible through an element of calling the Casper contract and sending Ether – or the coin who controls the Ethereum organize – together with it.

“You automatically get inducted after some time,” explained Vitalik Buterin himself on a post shared on Reddit.

"There is no need conspire for getting accepted into the validator pool itself; anybody can participate in any round they need, independent of the quantity of different joiners," he proceeded.

The reward of each validator will be "something close to 2-15%, " however he isn't sure yet.

Likewise, Buterin contended that there will be no forced point of confinement on the quantity of dynamic validators (or counterfeiters), however it will be managed monetarily by cutting the loan fee if there are excessively numerous validators and expanding the reward if there are excessively few.

A more secure framework?

Any PC framework needs to be free from the likelihood of programmer assaults, particularly if the administration is identified with cash. Things being what they are, the fundamental issue is: evidence of stake is more secure than confirmation of work?

Specialists are stressed over it, and there are a few doubters in the group. Utilizing a Proof-of-Work framework, terrible performing artists are removed because of innovative and monetary disincentives. Indeed, programming an assault to a PoW arrange is exceptionally costly, and you would require more cash than you can have the capacity to take.

Rather, the hidden PoS calculation must be as impenetrable as conceivable in light of the fact that, without particularly punishments, a proof of stake-based system could be less expensive to assault. To fathom this issue, Buterin made the Casper convention, planning a calculation that can utilize the set a few conditions under which a terrible validator may lose their store.

He clarified: "Monetary absolution is proficient in Casper by requiring validators to submit stores to take an interest, and taking without end their stores if the convention confirms that they acted somehow that abuses some arrangement of standards ('cutting conditions')."

Slicing conditions allude to the conditions above or laws that a client should break.

Conclusion

On account of a PoS framework validators don't need to utilize their processing power on the grounds that the main factors that impact their odds are the aggregate number of their own coins and current intricacy of the system.

So this conceivable future change from PoW to PoS may give the accompanying advantages:

1.Vitality investment funds;

2.A more secure system as assaults turn out to be more costly: if a programmer might want to purchase 51% of the aggregate number of coins, the market responds by quick value appreciation.

Along these lines, CASPER will be a security store convention that depends on a monetary agreement framework. Hubs (or the validators) must pay a security store keeping in mind the end goal to be a piece of the accord on account of the new squares creation. Casper convention will decide the particular measure of prizes got by the validators on account of its control over security stores.

In the event that one validator makes an "invalid" piece, his security store will be erased, and in addition his benefit to be a piece of the system agreement. As it were, the Casper security framework depends on something like wagers. In a PoS-based framework, wagers are the exchanges that, as indicated by the agreement rules, will remunerate their validator with a cash prize together with each chain that the validator has wagered on.

Along these lines, Casper depends on the possibility that validators will wager as indicated by the others' wagers and leave positive criticisms that are capable quickens agreement.

Thanks for that write up joulia.

For a second there I was worries mining would die out with the switch to POS but it sounds like I can still mine.

Being new to crypto currency I did not know what POW and POS were, but now I do :D

👍👍👍👍

I will share more infos about it , follow me

Already have ;)

I always have to give a thanks to people that offer readable and valuable information about Crypto-currency and block chain. I just recently (the last 4 or 5 months) started to read about, research, and try a little buy and sell. I really appreciate the information and love seeing people promote it. Investing, education, entrepreneurial ventures, basic opportunity should be accessible to all. the last several years of cryptocoins and block chain are great examples of opportunity for all.

I look forward to reading more of your articles.

DJ

You are welcome @djrees

Daily i share article about

-Love => The soul of life

-Music and Poetry => The soul of joy and pleasure

My profile is a garden to take advantage of and happiness ☺️

@minnowpond1 has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond. To be Resteemed to 4k+ followers and upvoted heavier send 0.25SBD to @minnowpond with your posts url as the memo

Follow me joulia

Done