WILL OIL PRICE SUSTAIN ITS CURRENT MOMENTUM ?

Source: istockphoto.com

Oil price has seen a pendulum-like behaviour in recent past. Prices have made new lows and within few months are back in upward trajectory. Oil price prediction is a difficult task, as it is often influenced by a lot of factors like production escalations to gain market share, speculation by hedge funds, movement in the dollar, the feasibility of competing renewable energy technologies, changes in the political situation and many others. We will have a look at the mentioned factors one by one.

PRODUCTION CURTAILMENT AGREEMENT BY OPEC

Back in 2014, the market was in heavy excess supply and even the storage capacities were running short to meet the increasing storage requirements. This glut in oil market lead to a crash in oil price. By November 2016, OPEC and Russia reached an agreement to curtail the oil production. This curtailment in oil price has provided the required support to market and market found its support price at around 50 Dollar.

Current Scenario: Sustainability of the oil price recovery is dependent on continued commitment by Russia and Saudi Arabia to not to flood the market with excess supply.

OIL PROJECT PIPELINE

Continued replacement of oil wells is a important constituent for future stability in the oil price. Collapse of oil price lead to delayed projects on back of their non-feasibility. Just to quote some figures, the number of delayed projects hit a peak in January 2017 at 111, which represented a combined $326 billion of Capex and 43 billion barrels of oil sitting on the side lines. (Source: Oilprice.com)

On the other hand, shale oil has changed the dynamics of the market; previously Oil prices were heavily dependent on the decision of OPEC regarding the oil production targets. The introduction of cheap technology for extracting oil from shale stones has proved to be turning point for the market. Oil extraction is normally a heavily front-end loaded cost and all the expenses which were necessary were already incurred are incurred at the beginning. This heavily front loaded cost structure has been cause of volatile nature of oil prices (Forbes article: Oil Price Forecast: Shale 2.0 Will Keep Supply Abundant).

In 2014 scenario, low variable cost and highly leveraged structure of shale oil companies contributed to continued increase in production to pay for their finance cost. With continued oil supply from shale gas from Saudi Arabia and Shale Oil, the oil prices crashed, many of shale oil companies defaulted on its obligations. Recovery in the oil prices, has led to opening up of shale oil wells, let's put some figures on the board

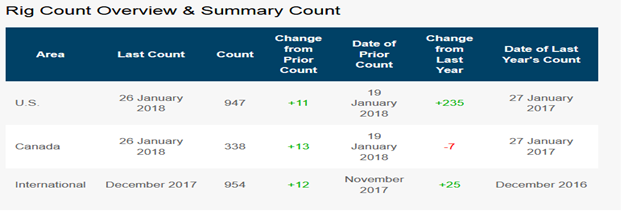

Source: Baked and Hughes (Link: Shale oil rig count data)

Current Scenario: According to, the number of oil rig have seen an increase of 253 rigs, and we may see more rigs if oil price sustains the 50-60$ level which is widely considered as the long term break even for shale oil. This continued addition to oil production will put barriers for any sharp positive movement ahead.

RENEWABLE ENERGY AS A COMPETITOR

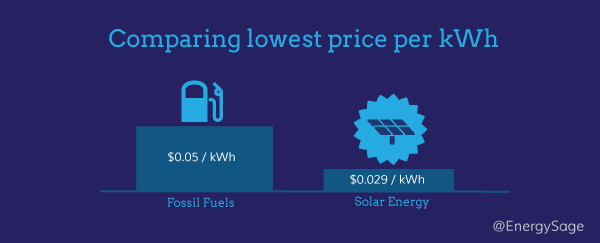

Renewable energy have been a possible source of energy for last ten years, but only recently they have become a viable source of energy without any subsidies. Energysage quotes “global coal prices have historically averaged $0.06 cents per kilowatt-hour (kWh). Until the past decade, no alternative energy resource came close to rivalling that price. Fossil fuel steam averages around $0.05 cents/kWh and small-scale natural gas can go as low as $0.03 cents/kWh.” But in late 2015 there came exponential decline in the solar panel prices, first came a Saudi Solar project which was prices at US0.058 / kwh, and recently Dubai Electricity and Water Authority (DEWA) has quoted that it received asking price for solar energy, at 2.9 cents/kWh. With this continued falling solar energy prices, replacement of oil with renewable energy is certain.

Source: www.energysage.com

The Only barrier in the solar energy has been its universal accessibility, but even that problem is now being solved by Companies like Tesla, which are providing electricity storage facilities at very cheap prices

Current Scenario: Under the current scenario, replacement of oil with solar is certain, therefore demand growth for oil will remain limited.

OIL INVENTORIES

The plague in the oil market boosted the inventories of the United States, which acted as a kind of shock absorbers in recent past. According to oilprice.com, recent hike in the oil prices has come along with depletion of the oil inventories with inventories dropping to 411.6 million barrels, their lowest level since early 2015 and are close to the five-year average.

Current Scenario: With these dropping inventories, Oil prices will remain volatile. Any negative or positive news will lead to big spikes and fall in price of Oil.

A WEAK DOLLAR

The dollar has been on the decline trajectory, with a decline of 5 percent in past two months. The fall in dollar pushes up oil prices as crude contracts are denominated in dollars. A weaker dollar makes crude more affordable to the rest of the world, pushing up its price. (Source: oilprice.com)

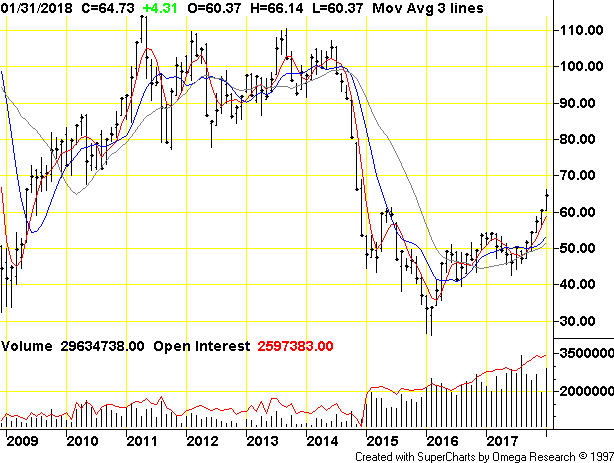

SPECULATION BY HEDGE FUNDS

Oil future contracts is a big speculative market, because of its liquidity, oil has seen a very large spike in speculation activity, with open interest in the oil future contracts doubling in last one year.

Source: http://futures.tradingcharts.com/

Given all these factors, I think oil will remain within 60-70 band range and on a long term basis, it will revert to lower end of the range. What's your call on the oil prices, I would love to hear in comments. The current article has become too long, so I will share the technical analysis of oil price in my next article.

Oil will go down again as there are now big incentives for oil producers to bring more oil out of the ground and the demand is weak. You can see it here in Germany at the gas stations. No higher prices this winter albeit a higher crude oil price. They tried to demand more money for gas but they failed. Prices went down each time they tried to heighten it. For months! I never saw this before.

thanks @manfredkurtauer for your input

i totally agree that oil will be unable to sustain its current momentum, they only plus going in oil favor is a weak dollar

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Resteemed by @resteembot! Good Luck!

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

@orignalwork

Hello, please follow the rules of the group Steemit for Resteem ↕ and you will be resteemed by the most active members in the group.

You have to resteem a post from the group before you post yours there.

Here is : HOW TO RESTEEM ON STEEMIT ?

I have resteemed the following post

https://steemit.com/cryptocurrency/@faneitef/chinese-companies-increase-exhibition-to-ciberataques-after-adopting-technologies-like-the-cryptoponoids

always looking for your support

you don't have to tell me what did you resteem, just post your link to the group again and I will check

Congratulations @ahmedvirani! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @ahmedvirani! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @ahmedvirani! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!