7 Reasons Why I'm No Longer Buying Physical Gold/Silver Bullion

first, let me say that this post is free from affiliate links and attempts to get you to buy into anything--these are my own opinions and I'm not a fiduciary/advisor so take this as just one of many steps in the Do Your Own Research (DYOR) process. Also, some people like to collect gold and silver coins for numismatic value or because they just think coins are cool (and I agree with that)--I'm not a collector though so this article is all about investment diversity.

Many people think that gold and silver is a good hedge against inflation--and for good reason. Governments around the world are entering into practices to dilute the value of sovereign currencies through programs like quantitative easing (money printing) and fixed supply commodities that are valued as money are a strong draw to anyone looking to escape. But there are a few gotchas when it comes to precious metals.

Below you can see where I predicted gold would break out in the beginning of a new "Disbelief" phase of the market cycle--and I do believe that gold and silver will continue into a new upward cycle:

More on TradingView here: https://www.tradingview.com/chart/GOLD/f67LDN41-GOLD-Bubble-Next-Stop-Disbelief/

So there are two camps in the world of precious metals hedging. One side says you should hold physical bullion because you can't always trust governments or companies who hold it for you, and the other side says to just buy it and have someone else manage the storage and security for you, because home delivery, storage and selling is a pain.

I am now clearly on the second side. Here are 7 reasons:

1. You need a safe/secure place to keep it

You might already have a safe, but if you don't and you are new to needing robust home storage, this is an extra cost to your investment. Additionally, keeping a safe "safe" is a non-trivial matter as you need to have either backup keys or codes so your family can access the contents if something happens to you.

2. Even with a safe/secure place to keep it, you risk theft/coercion/loss

Having a big safe delivered to your house (or having to move one from house to house) puts a huge radar blip on you and your family. Anyone involved in the paper trail of this process is potentially a threat. If you have a safe, it's a target for home break-in. I have honeypots all over my house, but as fun as it is to imagine a robber getting duped/caught, I'd rather not be a target at all.

Also every time you buy physical metals, whether it's via Ebay, an online retailer, or a physical coin shop, they will record your address. Coin shops demand to see a valid ID, which probably has your home address on it and they will record it in their system! Maybe you have a fake ID (more pain), but most people don't. You can get clever and have Ebay and online retailer shipments sent to a P.O. Box, under the name of an LLC, or a corporation, but this is additional work and requires additional annual cost to your investment--both for maintaining the P.O. Box (which isn't secure) and for annually registering the LLC/Corp.

3. Counterfeit Bullion is a Real Issue

There's a lot of fake gold and silver out there. It's getting easier to make forgeries. You can buy yourself a caliper and a scale and meticulously measure and assay yourself to ensure you are dealing with reputable sellers (I did this, and it adds more cost/time to an investment). Assaying sucks. Most coin shops don't even do it. They just look at it with their eyes and say, "meh, this guy doesn't look like he's trying to pull one over on me."

I literally went to a coin shop because they had a Canadian Maple leaf counterfeit detection device and the guy said it's a joke and they never use it because they just look people in the eye and they "know" if they are selling real gold. This doesn't convince me because most people don't know that the gold they have is real or not.

Assaying is not something you should have to do with your time. Also, in an apocalyptic collapse of society where paper money has no value, people will either not care about your gold/silver (they'd rather have toilet paper, food, and weapons) or a fake silver coin will get you just as far. So if you are stocking up on bullion for an armageddon, you may as well just stock fake bullion (and a fake Rolex) because nobody is going to be able assay that stuff in an emergency when you are talking your way onto a bus/plane to safely evacuate your family from a collapsing society.

4. As an escape SoV for wealth, it sucks

- Imagine you are in one of the many countries where fiat money is collapsing

- Now imagine you put all your family wealth into gold and silver bullion to keep it "safe"

- Now imagine crossing a border or getting on a plane with all that wealth and not getting robbed, shot, or having it confiscated

The first 2 are easy to imagine because it is a thing that has happened and a thing people have tried. The last item is hard to imagine because it almost never works in your favor.

If you are in a situation where money is collapsing, physical metals are unlikely to save you (unless you own a private jet).

5. Dollar-Cost Averaging is Not Practical / Possible

You can't buy fractions of physical metals in the same way you can buy fractions of digital metal holdings. Dollar-cost averaging requires that you spend the same fixed dollar amount on the asset on a regular interval. So if you want to buy $50/week of gold, well, you can't really do that with physical gold. You can come close buy buying a specific fractional coin (which has a higher markup), but this isn't dollar cost averaging--and if you only want to buy $50/week worth, you will have to pay for shipping (more cost).

6. The Premiums Suck

Physical gold and silver coins have an extra cost for minting and distribution. So coins have markup--even bars have markup, but bars are even more likely to be counterfeit. You can self-assay coins if you know well enough what you are looking for, but bars are risky.

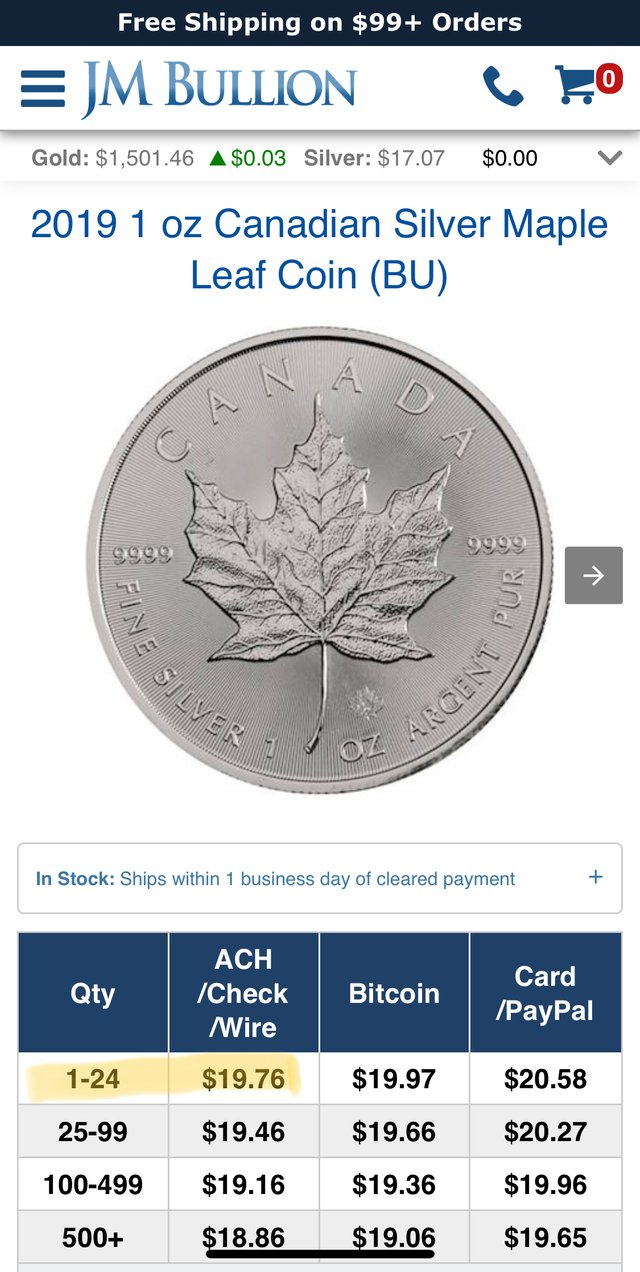

Let's take a look first at Silver:

With Spot Price of Silver at $17.07, the market on a single 1oz Canadian Maple Leaf Silver is $2.69 (+16%)!

You can get a little better if you buy in bulk but it's still terrible! And when you sell it, you won't get that +16% markup back--you'll get some of it, but you can kiss most of that goodbye, especially if the price didn't go up significantly since you bought it.

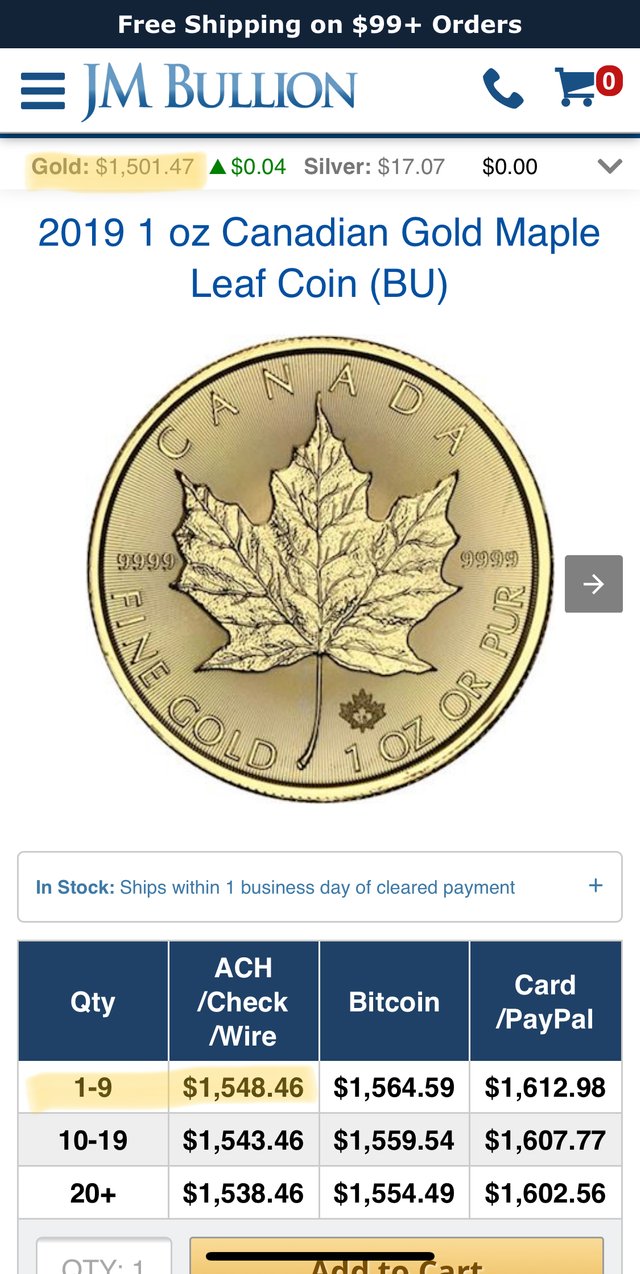

Gold is a little better. The markup for a 1oz AU Maple is only 5%, which most bullion purchasers are willing to accept as within the standard markup range for coins (3-5%). And you probably will get a 3-5% markup back when you sell it (maybe).

7. Selling physical gold is a huge pain (and cost)

First, you have to find a local coin shop, deal with the sketchiness of Ebay, or sell through an online retailer like APMEX. All of these options suck for different reasons, but all of them boil down to one main reason: lots of extra work!

If you are going for a local store, you have to be wary of doing it in large volume, otherwise you trigger tax reporting events. You are also carrying a lot of gold/silver/cash with you to a place where bad people would be expecting to find targets going in and out.

Selling on Ebay has the same issue as buying on Ebay--there are scammers on both sides (there are some protective measures but what a pain), and dealing with shipments sucks when you are the one doing the shipping (more work).

If you are selling via an online source like APMEX you have to deal with their assay process and mailing and again, it's more work.

So What's the Alternative

Well, there's Bitcoin, of course, but we are talking about Bullion, so let's stick with that. I like a service called Uphold: https://uphold.com (no affiliate link, use it if you like it, I don't get a kickback).

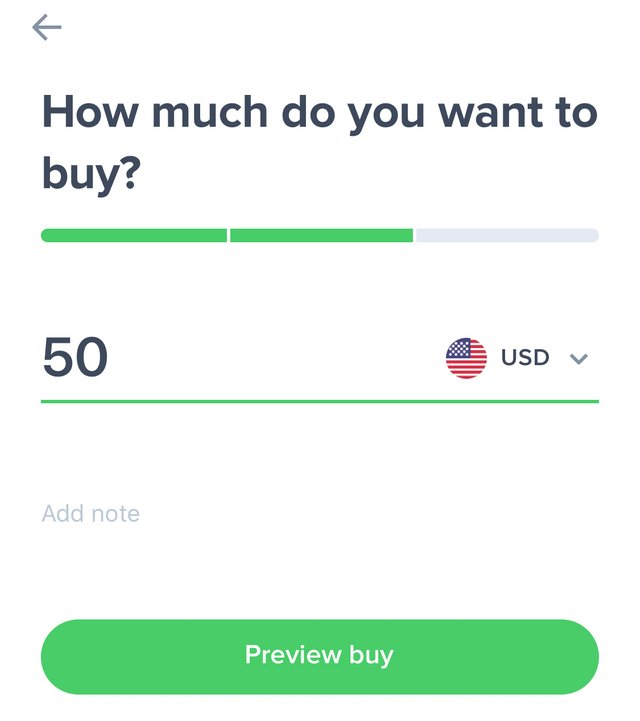

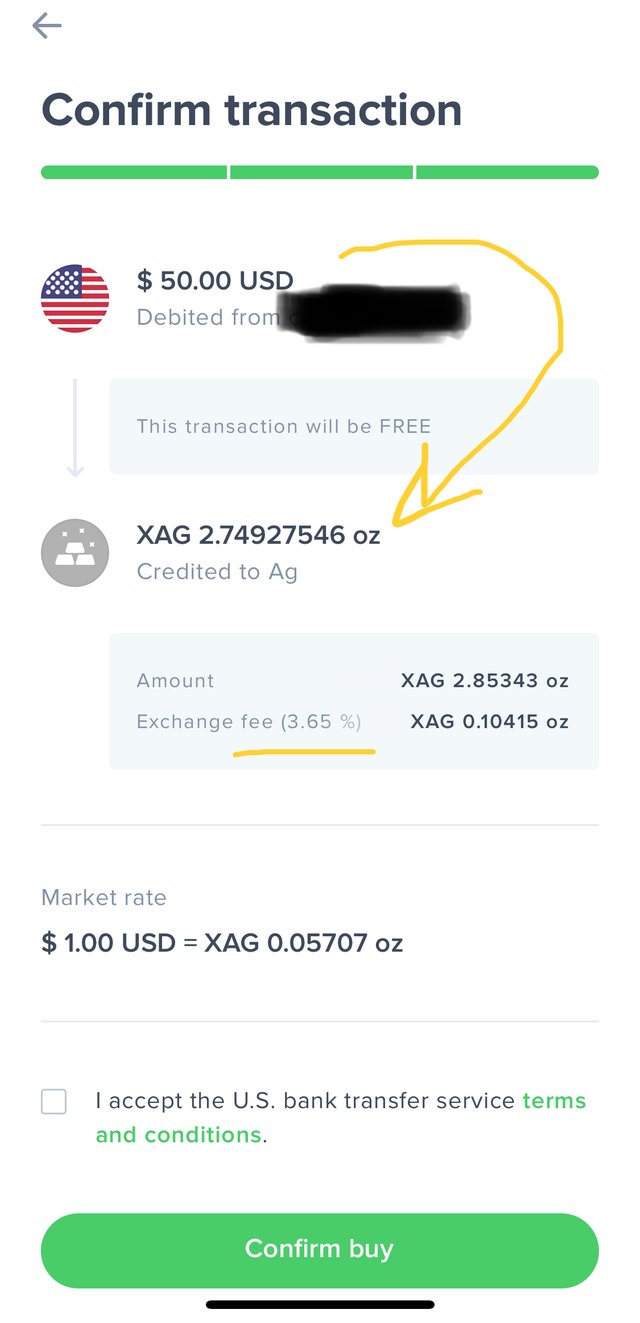

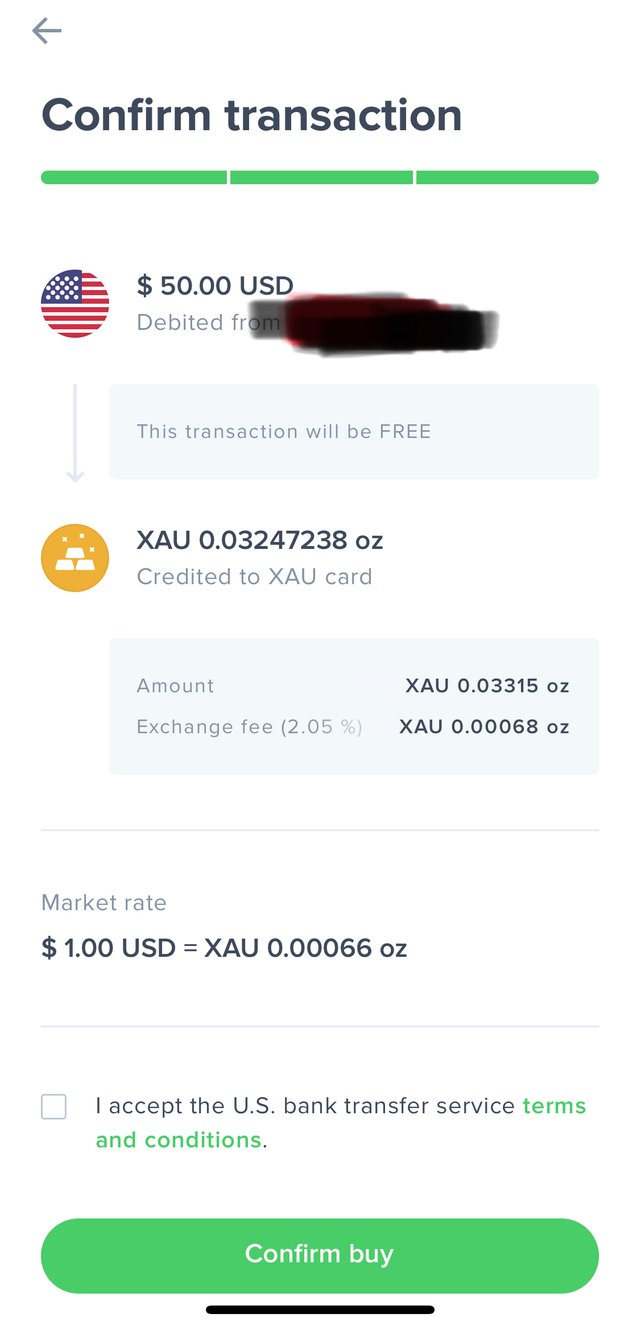

Uphold will allow you to do true Dollar-Cost Averaging. They hold the bullion reserves and allocate you a fractional amount based on your purchase. So you can buy $50 of gold/silver if you want to and actually hold a ledger entry that tracks gold/silver from there.

Also, their exchange rate is way better than the premiums on physical gold/silver. They currently charge just 2.05% for gold conversion and 3.65% for silver. You can also buy Platinum, Palladium, Cryptocurrencies and other Fiat currencies (though I would not recommend putting any money into more/other fiat currencies than the one your paycheck/bank defaults into).

The downside is that they don't yet have a recurring buy option, but you can easily buy at the current spot price + fee without having to wait for a bank transfer. WAY BETTER.

Closing

Thanks for reading this far. I do mostly art posts of my sketches but occasionally will post on financial matters and health related things (I'm also experimenting with longevity drugs). So follow me for more random things that might interest you!

And don't forget to upvote!

oh wow, @antic, i didn't ... i wasn't expecting this from you, but this is very interesting :D it's great to see a whole different side to you !

I am a varied individual ;)

Posted using Partiko iOS

Gold needs to go to 3,500 Fed Dollars per ounce and Silver needs to go to 350 Fed Dollars per ounce, for the New United States Monetary Reset into "Sound Money"... Yes... Our Coinage will be backed by U.S. Bullion Coinage... And Countries are going to be Selling their Gold and Silver like Crazy, to get their hands on our (Debt Free) "Sound Money"...

August 12, 2019... 11.8 Hollywood Time...

Fingers crossed. We need to fix the problem somehow. But I’m not sure it will happen so soon. Either we will go into recession (possibly already started), in which case I predict Trump winning 2020—and who knows what will happen (maybe back to the gold standard), or we avoid a recession through another round of QE, which leads to a Democrat winning the election, and big payout promises lead to more inflation and probably more QE anyway... but in that case I don’t see an appetite for going back to gold standard. I think we are more likely to go 100% digital—kill paper money (as untraceable drug/laundering source) and triple down on debt ledgers. Most people don’t understand hard money and are happy with the debt system. Even I take advantage of cashback rewards—why spend real money when you can spend debt and hold the money for up to a month before the bill is due, making both cash back and interest. Long winded reply, sorry 😳

Posted using Partiko iOS

My Pocket Change Theory is the only way Trump can make America Great Again... He must do this with an Emergency Executive Order...

August 13, 2019... 4.5. Hollywood Time...

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!