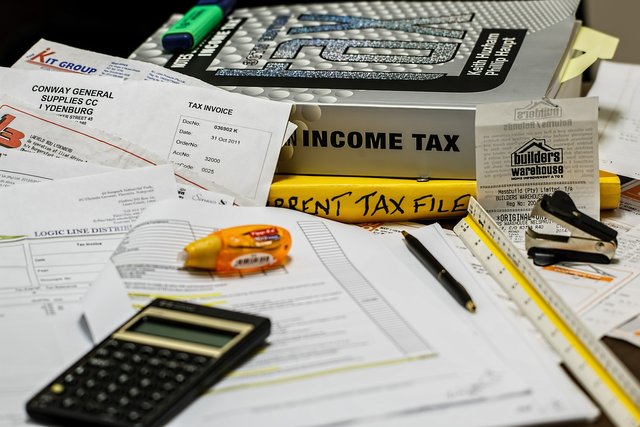

Don't Be Fooled Into Spending Around Tax Time

Disclaimer: I am not a financial advisor, nor an expert, and none of this constitutes as being financial advice whatsoever.

You see the ads from businesses like Office Works telling you to hurry up before the end of financial year EOFY, tonnes of companies trying to make their profits for the year capitalise on tax time.

One such tactic I know Office Works, in particular, are guilty of is telling you to spend before EOFY and then claiming it on your tax return. Well, here is the thing they don't tell you: on average, you'll go get back a third of what you spend.

So if you go spending up like your pockets are swollen thinking you are going to be getting that money back, you're not. I mean a third is better than nothing, but it's not a large amount you're getting back.

Then you have the generally unspoken rule of depreciation. Which means if you purchase something you need for your business such as a laptop, you can't instantly claim. This means if you buy a laptop near EOFY that you'll be using to make money, you can't claim it because it's a depreciating asset that declines in value over time.

Understandably, when it comes to tax-related matters they're complicated and confusing to understand (which is why we usually pay an expert to handle it for us). Companies advertising for you to spend up big during tax time capitalise on the fact they know most people don't know about things like depreciation or how much you get back when you claim.

Be smart, don't spend beyond your means and invest your extra money into Steem not material items you don't need thinking you'll get the money back when you file your tax return.

image from pixabay

I do agree with you and far too often would see people buy things because of these sorts of ads. I'd tell them not to buy anything unless they actually needed it. It's not like you miss out on the tax deduction if you buy it after 30 June, you'll just get to in the next tax return.

But if you are a small business you likely can claim the full deduction for a laptop using the instant asset write off for items under 20k. It's ment to free up cash sooner to help small business.

Congratulations @beggars! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Let's go for the Quarter-Finals

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

We have upvoted your post, and our bot will keep upvoting on in rounds until your bets are recovered. And Congrats for the games where you made SBDs! You can track your winnings/upvotes/bets here: https://goo.gl/wjkA8K

Voting Process is slow, please have patience. This is the disadvantage of Losing a bet. Please understand it takes time to recover the loss, don't expect upvotes every day as our SP is limited and user base is growing

Thank you for participating with BetGames!

To earn more SBD/Upvotes bet risk free with @betgames

If you win you get SBD, if you lose you will get back your investment via upvotes from @Betgames

Cheers and Happy betting!