Baby Boomers Will Lose Everything: Pension Crisis

We are going to look at, in great detail, one of the largest threats to the well-being of this generation. The idea of the pension has been around for a long time. Saving for retirement, with the ability to live off of cashflow generated by stock dividends, fixed-income assets, and capital gains was a popular strategy that worked well for the Silent Generation. Following in their footsteps, the retiring Baby Boomers thought that this strategy was the formula for achieving the American Dream.

It was so smart in fact, that the government mandated it with the passing of the Social Security Act way back in 1935. Since then, Americans have been required to put some money away by leaving it in the hands of the single worst money manager in the world – the government.

This article is not about Social Security. That topic is deserving of its own article since it is the single largest Ponzi scheme ever conducted. This article is about the public and private pension crisis, although it’s honestly hard to decide which is more grotesque.

The Numbers

Lynette Zang of ITM Trading does an excellent job pointing out the issue from a bird’s-eye view in the video below.

74 Million Americans started retirement in 2013 and 6,100 more are reaching the age of retirement on a daily basis. US state and local pension debt has risen from $292 billion in 2007 to $1.9 trillion (with a “T”) today, just 11 years later.

What assets are these pensions holding?

-46% is being held in stocks during a time when the market has the 2nd highest valuation in history, thanks in part to company stock buybacks. GE for example spent $45 billion dollars to buy back its publicly-traded common stock instead of addressing its pension fund which is underfunded by $31 billion dollars. [1][5]

-28% is being held in bonds, a market being artificially manipulated by the Federal Reserve.

-24% is being held in derivatives (assets that derive their value from the stock and bond markets) and illiquid commercial real estate (during a time of retail apocalypse, which I have written about).

-And only 3% in cash. [1]

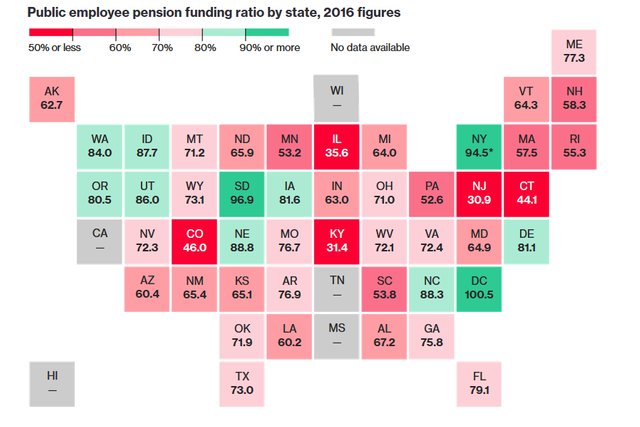

As illustrated by Bloomberg, there is currently only one state, Washington D.C., which has a fully funded pension fund. [2]

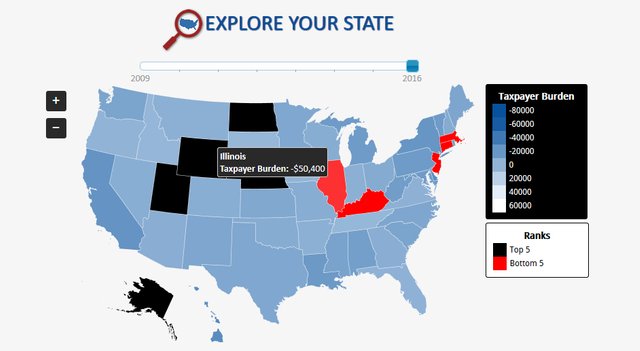

Illinois recently entered the news since it is one of the most insolvent states and currently facing a crisis. A huge increase in real estate taxes has caused many residents to flee to other states. Their tax liability per taxpayer is currently about $50,400 according to State Data Lab.org – an excellent resource for state budget information.

The state’s liabilities (debts) have exceeded their assets (insolvency). The state’s income is declining while their credit rating had been downgraded, giving them less ability to fund themselves with new debt and putting major pressure on their citizen’s tax liability.

“Despite reporting most of its pension debt, the state continues to hide most of it’s

retiree health care debt. The state's total hidden debt amounts to $51.9 billion….Bottom line: Illinois would need more than $20,000 from each of its taxpayers to pay

all of its bills, so it has received an "F" for its finances from Truth in Accounting.” – State Data Lab Report [3]

Illinois has access to chapter 9 municipal bankruptcy unlike Puerto Rico. I covered Puerto Rico’s debt crisis in my recent article: Crises in Puerto Rico: How big government destroyed the island long before any storm (here). That has changed since the passing of PROMESA which now allows Puerto Rico access to that debt restructuring option. But as I explained in the article, it is the average person, not Wall Street or the politicians who will suffer. Bond holders will be taking a haircut, but it’s your average mainland Baby Boomer who is invested in these bonds via “…US banks or investment firms. The top two, OppenheimerFunds and Franklin Resources, are based in New York and invest money for mainland US citizens.” [4]

Lynette confirms this by pointing out that over 70% of municipal bonds are held by the public in the form of Mutual Funds, Exchange Trade Funds (ETFs), and Money Market Funds. In other words, Baby Boomers are exposed to this risk while these bonds are yielding next to nothing. Ironic since these municipal bonds are considered “safe” meanwhile they approach junk status.

The Demographics

The Baby Boom generation helped change the American economy from one that is commodity-based, to a consumer-based economy. This type of economy requires an ever increasing about of consumption in order to keep growing, otherwise the economy falls into a recession or deflationary depression similar to the one seen in the 1930s. Looking at the demographics does not provide any hope for those who think that our economy can outgrow these issues.

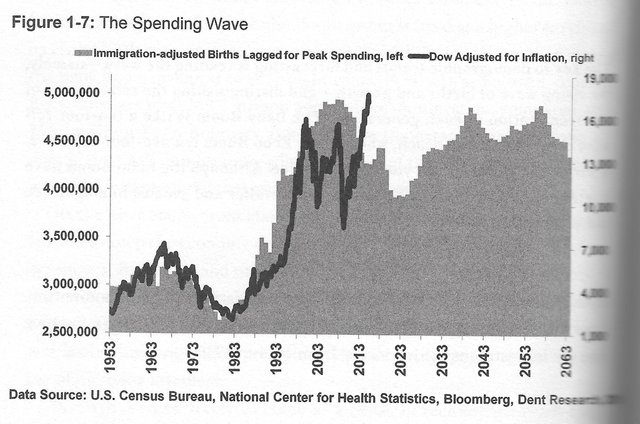

Harry Dent Jr. is an expert when it comes to demographics. His book, The Demographic Cliff, outlines the issues with the mentality that an economy can grow forever. Through his research, Dent has taken the standard chart of the population growth and moved it forward 46 years, since this is the age at which spending peaks. The result shown below is called the “Spending Curve”.

[Source: Dent]

As you can see, the Baby Boom generation (the largest of the grey waves) had their spending peak at 2007. Incidentally that occurred at the same time as the sub-prime financial crisis. The black line represents the Dow Jones Industrial Average index, which is the most popular tracker of the stock market. You can see the dip and subsequent rise; that rise is the bubble that we are in today. After that peak is the next two shown on the graph, this is the anticipated spending of the next generations which are not nearly as large. Dent points out:

“This is the first time in modern history that the new generation is smaller than the preceding one.” [Dent]

But despite this wave passing almost completely, we have seen the stock and real estate markets recover almost all of their lost value. That is because, instead of letting the debt deleverage itself and the economy go into a recession back in 2008, the policy response was to implement low interest rates, quantitative easing, and other stimulus-style activities.

Japan as an excellent example of what happens when the policy response to a debt deleveraging is endless stimulus. Japan’s spending wave peaked much earlier than the United States’ back in 1989. Since then the Japanese stock and real estate markets have crashed. The policy response to this crash was the same as the United States’ today, only Japan implemented them earlier. Stimulus for 17 plus years in Japan has not produced the results on a long-term basis that the United States is hoping for from its stimulus program. Japan’s stock and real estate markets have not recovered, wages are stagnant, and they suffer a decreased standard of living with a devalued currency. The youth of Japan are the ones who have suffered from the older generation’s mismanagement since the debt burden is now theirs. The youth have responded appropriately with a declining birth rate. Males are not interested in sex or marriage partially due to the fact that children would cost too much. This compounds the problem.

“If aging, wealthy countries do not restructure their massive private and government debt, and restructure their bloated, unwieldy entitlement programs to account for longer life expectancies and more realistic benefits, their youth will follow in the footsteps of their Japanese counterparts.” [Dent referring to Japan’s declining birth rate]

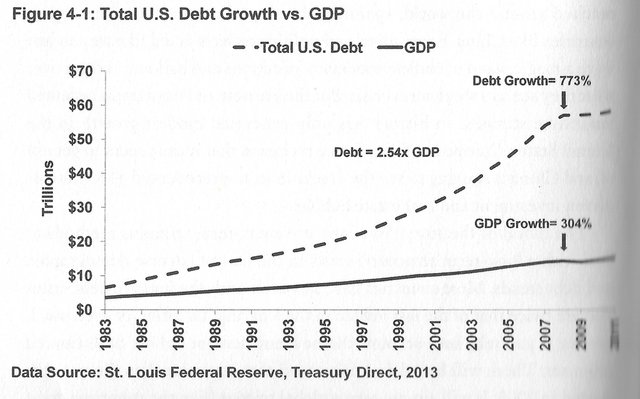

Despite the demographics, many still believe that we will be able to outgrow these financial problems, and repay the debts owed bringing the pensions back into fully-funded territory. Unlikely, since the total US debt has grown consistently at 2.5 times GDP. As illustrated below, debt used as stimulus does little to grow the economy.

[Ibid]

This is why the economy struggles to grow at more than 3% every year, stimulus is a poor substitute for real economic growth. The Federal Reserve has struggled to hit its inflation goal of 3% because of low money velocity making real, inflation-adjusted GDP growth less than 3% per year since 2008 (subtract inflation from GDP growth to get real growth). The low money velocity is caused by the public using funds to pay down debt, as I explained in my article Retail Apocalypse Hits Minnesota – Why? (here).

Fraud, fraud, and more fraud

Catherine Austin Fitts, former assistant secretary for the Department of Housing and Urban Development, now writes the Solari Report. She does an excellent job summarizing in great detail the pension crisis in her report titled: The State of Our Pension Funds. This is a must read for those who whish to understand this crisis in depth. The article explains that the pension crisis does not exist in her view, but rather it is a crisis of mismanagement and fraud that has funneled wealth from the funds into the hands of the financial elite.

“There is no pension fund crisis! The so-called pension crisis is the result of a leadership decision that financial obligations to the elderly are expendable. After buying their votes and labor with promises, the leadership is wiggling out of those promises by draining returns with an engineered housing bubble, low interest rates, and not funding on a pay-as-you-go basis, then cutting benefits and throwing retirees overboard… This is a political choice. It is not a financial crisis. It is part of a well-executed plan.” [5]

In 1974 the Employee Retirement Income Security Act (ERISA) was passed, this act created an agency called the Pension Benefit Guaranty Corp (PBGC). This agency provides a backstop for 40 million American’s retirement incomes. It transfers risk away from the pensions onto itself (and eventually the taxpayer when it needs to be bailed out). It is funded by premiums paid by employers who provide the insured plans and also receives revenue form the pension plans that it takes over. Its model is similar to the guarantee provided by FDIC for bank deposits.

In 2016, the PBGC paid for the retirement benefits for 840,000 retirees in more than 4,700 pension plans. It is uncertain how much more pressure this agency can take since it is already responsible for the pensions of 1.5 million Americans. In her article, Mrs. Fitts quoted a Milliman survey of the top 100 corporate pension funds, it reports that the fund’s stated assets of $1.3 trillion with obligations of $1.7 trillion at the end of 2016 making them only 81.2% funded. That ratio may not seem so bad, but when you consider the fact that stocks and bonds are at all time highs, these ratios should be higher. [5]

What’s worse is that it is common procedure for many pension funds to overstate their future return assumptions in order to appear to have a greater funding ratio. James Turk and John Rubino explain further in their book The Money Bubble:

“…Assume for example you are running a state teachers’ pension fund. You have a certain amount of money on hand and more coming in each year. Your invested capital will probably earn about 4 percent annually over the next twenty years, but that won’t leave you with nearly enough to cover the likely benefit costs. In other words, you’re massively underfunded. But raise the return assumption to 8 percent and the magic of compound interest gives you twice as much hypothetical future income, which might spell the difference between being 80 percent funded, which is adequate, and only 40 percent funded, which is catastrophic. This ploy is common enough to be thought of as standard operating procedure.” [Turk, Rubino]

By the way, accounting tricks such as these are not conspiracy theory. Here is a quote from Bloomberg’s article Pension Crisis Too Big for Markets to Ignore:

“It’s no coincidence that pensions’ flight from safety [into stocks / bonds] has coincided with the drop in interest rates. That said, unlike their private peers, public pensions discount their liabilities using the rate of returns they assume their overall portfolio will generate. In fiscal 2016, which ended June 30th, the average return for public pensions was somewhere in the neighborhood of 1.5 percent.

Corporations’ accounting rules dictate the use of more realistic bond yields to discount their pensions’ future liabilities. Put differently, companies have been forced to set aside something closer to what it will really cost to service their obligations as opposed to the fantasy figures allowed among public pensions.

So why not just flip the switch and require truth and honesty in public pension math? Too many cities and potentially states would buckle under the weight of more realistic assumed rates of return. By some estimates, unfunded liabilities would triple to upwards of $6 trillion if the prevailing yields on Treasuries were used. That would translate into much steeper funding requirements at a time when budgets are already severely constrained. Pockets of the country would face essential public service budgets being slashed to dangerous levels.” [6]

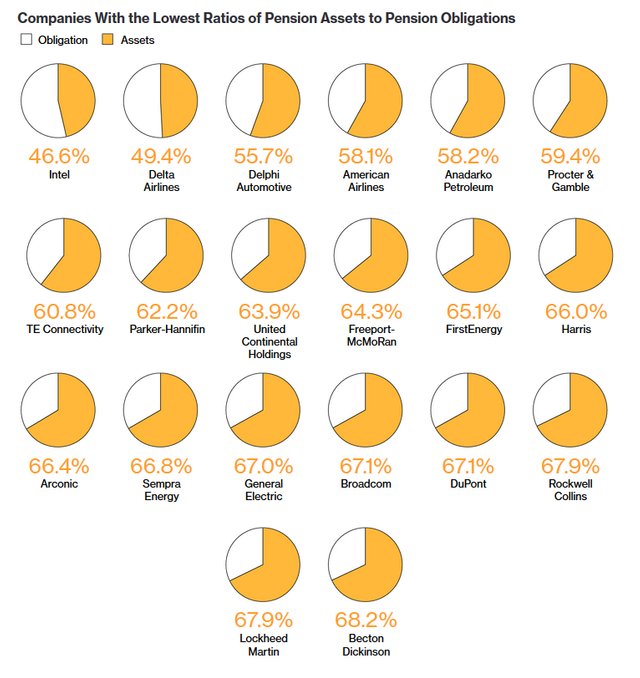

The above quote from the article talks about the somewhat more prudent corporate pension funds that use “honest pension math.” Lets take a look at how those pensions are doing. According to Mrs. Fitts’ article, 186 of the top 200 corporate pensions in the S&P 500 index of companies are underfunded to the tune of $382 billion. Below is a closer look at a few individual companies.

[Source: Bloommberg]

A brief history of pensions

“The assets our pension funds now own are IOUs from ourselves as taxpayers backing the US government. We have transferred real savings to private investors in exchange for an IOU from ourselves.” [5]

The first pension crisis in recorded history supposedly dates back to the Roman Empire in the 5th Century B.C. Roman soldiers in retirement could receive a pension of 12,000 sesterces, worth nearly $40,000 in today’s money. This was unheard of at the time since most worked until they died. The retired soldiers began to rely solely on their pensions to sustain their lives in retirement. Eventually the amount of pensioners became too great and exceeded the amount of money put away for the pensions by the Roman government. This led to social unrest that put pressure on the Roman Empire and was a contributing factor to its demise. The narrative has continued thought history to present day. [7]

The pension idea became very popular in the United States during the 30s and 40s. The 30s saw the Great Depression and caused a demand for more populist policies from President Roosevelt who passed Social Security in 1935. The pension was even more popular in the 40s since the country was experiencing war-time price and labor controls which severely limited the earning potential for workers. President Truman was responsible for these price controls which he implemented from 1942-1946. This was an attempt to stop inflation During WWII. Pensions were a clever work-around for workers since they were not considered income and not subject to the controls. It was a win-win situation for companies, as well as labor unions who could claim playing hardball with management for the extra pension money. The companies, of course, did not need to fund their pension pools 100%. They only needed to wait until the soldiers came back from war to start spawning children who would become the largest generation in modern history. That way the Ponzi scheme could continue with a brand new set of workers to take over paying for the promises made to the preceding generation. [8]

After WWII, the US led the way to a globalized world of open trade. In order to remain competitive, the pension system continued to centralize capital in order to finance multinational corporations, as well as provide an incentive to workers to stay employed at these companies. This was an important shift of capital control away from the household to a pool managed by a central authority.

“If you want to build a global juggernaut of both multi-nationals and the national security state, you need an enormous flow of capital. Pension funds were an essential vehicle to control and concentrate cash flow to do so.” [5]

Mrs. Fitts describes more fraud in her article, but of course the most damning financial fraud conducted in recent memory happened during the 2008 financial crisis with housing. I detailed this is depth in my article We Are In Housing Bubble 2.0 (here). Mrs. Fitts also speculates that the financial elite of the G-7 engineered this crisis because they saw the massive Baby Boomer retirement coming and wanted to replace their own capital with paper promises such as mortgage-backed securities, and US Treasuries. They then started to invest in emerging economies in Asia. Regardless, retirement pensions have been a Ponzi scheme from the very beginning.

Let’s look at the Securites and Exchange Commission’s definition of a Ponzi scheme:

“A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors to create the false appearance that investors are profiting from a legitimate business. With little or no legitimate earnings, Ponzi schemes require a consistent flow of money from new investors to continue. Ponzi schemes tend to collapse when it becomes difficult to recruit new investors or when a large number of investors ask to cash out.” [9]

Just for fun, let’s replace “Ponzi scheme” with “Pension fund:”

“A [Pension fund] is an investment fraud that involves the payment of purported returns to existing [pensioners] from funds contributed by new [pensioners]. Ponzi scheme organizers often solicit new [pensioners] by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many [Pension funds], the fraudsters focus on attracting new money to make promised payments to earlier-stage [pensioners] to create the false appearance that [pensioners] are profiting from a legitimate business. With little or no legitimate earnings, [Pension funds] require a consistent flow of money from new [pensioners] to continue. [Pension funds] tend to collapse when it becomes difficult to recruit new [pensioners] or when a large number of [pensioners] ask to cash out [retire].”

It has been known for a long time that pensions are a Ponzi scheme. Paul Piorot explains how ownership in a corporation’s stock is largely an illusion in a quote from his book The Pension Idea that was written way back in 1950:

“Does not investment in the stock of business corporations afford some security against the hazards of inflation? Ordinarily, one might think so. But today, it is pure speculation. It is speculation in the face of multiple taxation of corporate earnings… Ownership of stock is an illusion in a company whose management has pledged to employees that future buyers of that company’s product will pay enough more for the product to provide pensions for those who have ceased producing. [8]”

Not only are Baby Boomer’s retirements subject to taxes from corporate earnings, but also from taxes levied on their retirement accounts when they cash out. Not to mention inflation, which is the hidden tax that can cause bonds to generate a negative yield in certain situations (these are the “IOUs from ourselves” Mrs. Fitts was talking about). Also when they die, their estate will be subject to the “death tax” which will prevent even more of their money from being transferred to their children.

The all important questions is: Who is going to be the next round of suckers; rather, who is going to buy those assets from the Baby Boomers?”

This is a hard question to answer since the Millennials certainly aren’t. Only 1 in 3 Millennials owns stock according to a survey by Bankrate. “73% of individuals with an income of $75K or more invest in the market compared to only 9% of people who earn under $30K per year.” [10] This would make sense considering 48% of those who responded say they don’t have enough money. That coupled with foreboding demographic cliff leaves one entity as the buyer of last resort.

In the end, the government and the Federal Reserve will need to bail out these pension funds leaving the next generation to pay the debts through taxes.

What can be done?

I would strongly suggest that today’s Baby Boomers strongly take Catherine Austin Fitts’ advice and re-concentrate the power away from these central authorities and direct it back to the household. This is done by managing your own money. If I were a Baby Boomer, I would reconsider my financial position in these investment instruments. Take a look at what is in your portfolio instead of just looking at the statement balance every month. You may find that you have been holding some worthless Puerto Rican municipal bonds in your portfolio.

Ask yourself, if the stock market were to drop and lose half of its value, would you even be able to retire? Ultimately only you can decide what the best decision is for your personal situation. Although it is an option, you do not need to cash out of your portfolio now and take a tax loss. Reallocating a portion of your portfolio into assets that do well in a crisis situation as a hedge is a conservative strategy.

Stocks are currently at all time highs, weather or not they have more room to grow is questionable. Real Estate has been in a bull market for over 70 years. Gold and silver, on the other hand have retained their purchasing power over time and have carried investors through many crises over the last 5,000 years.

Whatever you plan to do with your money, just know that you are more qualified to manage your money than a professional. Did you know that a monkey, throwing darts at a dartboard full of blue-chip stocks, makes a portfolio that out-performs the average investment advisor / fund manager? Don’t take my word for it, listen to Preston University professor Burton Malkiel:

“A blindfolded monkey throwing darts at a newspaper's financial pages could select a portfolio that would do just as well as one carefully selected by experts.” [11]

Sources

[1] https://www.youtube.com/watch?v=jrC4_PbOnVc&t=605s

[2] https://www.bloomberg.com/graphics/2017-state-pension-funding-ratios/

[3] https://www.statedatalab.org/

[4] https://steemit.com/travel/@bretjfeller/crises-in-puerto-rico-how-big-government-destroyed-the-island-long-before-any-storm

[5] https://pension.solari.com/2018/01/22/pension-fund-stats/

[6] https://www.bloomberg.com/view/articles/2017-03-24/pension-crisis-too-big-for-markets-to-ignore

[7] https://www.lewrockwell.com/2017/03/no_author/worlds-first-pension-crisis/

[8] https://www.lewrockwell.com/2004/08/gary-north/the-coming-pension-catastrophe/

[9] https://www.sec.gov/fast-answers/answersponzihtm.html

[10] https://www.bankrate.com/pdfs/pr/20160706-July-Money-Pulse.pdf

[11] https://www.forbes.com/sites/rickferri/2012/12/20/any-monkey-can-beat-the-market/#60a2a35e630a

Books

James Turk, John Rubino, The Money Bubble. DollarCollapse Press. 2013

Harry S. Dent Jr., The Demographic Cliff. Portfolio / Penguin. 2014

Congratulations @bretjfeller! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!

Update: source [5] is a broken link. The article can now be found here https://pension.solari.com/pension-fund-stats/