My 2019 Forecast

If 2018 could be summed up in one word, it would be: volatility. We started off the year with a stock market selloff. The S&P 500 bottomed in February nearly 12% off its high in the first quarter. From there it was able to make one last rally before breaking down. October 10th saw a heart stopping 3% selloff in one day after several rate hikes already that year from the Fed, four in total for 2018.

As I was watching the crash begin on the 10th I remember thinking to myself that Trump was going to blame the Fed for the selloff instead of a weak economy and the ending phase of a stock market bubble (this would contradict his narrative). I should have known better by now to put this thought on record and write about it because, sure enough, the very next day Trump described the Fed as “out of control” in regards to its decision to continue rate hikes. [1]

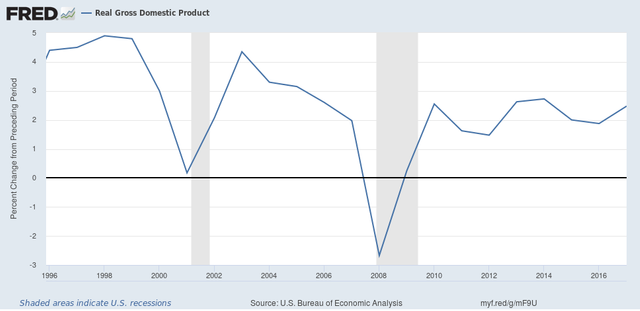

It’s staggering to see Trump’s flip flop on monetary policy since during his campaign he had criticized the Fed for not raising rates and also took stabs at the Obama administration which had failed to see even a 3% growth in GDP (year-over-year) for the entire presidency (see graph below). It should be obvious at this point that Trump’s decision to appoint Chairman Jerome Powell to the Fed was a strategic circus act to play good cop / bad cop. Powell, being described as a “hawk” (someone who prefers tighter monetary policy), would raise interest rates causing a hard stop in the stock market and giving Trump a reason to act disappointed in the Fed. This will allow the Fed enough room to cut rates when the economy inevitably ends up in a recession. I am forecasting an official recognition that the US is in a recession in 2019. This will start a hard reversal in the tightening of monetary policy by the Fed this year.

Although the economy continues to grow, I would like to turn your attention to an excellent interview of Jim Rickards who points out that our economy has actually been in a depression since the financial crisis of 2008:

“You can grow during a depression, but you don’t grow at trend, if trend is 3.25%, and you’re growing at 2.25% which we have for the last 9 years. That 1% gap between trend growth and actual growth… that’s depressed growth… If the economy would have grown at trend since 2009, the country would be five trillion dollars richer than it is today”

If you caught his wink to the interviewer after this statement, that is because this definition of a depression is that of economist John Maynard Keynes who is an icon among the Fed and policy makers who believe we are in an economic boom. Jim is taking a stab at the conventional economists who dictate policy. It is an excellent interview.

A quick word on trade: In early 2018 Trump slapped China with sanctions citing intellectual property theft by the Chinese. Make no mistake that this trade war is about more than intellectual property. The Chinese are still the largest foreign holder of US debt, which gives them a tremendous amount of power and leverage over the US. Since China has become our largest trade partner, they have been paid in dollars and dollar denominated assets for their exports. With easy monetary policy and quantitative easing (money printing) in the US since 2009, the Chinese are displeased with the fact that the US is undermining China’s reserves. Printing dollars weakens the currency that they essentially save in. Imagine how upset you would be if someone continued to steal 3% – 10% of your savings account every year and you will start to understand where China is coming from. Under the Bretton Woods system, which ended in 1971, China would have been able to convert dollar reserves into gold via the US Treasury. That is no longer an option, so instead they have been quietly purchasing gold from the open market over the last decade. That is the best that they can hope for to make sure that they actually get something of value for all their hard work over these years. I am sure the Chinese do not think that their sole purpose in life is to accumulate the little green pieces of paper that the US Fed prints (it’s certainly not mine).

This highlights another fact that I had pointed out in my previous article entitled: Donald Trump Is Going to print A Lot of Money (here), Trump had labeled China a currency manipulator when in fact it is the US who is the manipulator. Being the world reserve currency, the rest of the world is at the mercy of US monetary policy. If China’s central bank were not to actively manage the value of the Yuan in response to the value of the dollar, their exports, and by extension their economy could suffer. It is disappointing that mainstream media fails to cover this and instead continues to focus on things that do not matter at all, for example, Trump’s insensitive comments about other countries or people. There is plenty to criticize Trump about, unfortunately the mainstream media misses the mark every single time. Pathetic.

The only question now is whether or not the US has the leverage to negotiate and come out ahead. China’s economy is slowing, and sanctions from its largest importer will definitely hurt. The timing is very opportune for Trump, I expect that he will seize this. But make no mistake, this trade war is all about negotiating the huge trade deficient with China. [2]

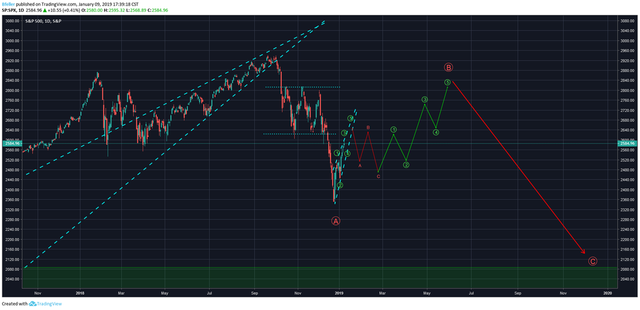

Finally I would like to throw my hat into the ring in regards to a market forecast for the end of 2019 for the S&P 500 index. Using Elliot wave analysis, which I have been studying for only a little while now, I think that we have started a classic A-B-C correction. Traditional technical analysts would know this as a “dead cat bounce.” This is a sharp decline (wave A), followed by a rally (wave B), followed by another sharp decline (wave C). See below.

The blue trend lines on the right represent an upward wedge pattern that broke out in October to the downside. This was a major pattern shift and represents the probable top of the market. As of this writing we are in another smaller wedge which will rally into the next few weeks, we will then have a correction into about March. After March the last fool's rally will start and take us into about July at which time we will start the wave C decline. By the end of the year we should see a retracement back to the start of the “Trump rally” which started November 2016 when he was elected.

Other fundamental factors are usually kept independent of pure technical analysis. However, it is important to mention the main fundamental drivers of this market. Federal Reserve monetary policy remains the driving factor behind stock prices. I expect a hard reversal of rate increases in 2019 and perhaps even a cut if we get an announcement of a recession, this will cause a rally in the stock market which could be very powerful. Whether or not this renders Elliot wave analysis unusable is something I do not have the answer to, however I believe the timing of the Fed’s decisions should match up with the forecast (I did not purposely compose my analysis to line up that way). We know however from history that money printing and easy monetary policy is unsustainable. I believe that this is the beginning of the stock market crash that I eluded to in my post Baby Boomers Will Lose Everything: Pension Crisis (here).

I would like to say that I am not a financial advisor and this information should not be considered investment advice. Always consult a trusted professional for financial decision making. This information is for educational purposes only and represents only my opinion based on very accurate Elliot wave analysis, which itself is not infallible and neither is my interpretation of it.

Sources:

[1] https://www.bloomberg.com/news/articles/2018-10-11/trump-escalates-fed-assault-laments-high-rate-he-s-paying

[2] https://www.bloomberg.com/news/articles/2018-06-14/china-s-economy-dials-back-a-notch-as-output-and-investment-slow

Graph:

Federal Reserve Bank of St. Louis FRED Economic Data

https://fred.stlouisfed.org/series/A191RL1Q225SBEA#0