How to be a millionaire slowly but surely.

Index Funds and The Eighth Wonder of the World: Compound Interest.

Before I begin, this is not some get-rich-quick scheme or some clickbait scam. Time, consistency, basic knowledge of compound interest, and the power of your choices is all you need.

Two 25 year-olds have managed to save up $3,000 each and don't not know where to invest their money. They both have the same goal of putting this money away for their retirement and slowly add to it.

Alan decides to put his money into the average savings account with simple interest. I will use the national average of 0.06% APY for Alan's account.

Chad decides to put his money into an S&P 500 Index Fund and chooses to automatically reinvest his returns.

They both add $100 per week, or $5,200 a year into their investments.

40 years later they are logging in to pull up their account information.

Alan has $197,389.83 in his account. Crap.. That'll be gone in no time.

Chad has $1,155,693.14 in his account. WHAT?

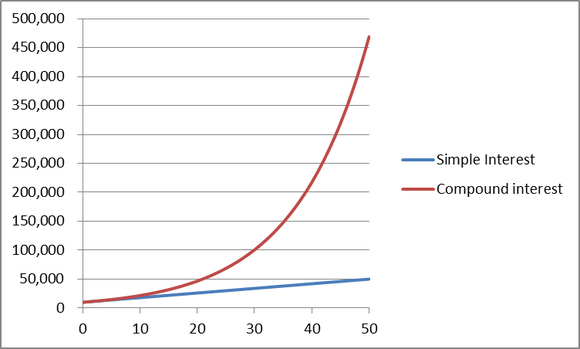

They both started with $3,000 and both put in $100 a month, yet Chad has almost 6x the amount. This is the power of compound interest. Earning interest off your interest.

So while Alan is stressed out budgeting his golden days, Chad is deciding whether he wants to go to France or Italy first.

I used a 7% yearly return for Chad and that is underestimating the average yearly returns he would actually get. At 8% return he would have $1,520,034.97. This is already adjusted for inflation.

Now, imagine instead of $100 a week Chad had invested $150? He would have $1,711,078.02 at 7% return and $2,247,465.68 at 8% return.

The difference of an extra $50 per week ($104,000 over 40 yrs) increased his total by around $555,000.

How about at $200 a week? $2,266,462.90 at 7% return and $2,974,896.38 at 8% return.

As you can see, the sky is the limit.

( )

)

“Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.” - Albert Einstein

Hold on.. What if the market crashes again like in 2008? What happens to Chad's money since it's invested in the stock market?

Well, the market will surely crash again. And again. And again..

One of two things can happen at that point, based on the power of his choices:

Scenario 1: Chad freaks out, pulls out his investment at the market's lowest point and loses a whole lot of money from fear and emotions.

Scenario 2: Chad stays calm, knows that it is only temporary and rides through the storm. Once the market recovers, and it will, Chad will be pleased to see his money growing exponentially again.

()

And no, it isn't a good idea to wait for a crash to start investing. You don't know when that will be. It could be tomorrow or it could be in 5 years, but surely within 20. Waiting defeats the purpose of compound interest. Those 5 extra years of compounding will make a huge difference in the end.

You need as much time as possible in the market to maximize your returns as you can see with the chart. It doesn't really matter what the price is now, it matters what the price will be in 30+ years.

There will be bad years, don't get me wrong, but a couple bad years out of 30 or 40 is worth the risk in my opinion. You saw how Alan ended up by playing it safe!

Wait, aren't there fees for maintaining an Index Fund? Yes, they are called expense ratios. The Vanguard 500 Index Fund is my recommended choice at a 0.14% expense ratio, which is 86% lower than the average expense ratio of S&P 500 Index Funds. And no, I am in no way affiliated or being paid by Vanguard, it's just what I personally use. Since it's inception in 1976, it has produced an annual average return of 10.97%.

You need $3,000 to open the Vanguard 500 Index Fund. I am not sure about other funds. You can do your own research on which Index Fund to pick!

The Importance of Starting Young:

In order to take full advantage of the snowball effect of compound interest, you need to start as young as possible. Here is an example of three people at different ages investing at different rates.

Person A: 20 years old, invests $50 per week ($200/mo)

Person B: 35 years old, invests $150 per week ($600/mo)

Person C: 50 years old, invests $500 per week. ($2000/mo) ouch!

How much do they have at 65?

Person A ends up with $734,854.35

Person B ends up with $728,867.74

Person C ends up with $646,692.80

So even at $2000 a month, Person C still falls way short of Person A and B.

And at $2000 a month, it can definitely be a financial burden for some.

Try messing around with a compound interest calculator with your own numbers to see the crazy potential: http://www.moneychimp.com/calculator/compound_interest_calculator.htm

If I've helped even just one person understand the power of compound interest and the importance of starting young with this post then I take that as a success. Everyone deserves a good retirement after working most of their lives and I believe this is the best way to do so for the average person.

Invest your money, as early as you can, as consistently as you can, for as long as you can.

-CryptoCouch

Loved this blog. This is a fantastic post. Upvoted and resteemed. Would love to see future posts like this. Following also. Great work!

Congratulations @cryptocouch! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPHey @cryptocouch , would love to offer to come onto my podcast sometime.

It is all about entrepreneurs; what you are doing, believe in and what difference you are making in the world.

Here is the playlist: https://www.youtube.com/playlist?list=PL5CpCNPna6p95oJfKPew0N3ZT0k-khdgg

It is audio only over skype. Does this sound of interest to you?

Great post. I think this is a super important lesson that many people forget about. I actually posted a similar blog this week! I'll be following for more updates! https://steemit.com/investing/@ethandsmith/investing-in-crypto-don-t-forget-about-the-get-rich-slow-method