Why Digital Currency?

The Rise of Digital Currency

The benefits of digital currency are clear for all who care to observe. Credit cards have surged in popularity since their inception and if a customer wishes to transact when not in person, which can be online or over the telephone then, paying digitally is the only option. In more recent times we have seen the introduction of contactless payments and it is here where notable improvements to the buying process can be observed. Never has the buying process been as efficient as it is now when a vendor can display a price on a device and the consumer can pay by simply flashing their phone in front of the device. No loose change is needed like times of old and even germaphobes are happy with the reduced probability of contagion.

To anticipate a future where the overwhelming majority of purchases are made digitally, seems almost a given at this moment in time. Yet cash is still in use and for very good reason. For all of the benefits exhibited in digital currency, there are some features of value provided by cash which are missing in traditional digital currency. Two such features are privacy and possession. Reasons for valuing these two features in a money are varied, but trust is the prominent factor. Trust in keeping your business private, trust that your funds are secure and trust that your money is accessible, unlike what happened to Greek citizens during the controversies of Grexit or having bank deposits seized as happened in Cyprus in 2013.

Enter Bitcoin

On 03/Jan/2009 a new digital currency technology was brought in to existence. This new technology solved the problem of possession. For the first time in the history of digital currency, an individual can possess their own quantity of a digital currency without the need for any trusted third party. They could also send it to another individual who was willing to accept it without having to trust a third party. With traditional digital currencies it is not possible to possess the digital currency at all. Traditional digital currency must always be in the possession of a bank who the beneficiary must instruct and has no other option but to trust.

Technical side note: Trust in a third party is redundant in bitcoin, but trust in the network, i.e. computer code, i.e. maths is required upon participation. The computer code is open source, meaning it is publicly available to view and any would-be-attacker attempting to doctor the code is not validated by the rest of the network.

We can observe that the creator of this new technology added the following text to what is called the genesis block,

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

Competition in currency has arrived. No longer is man limited to the services of heinous central banks. This is not the first time that people have tried to compete with central banks, but this time the competition has arrived without a headquarters, unlike the noble attempt of the prior digital currency eGold, which was shut down through government coercion. We now have a technology where anybody anywhere in the world with a computer and an internet connection can participate in the network by operating a node, and to quote the bitcoin whitepaper,

Nodes can leave and rejoin the network at will

In sum, bitcoin can not be shut down without disabling the internet for the entire planet. Surely a feat too far for any megalomaniac? And so, the central banks are forever exposed to competition which they can no longer plausibly coerce out of existence.

The Problem With Cash

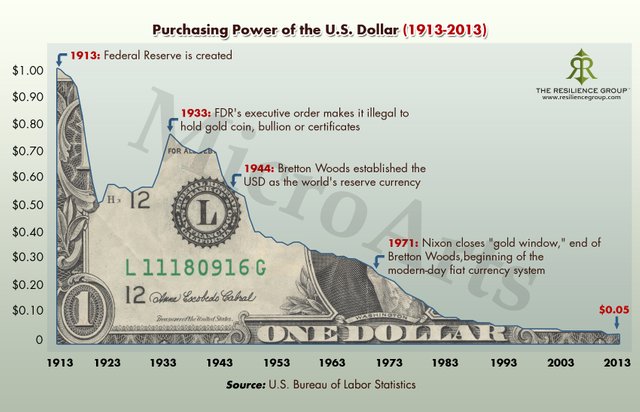

To own a thing is to have the exclusive right to restrict others from utilising that thing. This is present in cash, but the main flaw with cash is that it is exposed to the government predation of inflation. This subsequently leads to the GBP being a poor store of value for people who own it.

And indeed other fiat currencies.

Also cash is useless for making payment over large distances, which is where lots of commerce takes place. Bitcoin is an amalgamation of the features of traditional digital currency and cash. There is no coercion being applied to people in order to use it unlike legal tender laws attached to GBP or any other national currencies. Any value which is attributed to bitcoin is attained purely on its technological merit. I suggest that the voluntary mechanism of attributing value to a currency (or to anything) is the superior of the two mechanisms. The sheer fact that one is compelled to use a currency is reason alone to question it's long term value.

Room For Improvement

It seems that the abolition of cash is not just plausible in the near future, but it is indeed probable. High denominated bank notes were declared illegal overnight in India in 2016. Is it out of the question that this could happen where you live? One can only speculate as to how cash may disappear but the desire for a sound money has been left unsatisfied for far too long. The benefits of a sound money can be anticipated. Bitcoin may not be the perfect sound money and perhaps there can be no such thing as perfection, but with it, bitcoin brought about the ability for countless developers and competitors to utilise and tweak this technology. What can be said for certain is that this technology has provided you, dear reader, an opportunity to appraise it. How valuable will this technology be in a year, five years, twenty years? It's value will be derived from two things. 1. It's scarcity, which for bitcoin is hard coded to be twenty one million and 2. How many people use it.

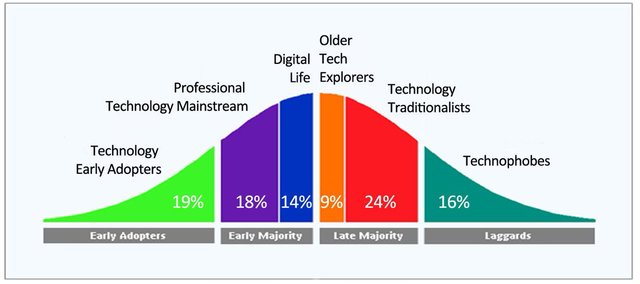

I will leave the valuation squarely with you as at this time the price, if widespread adoption occurs, can only be predicted and if widespread adoption occurs at all, it can only be anticipated. If the future does bring widespread adoption then my own personal assessment is that we are currently in the early majority phase. Where the price may go as the technology moves along this adoption curve I shall also leave squarely with you.

There is a lot to consider and it is pure speculation. Should you decide that like me, you wish to own some of this new digital currency, I would like to be the first to offer to help you navigate what can at first appear to be an intimidating landscape.