Brickx - Is fractional property investing a feasible way to get on the property ladder?

.jpeg)

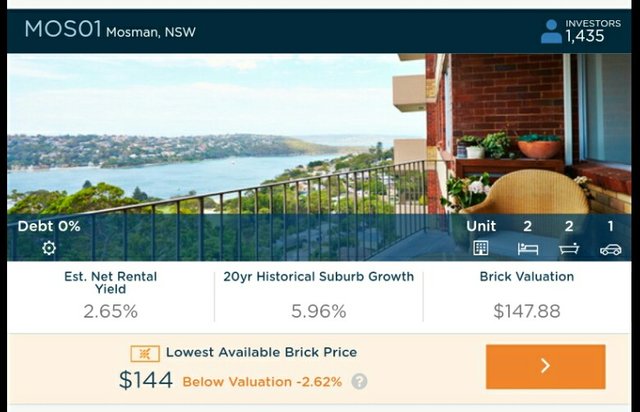

Brickx splits an investment property into 10,000 units (or “bricks”) and provides a marketplace where investors’ can buy and sell a minimum investment of one brick.

In this post I will attempt to review the merit of the investment by running through an example using the highest forecasted yield available at the time of posting.

I have chosen to ignore capital gains as the market in Australia has plateaued/started falling. With analyst divided on if we are at the start of a market correction or just entering a period of lower more normal growth.

Please note that all prices are in AUD, the views expressed are my own and are not intended to be a source of advice. #DYOR

Fee Structure

BRICKX charges a 1.75% transaction fee when you buy or sell your Bricks.

In addition, a 6%+GST property management fee is deducted from the gross rental income.

Comparative

As a baseline, I will be comparing the investment to depositing the funds in a savings account.

A quick internet search returns an average interest rate of approximately 2.5% per annum so I will use this as my baseline.

Highest Forecasted Yield Property

Cost for 1 brick: $144+1.75%=$146.52

Gross rental income P/A: $990 (per week)*52=$51,480

Management fee P/A: $51,480*6%+GST=$3,397.68

Net rental income P/A: $48,082.32

Net rental income P/A, per brick: $4.81 or 3.28%

Vs savings account: $3.66-$4.81=($1.15) or 23.91% less

Few More Things to Consider

The market for this property appears fairly liquid with the website reporting over 300 bricks changing hands in the last 30 days.

The rental income assumes that the property is always tenanted and this will not always be the case.

Any maintenance cost will be deducted from your income.

Conclusion

On face value, brickx seems like a better position than cash. However, the income is not guaranteed and your capital is at risk.

I do not think that I am being appropriately compensated for the uncertainty in the property market and the income. Therefore, I will be giving this a pass but will keep it on my list to revisit in the future.

No getting much traction...

Maybe to niche or not many people from #Australia on here?