Ugly, Tailing 3Y Auction Prices At Lowest Bid To Cover Since May 2009

It is not a pretty start to this week's bond auctions.

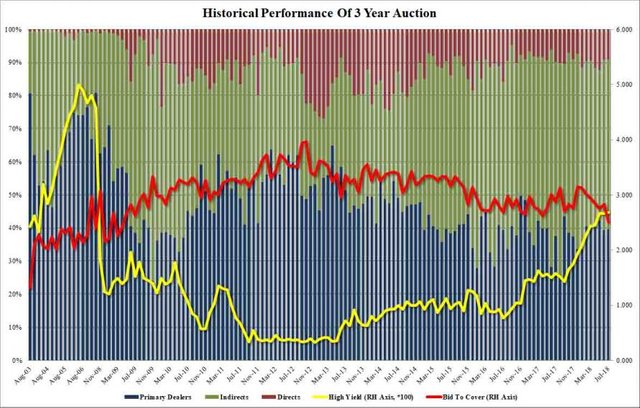

Moments ago the US Treasury sold $33BN in 3Y bonds in what was an ugly, tailing auction, with the High Yield of 2.685% not only tailing the When Issued 2.679%, but also the highest since the summer of 2007, and 2 bps above June's strong 2.664% 3Y yield.

The internals were even uglier: the Bid to Cover tumbled from 2.83 in Jun to 2.51, far below the 6 auction average of 2.92 and the lowest since April 2009.

One reason for the ugly auction may be that for the second month in a row, the Indirect bid i.e. foreign central bank, slumped, and was just 39.6%, in line with last month's 39.4%. Directs took down 9.1% of the auction which left a whopping 51.3% going to Dealer banks who ended up with a majority of the takedown for the second month in a row.

Overall a very ugly auction, and coming at a time of heightened curve inversion fears, it may indicate progressively lower interest in owning the short end which keeps on rising with every passing month as the Fed continues to hike rates.

Is the weakness in the primary market specific to this point on the curve or is it more systemic? Find out tomorrow when the Treasury offers a $22 billion reopening in benchmark 10Y paper.