Talk about operating in the internal market of steem, 30% profit story in 3 days

With regard to these benefits in the internal market, I would like to chat with you today. First of all, I started to touch internal market transactions one month ago. From scratch, I learned to benefit from writing robots. (The following are some of the lessons I learned from beginner.)

What is the internal trading market?

This is the internal transaction address. The internal trading market is mainly for SBD and STEEM to facilitate the circulation of steemains within the platform. It plays a very important role in the initial value of steems.

Why come to the internal market?

I think if it is not for the benefit, basically you can ignore the internal market, and use steemit as a place for writing and communication is also a good choice. I came to the internal trading market and it was also a coincidence that it was also in the leisure period of a month ago. I saw @maiyude in the community established by @justyy gods to discuss that the internal market is profitable and it is a zero-rate transaction. I was also attracted by the zero rate, and then began to study.

To trade profit, we must first look at each data and function of the internal market, and we can basically begin manual operations.

Learn to look at the internal market

(Turn on the computer and go straight to the internal market)

(Yes, I didn't understand it at first.)

Get ticker

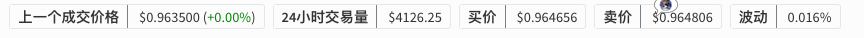

[figure 1]

Figure 1, is to obtain quotes,

Last price: The price of the most recent transaction (the price is slow at the end of the page, so you can't ignore it)

24 hours trading volume (sbd_volume): current SBD trading volume within 24 hours (steem trading volume will also be displayed within the api, here is hidden)

Bid price: When SBD buys STEEM, we call the purchase price

Selling price: When STEEM buys SBD, we sell the price

Volatility: In Figure 2, the empty area between the green area and the red area, ie, the area without pending orders [Variance = (lowest selling price - highest buying price)/100]

(The above price is the exchange rate between SBD and STEEM as a pair of transactions, ie the price (exchange rate) = SBD/STEEM)

SBD-STEEM Trading Pending Order Quotes

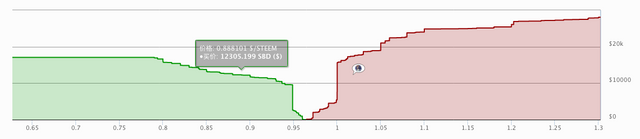

[figure 2]

Figure 2, is a visual STEEM and SBD's pending orders, the official side of the site to buy and sell orders are to obtain 500, this map is mainly to facilitate our intuitive look at the current situation of pending orders to facilitate our immediate adjustment (see In this map, everyone did not expect the story of Yugong Yishan. Yes, we did a trade, that is, digging up the mountain to fill in another mountain. This side of the road changed the road to facilitate the passage, and the change of mountains there helped promote the prosperity of the resources. Why not)

STEEM and SBD Order Ordering (Buy & Sell)

[image 3]

Figure 3 is a tool for manipulating pending orders and direct transactions. When you are not in a hurry to redeem your coins and want to sell at the best possible return price, we usually place orders. Otherwise, we will directly purchase the goods already on the market. The single, as shown in Figure 4, shows the left side is the SBD from top to bottom buy one to buy ten pending orders, the right is STEEM from top to bottom sell one to sell ten pending orders, when we have STEEM on hand to rush to direct exchange SBD, we directly click on the left side to pay the corresponding pending orders (when shopping is the same to see which goods to choose, we can see which price clicks); otherwise, SBD buy STEEM is the same. Another is a pending order. If you still have STEEM in no hurry to sell, you have to set a high price point. We can choose a price on the right. Similarly, the SBD is also a pending order.

Observe the order list and transaction history (get order book, trade history)

[Figure 4]

Figure 4, first to observe the pay list,

Total SBD($): The cumulative number of buy orders sold, such as buying a single SBD is 47.513, accumulative 47.513; buy two orders 29.212, cumulative buy one plus two buy, as 76.725; as a pair, odd analogy statistics, convenient need Purchased user set price

SBD($): This is the amount of pending order to sell SBD

STEEM: This is how much STEEM a pending order can get

Price: written above, is SBD/STEEM income, that is, the exchange rate

Then the sell order list also means this, the rightmost is the display of real-time transaction data, which can be used to initially determine the buyers and sellers of the purchase situation, the green font is SBD buy STEEM, red font STEEM buy SBD

Cancel Order

[Figure 5]

Figure 5, when you need to adjust the price, or do not want to order, click Cancel to cancel the order

Well, the above is the white can operate and can start trading profitable

Next, talk about how I profit and strategy

24 hours trading volume is less than 10,000, artificial staring

If you treat steem as a stock, I believe his trading volume is really low compared to other stocks. So you think that if there is such a stock in the stock market, I think basically no one is playing, too low, the transaction is very inactive. However, in turn, I would like to think that here is 24-hour trading without any disruption, but also free of handling charges (I have been wondering about such good trading conditions, and even though I have checked the data once, only a few dozen active users are playing one day). When I started playing in the first week, I was not very familiar with it. I adjusted several strategies, and finally I sold it on a one-percent basis, selling high and low (the buying price was set to be 5 times lower than the highest buying price, selling price. Set a price that is five thousandths higher than the minimum selling price. This setting is for high-frequency trading. With this kind of strategy, I rushed for half a month and I held the steem from 100 to 120 (plus the rented sp. 10STEEM, there are swaps, actual profits should have more than 30 percent), very high, I think.

Three days trading with robot program, gain 50%

Because manual trading is too physical, based on my self-learning judgement for a half month, I wrote a simple robot and let him work instead of me. Fortunately, on the first line, I encountered a high volume of trading. I was profited 50% for three days (plus the creation of a new number and rental sp 13 STEEM, the actual three-day profit of more than 60%), from the admission Up to now, I have actually had more than 80% of the proceeds. For the sake of conservatism, the money spent is not included, but I'm content to benefit so much, although I only have 100STEEM's principal (actual price of 1000RMB)

In internal transactions, I was still a novice. Now I haven’t encountered any problems with the small amount of play. If this article works well, I’ll give you a robot tutorial for everyone to play with.

Finally, remind everyone that investment is risky. Please be cautious when playing. The reason why I don’t have large capital investment is that one is a novice and the other I am really poor (I hope to buy a car on the steemit platform).

Well, wake up, it's time to get out of the car