Ultra Rich Became 20% Richer in 2017, Meanwhile the World Economy Crumbled from Money Manipulations

While many might be feeling economic forces pressing down on their lives, getting deeper in debt and closer to poverty, the ultra rich are feeling the opposite. 2017 is a record setting year for the billionaires of the world, as they made more money that any other previously recorded year in history. Their wealth increased by 20%, according to a report by the UBS, the famous Swiss bank, alongside the tax accounting firm PwC.

Famous names like the Rothschilds, Rockefellers and Vanderbilts who are known for their massive wealth, and have their part to play in many conspiratorial accounts of shaping of human history in the past few hundred years. They controlled most of the wealth in the past 20th century, but now there are more people and families joining the ranks of the super wealthy. There is so much money in hands of these upper tier ultra-rich that they will create a "new wave of rich and powerful multi-generational families".

In Section 3 titled "Managing family wealth in the 21st century", is says:

The past 30 years have seen far greater wealth creation e Gilded Age of the late 19th Century. That period bred generations of families in the US and Europe who went on to influence business, banking, politics, philanthropy and the arts for more than 100 years. With wealth from entrepreneurs to their heirs in the coming years, the 21st century multigenerational families are being created.

In 2013, there was a total of 1,512 billionaires in the world, totaling a total wealth of $6.3 trillion. This increased to 1,751, to 1,760, to 1,979 in 2014, 2015 and 2016 respectively, and finally to 2,158 in 2017 with a total wealth of $8.9 trillion and an increase of $1.4 trillion from the previous year. That's a larger growth for the ultra rich than the whole GDP of Spain or Australia.

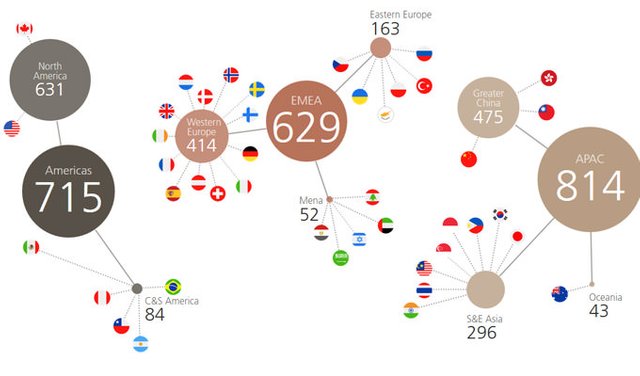

This is what billionaire distribution looks like per region:

Source

Over 40 of the 179 new billionaires got that way from inheriting their wealth. Many billionaires are over 70, which the report expects to generate more inherited billionaires in the next 20 years as approximately $3.4 trillion is to be handed down to them.

A major wealth transition has begun. Over the past five years (2012–2017), the sum passed by deceased billionaires to beneficiaries has grown by an average of 17% each year, to reach USD 117 billion in 2017. In that year alone, 44 heirs inherited more than a billion dollars each (56% Americas, 28% EMEA, 16% APAC), totaling USD 189 billion.

Over the next two decades we expect a wealth transition of USD 3.4 trillion worldwide – almost 40% of current total billionaire wealth. The calculation is simple. There are 701 billionaires over the age of 70, whose wealth will transition to heirs and philanthropy over the next 20 years, given the statistical probability of average life expectancy.

The 30 richest billionaires over 70 years old have a combined net worth of over $1 trillion. David Rockefeller died last year at 101 with a fortune of $3.3 billion. He was the last grandchild alive from the founding fortunes made by John D. Rockefeller and his Standard Oil company that made him the world's first billionaire.

Families are getting wealthier, where the old adage is less of a reality:

From family businesses to business families

They say that the first generation makes it; the second generation preserves it; the third generation squanders it. Yet the cliché no longer appears to be appropriate. As we work with our billionaire clients, many of the next generation seem highly motivated, committed to their chosen careers, the family business and/or doing social good. For sure, there are exceptions, but there is a tendency for the next generation to approach the responsibility of wealth extremely seriously, even becoming entrepreneurs in their own right.

Apparently, keeping the family business alive matters to keep the wealth going for themselves and future generations:

Business families are emerging, not just family businesses. The family business is a good nursery for entrepreneurs. Of those multigenerational billionaires who inherit a family business, almost two thirds (62%) then start entrepreneurial ventures themselves. By comparison, only 42% of those who inherit assets do so.

Most of the ultra rich are in the U.S., but there are a growing number in China. China has only 16 billionaires 12 years ago, while in 2017 that has risen to 373. This means that for every 5 billionaires int he world, 1 of them is Chinese. The growth in China is fueling the rise of more billionaires.

Ont he other hand, a report in June by Philip Alston, the U.N. Special Rapporteur on Extreme Poverty and Human Rights, says 18.5 million Americans live in extreme poverty, with 5.3 million living in conditions of absolute poverty that are akin to a Third World country. While the gulf between the rich and poor grow, the world burns for many and the ultra rich few grow further in their monetary dominance and excess.

What do you think of all of this? It's just fair play? Just honest working people who make money by making the world better? I think it's more nuanced than that. We are living in an age of money-magic number-manipulating games and gambling. They play around with money, and sure some lose money, but some make a lot of it, and all it is, is high-stakes gambling, like the stock market for one, or worse yet, with collateral debt obligations (CDO) and the laughable derivatives market and bubble.

The derivatives bubble is at over $500 trillion. The GDP of the planet, called the GWP, was estimated to be at around $107.5 trillion in 2014. Many of the ultra rich have been playing games with money, number-magic, in unreal schemes. And when their tricks pop, the world blows up in economic crises.

We only saw the tip of their financial misdeeds in the 2008-2009 crash. There is a lot more pain ahead for the rest of us in the future. Expect more people to become poor in the next big crash that was engineered by many of rich fraudsters of the world. Each time this happens, more wealth is transfered from those who have less money to those who have more money, further widening the gap of wealth inequality.

References:

- Billionaires report 2018

- 'While the Rest of the World Burned,' Billionaires Made More Money in 2017 Than Any Other Year in History

- World’s billionaires grew their combined wealth by more than GDP of Spain or Australia in 2017, says report

- World's billionaires became 20% richer in 2017, report reveals

- Report of the Special Rapporteur on extreme poverty and human rights on his mission to the United States of America

Thank you for your time and attention. Peace.

If you appreciate and value the content, please consider: Upvoting, Sharing or Reblogging below.

me for more content to come!

me for more content to come!

My goal is to share knowledge, truth and moral understanding in order to help change the world for the better. If you appreciate and value what I do, please consider supporting me as a Steem Witness by voting for me at the bottom of the Witness page.

I would argue (quite rationally, I think), that if you are financially indebted, you are not only already in poverty , but delusional also...Soz...

(In a 'personal household finance sense', not a business one)

(This isn't pedantry!)

Since before the battle of waterloo (1815) historically speaking, the rothchilds have had the financial system by the gonads.

There are no 'nouveau riche' that will ever be joining the old money - just the illusion of it..

With a corrupt financial system (centralized banking owned by the rothchilds), and then the bankers deciding the value of money - through interest and fiat printing -it's a rigged game that's mathematically impossible to ever win.

interesting factoid...

bezos is worth 150 billion (ish)..

estimates of the rothchilds ...... no one really knows -

500 trillion...

Yes, getting into debt is not a wise move in my book either ;) The old money stays in the dark in their hands and we have no clue indeed. Only a facade is presented to us to gleam at their massive hordes of wealth. Rothschilds likely in the trillions, despite some news about their dwindling wealth... unless they really mismanaged shit over history... I doubt it though.

I believe one of the most important factors in change is keeping presssure on people in our local communities. We will never find the very few who are pulling all the strings, but thankfully it is not them that are carrying out the actions. It is our local police officers and military. It is politicians and people that take government jobs. They are the ones enslaving and enforcing the system. Judges, CPS, any state agency. We need to stop consenting to government. The people who take these type of jobs shove off their responsibility for a paycheck, they do not love themselves. They claim they have to feed their families, but I bet even if the worst of them stopped, people would be happy to forgive and share their food, resources to help. To say thank you for taking responsibility for your thoughts, emotions, and actions. That is what we need to do to be free.

Yes, the only power we really have is in our local lives. If we stop giving out power away to centralized forces further away from our lives, then we become more responsible for how things plays out.

I think it's partly caused as you describe and also partly that they can afford to do things we don't have access to do. Just being "an accredited investor" means they can participate in IPOs and even now ICOs. This is where so much wealth is created. And then there is hedging in so many different ways that they are sure to always be growing wealth even if some things are declining. Buying multiple real estate properties, being able to develop raw land into income generating property, investing in multi-million dollar art, and so on.

So yes, there is some absolute corruption and exploitation going on, including "buying" politicians to make policy and tax law more and more favorable to them. But some of it is simply the cost of many of the things that earn the most.

Good points ;) They have the means to just make more because they have more, while those who have less are stuck just trying to just get by :/

The federal reserve keeps buying financial assets and supporting socialism for the rich.

Very well throughout and informative article! I always heard of billionaires donating most of their wealth to charity, but I guess that’s not really the case!

I wonder how many billionaires will be made through crypto/ how many current billionaires will lose their fortune if the current financial system collapses and they fail to get into more progressive assets like crypto

Posted using Partiko iOS

Some do. Gates started a charity drive for the richest to donate a part of their fortunes to when they die I think (not that it makes him a saint for doing that). Jeff Bezoz, founder, CEO and chairman of Amazon, hasn't joined it though ;)

Very well throughout and informative article! I always heard of billionaires donating most of their wealth to charity, but I guess that’s not really the case!

I wonder how many billionaires will be made through crypto/ how many current billionaires will lose their fortune if the current financial system collapses and they fail to get into more progressive assets like crypto

Posted using Partiko iOS

Thanks. Some of them do, but not most. The tides can and probably will change in the future, and the flippening might happen with trad. vs. crypto financial dominance.

I appreciate the read and this will continue unless redistribution finds a better approach for the minority communities. One of the ways this could happen is with blockchain which is another of the dozens of reasons I believe Steem could change the world. Universal Basic Income would be a great addition for billions of people around the world and blockchain could help that process. However, as the rick get more concentration of the wealth, they have more resources to battle the move towards decentralization and these initiatives.

The blockchain could help, as long as the UBI isn't tax-derived, then I guess it's worth a try as @dan has explained as possible last year.

Interesting, there is certainly a bigger divide between these financial groups and it gets larger and larger every second. I have no interest in being that wealthy, the more money the more worries I feel like. It isn't easy being middle class that's for sure but there's less for me to worry about. If the stock market shits the bed I don't lose a whole lot but the ultra rich depend on things like the stock market. If the housing bubble bursts I won't lose much either. Having a decent amount of money is all I want, enough to pay my bills and be able to afford things without having to necessarily do a budget and count every transaction.

Yeah, decent cash flow to be able to not worry about starving or surviving ;) If workers held more value for what they produce, rather than it going to the top, the wealth disparity would be reduced quite a bit.

Will be curious if a collapse happens how many will retain their wealth. I suspect that in every financial system there will be corruption that will influence the flow of money back into the manipulators hands.

Physical asset holders will keep their wealth. Digital and paper will be hit hard. Only the real things matter in a crisis. The rich buy low in those times of crisis, and get richer while the poor have to sell to barely get by...

They propose to get rid of poverty by using other people's money.

Raise the bar by lowering the bar :P