LOSS AVERSION WHEN FACED WITH RISK & REWARD

Loss aversion is a preference for a sure outcome over a gamble with higher or equal expected value.

Conversely, the rejection of a sure thing in favour of a gamble of lower or equal expected value is known as a risk – seeking behaviour.

To measure your risk tolerance if you were to flip a coin with the chances of it landing on heads rewarding you $100, tails losing you $500 and the option of taking $50 to not flip the coin, if you were to take the $50 you would be “risk averse” or “risk neutral”.

Many experiments from behavioural economists have shown people are generally more risk avoidant when considering potential losses more so than risk seeking when considering potential gains.

The reason for this cognitive bias is due to a fear, more specifically a fear of the perceived pain that loss brings.

Results from studies on loss aversion show that the pain of losing money is more than double as painful as gaining the same amount.

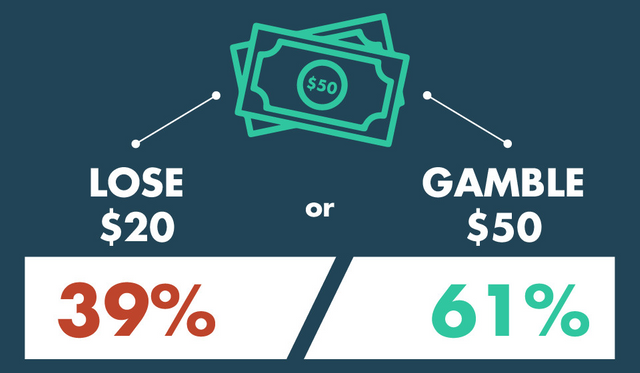

Here are some examples from risk/reward experiments that show how these factors drive our decision making using the principle of loss aversion.

CASE 1: INCENTIVIZED EMPLOYEES

Researchers measured how loss aversion could incentive employees by giving bonuses at varying checkpoints.

The study divided employees into three groups:

Group 1: A control group that wasn’t given a bonus for performance.

Group 2: Promised a bonus at the end of the year if performance objectives were met.

Group 3: Given a bonus at the beginning of the year and were told the bonus would need to be given back if performance objectives were not met.

The results from the study showed the first two groups performed relatively the same, while participants of the third group who had the risk of losing their bonus significantly out-performed the other groups.

CASE 2: DOUBLING DOWN ON LOSSES

Gambling addiction is an affliction that puts many at serious financial and often consequent personal loss.

What many find confusing about gambling addiction is how gamblers are perplexed at their own behaviour and what causes them to continually gamble and seemingly unable to stop.

Against their own will they feel compelled by some inner force to continually bet, even at significant losses they find it very difficult to walk away.

The reason is loss aversion, which may seem paradoxical as gamblers put further loss at risk with continued gambling.

However, those with a gambling addiction fail to recognise that loss aversion works not only to prevent or mitigate potential losses by deciding not to continue gambling but loss aversion itself can trigger us to act impulsively toward taking greater risk to recover existing losses.

Gamblers are more likely to place higher bets and continue to play to win back their losses than they are to walk away from the table even while at a net positive.

Gambling motivated by loss aversion increases both risk and pain (loss) over time and can perpetuate impulsive triggers and anxiety leading to sustained irrational behaviour.

4 COGNITIVE FACTORS THAT INFLUENCE GAMBLING BEHAVIOUR PROBABILITY FALACIES

There are 3 predominant probability fallacies in gambling that affect behaviour;

One is the “Gamblers Fallacy” which is the belief that a string of losses make the gambler due to win soon.

Another is the “Hot-Hand Fallacy” which is the belief that because of a string of wins occurring, the gamblers streak is sure to continue because he or she is “on a roll”.

Similarly the “Near-Miss Fallacy” is believing when a failing bet is close to a win that the probability is that they’re “near to winning”.

All 3 of these fallacies are based on hope, not evidence and perpetuate a gambler into taking more risk to recover losses.

ILLUSIONS OF CONTROL

Behavioural studies have experimented on how the illusion of control over a test environment can influence the belief that an uncorrelated decision can lead to a successful outcome.

The results show that the more frequent a result from an uncorrelated response, the more the participant believed a personal skill attribute had bearing on success rate.

For example; one test had participants press a button in reaction to a light being shown. When the button was pressed the light would either show “Score” or “No Score”. However, the button being pressed had no bearing on whether “Score” or “No Score” would light up but participants attributed the skill of reaction time and the speed in which they pressed the button having an effect on whether they scored.

The results from the experiment showed the more frequently “Score” was shown, the more participants believed in them having conscious control over the success outcome.

SELECTIVE RECALL AND MEMORY BIAS

Human beings have a natural tendency to privilege some events over others in memory.

It’s often easier to recall memories that reinforce our beliefs, hopes and expectations and remembering wins and

forgetting losses.

However, as is often said in the financial markets “Past performance is not indicative of future results”.

By remembering past successes and ignoring the lessons losses have taught us we are at risk of founding our decisions on hope, not evidence, which can lead us to repeat mistakes and bad decision making.

BELIEFS ABOUT PERSONAL ATTRIBUTES

As shown in the earlier example, given the opportunity and right set of circumstances we can attribute “luck” as a personal attribute.

Some people do consider themselves as “lucky people”, which again because of selective recall and memory bias, this happens to become somewhat of a self-fulfilling prophecy as optimism paints a different picture from the perspective of the person with a tendency toward a more positive disposition.

Superstitions, believing in the fate of life having a predetermined outcome and positive thinking all have a part to play in ones decision making when taking risks and tend to guide those with a fatalistic outlook on the side of intuitive action before evidence.

Loss aversion in markets appear at the opposite ends of the spectrum. During a down cycle novice traders are likely to hold onto a losing asset for fear of letting go of a potential winner, despite value of the asset showing fundamental signs of weakness.

In contrary, ‘Fear of Missing Out’ also known as ‘FOMO’ by purchasing stock in an asset that has already made significant upward price movement.

In this instance ‘Fear Of Missing Out’ acts on impulse behaviour which puts the trader at an increased risk of loss by motivation of short term anxiety being intensely felt as an irrational call to action.

RISK AVERSE INVESTORS

A risk-averse investor dislikes risk and, therefore, stays away from high-risk stocks or investments and is prepared to forego higher rates of return. Investors who are looking for "safer" investments typically invest in savings accounts, bonds, dividend growth stocks and certificates of deposit.

FEAR OF MISSING OUT

We hate to lose what we already own, as once we own something its perceived value increases, this is called the ‘Endowment Effect’, ascribing added value to something we own.

However, with the power of visualisation we can perceive how it would feel to own things we do not yet have and imagine the experience through the lens of a projected reality.

WHAT IS FOMO?

FOMO is described as a “pervasive apprehension that others may be having a more rewarding experience from which one is absent” (-wikipedia)

FOMO can elicit anxiety and be synonymous with a ‘Fear of regret’ relating to missed social interactions, key information, pleasurable experiences and profitable investments.

FOMO can be summarised as the perpetual fear of having made the wrong choice by comparison of an imagined alternate reality in which the other scenario would have been better, having the effect of negative psychological well-being by feeling anxious and depressed.

As discussed, emotions have a key role in impulsive decision making, particularly emotions which cause discomfort by applying psychological pressure to take -action or change something in our environment even if our orientation shifts away from the rational, long term objective to short term, pleasure-seeking on a whim.

FOMO works much the same way as loss aversion whether it motivates us to buy into a stock or cryptocurrency rally to chase the price or to fill our social media portfolios with symbols of grandeur.

By discerning motives toward action we our able to create distance from impulsive thoughts to make more calculated decisions, which long-term may have more consequent loss than the immediate opportunity.

OVERCOMING RISK TAKING BEHAVIOUR MOTIVATED BY LOSS AVERSION

By recognising our natural tendency toward making quick decisions based on projected outcomes from past-experience and intuition we can slow our impulses away from choices that put our stake at risk.

Here are some practices that are of utility when facing probability and loss aversion;

Take your time

IF you feel the impulsive need to make a quick decision be aware that your first choice may not be the most logical choice you could make given the (self-imposed?) time constraints and added pressure to act now.

Buy yourself some time by putting pen to paper and calculating the risk to reward ratio and being objective about how the current opportunity is aligned with you long term strategy.

Be open to take, and not to take the risk

By being impartial to the demand on time influencing your decision you’ll be better able to asses the value proposition with long-term success in mind.

Opportunities with a “limited-time offer” add buying pressure, however opportunities which come at a time with greater upside potential than potential downside risk may be worth pursuing.

Focus on one thing at a time

Many studies have conclusively shown that the human brain operates best when focussing on a single task at a time.

Multitasking significantly interferes with effective decision making.

Don’t feed the FOMO.

Identifying the cause for a conflict of interest with present moment desires and long term objectives will help to nullify the chances of making a decision based on FOMO induced loss aversion.

Is compulsively checking your portfolio making you itch to make a trade?

Is spending too much time on social media channels comparing the lives of people you may or not know fuelling desires to fulfil short-term pleasures or spending money counter productively to your long-term strategy?

Take account for impatience and being prone to envy by being present with your own life goals and always keep your strategy as priority.

Weighing investment risk objectively

All investments carry some risk whether it’s low risk investments like treasury bonds or a highly speculative asset such as cryptocurrency, formulating an investment strategy is a personal preference that should be measured against one’s objectives and risk tolerance.

Are you willing to forgo high return on investment for a lower risk investment and incur a potential loss in opportunity cost?

Or is the safety of the principal amount invested being protected against loss more important to you than the rate of growth?

Are your investments likely to keep you up at night with worry?

Are you over-extended in your investments, potentially risking your living standards, bills, food, mortgage payments, rent etc?

Are you willing to make lifestyle changes in the interim and perhaps explore extra income generating streams to supplement your cash-flow in exchange for potential higher risk/return investments?

These are key questions to ask yourself when weighing the risk and opportunity cost of low/high risk investments and your tolerance toward loss or potential yield.

SUMMING IT UP

How much risk is appropriate for an individual is uniquely personal, by measure of risk tolerance, goals and circumstances.

When it comes to investments you can formulate a strategy quickly by calculating how much principal you’re willing to invest, how much of your principal to allocate to speculative assets and how long it would take at X ROI. This will help you paint a picture for asset allocation of your portfolio.

Example:

If you have a 5 year financial goal of $1,000,000 with a $200,000 principal to invest your target rate of return each year would be 80% per year. What kind of market would you need to be in to see this kind of return? Is growth of your principal more important than the volatility of the market you’re in?

By considering these 3 elements you’re able to have flexibility to the degree of risk and return you’re willing to undertake:

- Principal amount invested

- Amount of time in the market

- Rate of return

If you’re a retiree then protecting your investments for longevity over volatility may mean you’d allocate only 5% of your portfolio to speculative assets and the majority diversified over large cap stocks and bank investments.

Whereas if you’re beginning work you may have a large portion of your portfolio allocated to small cap stocks, speculative assets and a more concentrated portfolio as your risk tolerance may be higher given your ability to earn back capital losses.

In conclusion by being aware of how emotional triggers lead to impulsive and often irrational decision making you’re armed with the knowledge to create distance from reactionary decisions when stake is at risk and to look at investment strategies, life choices and personal goals methodically by having a strategy and focussing on the long-term goal over immediate pain or pleasure.

Thank you for reading.

Congratulations @matthewreynolds! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!