Compound Interest and Why It is a Big Deal

You have probably heard of the concept of compound interest, but do you know what it is and how it works? You put money into a savings or investment account and the gains or "interest" earned starts to accumulate over time. The initial return you make on your money is basic interest. However, once the future interest payments start being calculated, the bank will base the payout on your new balance WITH the new interest that you've already received. VOILA! Compounding interest is at work. If you're already aware of the details of compound interest and are not using it to your advantage, please read on and I'll tell you why you could be making a big mistake with lasting implications.

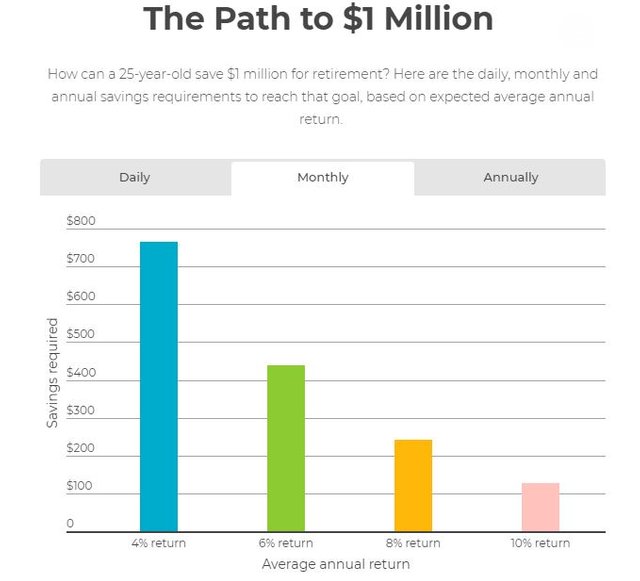

Since most people need visual proof when it comes to math and money, I'm going to start off with a quick visual representation of the difference between trying to save $1 million dollars starting from age 25 and age 30. I found a couple of great charts in an article from CNBC.com that they pulled from NerdWallet (an outstanding personal finance website that I highly recommend). This will show you the difference that just 5 years of saving with compounding interest will make on your balance.

If you start at age 25, your path will look something like this:

That clearly shows the power that interest and compounding interest can have on your nest egg.

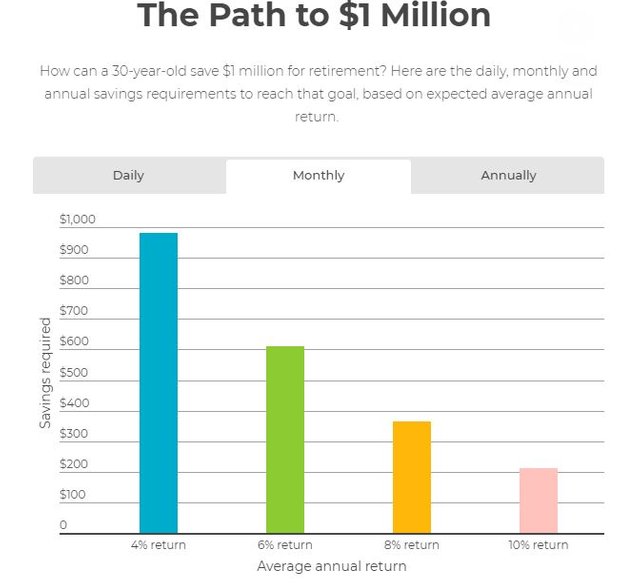

Now, lets look at the requirement to reach $1 million if you start at age 30, instead of age 25:

As you can see, the difference in monthly savings is somewhere between $100-200, depending on your average return. Maximizing your return is a whole different topic for another day. For now, we'll just stick to the reasons why compound interest is important for you.

So what is compound interest?

Simply stated, compound interest is the interest earned by the interest you've already earned. When a bank pays you an interest payment, the amount of the payment is based on your interest rate and account balance at the time of the payout. Since percentages are in play here, that means that the bigger your balance, the more you shall receive. That is why it is important for you to not only continue to put money into your savings account, but to also put in as much as you can afford. The repeated deposits and interest payments will create a snowballing effect of growth for your account.

Why is that such a big deal?

That's an easy one. People who have taken advantage of compound interest typically don't speak poorly about it. Take Warren Buffett for example. Here is a guy who has lived his life by making compound interest work for him. He started out by earning money, buying assets that pay interest, and holding them for as long as possible. Through the power of compounding interest and dividends, he has grown into a very wealthy individual. All because he started as soon as possible and he has remained consistent with using the power of compound interest. If you want to build up a nest egg for retirement or just save money in general, you need to be taking advantage of this concept.

The Numbers

The Monthly Interest Payment Formula - b(r/12)

If you want to know how to determine the impact of compound interest on your money, use this formula. The variable b represents your current account balance, and r represents the interest rate. If you're not very savvy with Algebra, I'll give you a quick explanation. Take an account with a $5000 balance that earns an APY of 2.25%.

If I calculate the number in parentheses it would look something like this:

1+0.0225/12 = 1.001875

This is the number that you'll be multiplying your balance by to determine the balance at the end of the first month. So, if I multiply the $5000 balance by this number, I come up with:

5000(1.001875) = 5009.38

The $5000 in your account earned you an easy $9.38 in just 30 days, for doing NOTHING. That is the reason the rich stay rich. They are able to put their money to work, so that they don't have to work as hard for the same amount of income.

Now just imagine this occurring every month and the bank paying you on the money they've already paid you. That is the concept of compounding interest in a nutshell. According to NerdWallet's interest calculator, at the end of 1 year of this, you'd have made $114 in interest. Not bad for doing nothing at all. The key to achieving this is to save the money and not touch it for any reason. That will require a sound budget and consistent behavior on your part. Again, something for another discussion on another day.

Just keep in mind that money is something that must be managed. If we do not manage our money, our money will manage us. That is a familiar phrase, but still has a lot of truth to it. I have discovered this from my own personal experiences and failures with money. Hopefully, the tips and information I'm sharing with you will help you to avoid some of my pitfalls. As always, if you have any other questions about the information in this post, give me a shout in the comments or to my email address, [email protected]. Thanks again, have a great day!

- The Penniless Gentleman

Everything we do compounds and my journey here with STEEM Blockchain compounding exponentially

Let’s keep our money compounding