GE’s Demise Is Primarily GE Capital’s Fault

What happened to General Electric, I thought they brought good things to life? Well, I guess it did. GE is responsible for the incandescent bulb, the first commercial power station, the first commercial nuclear plant, the first American jet engine. I guess GE is still bringing good things to life. Its jet engines are all over the world, it turbines still provide a third of the world’s electricity, when I go to the hospital, all I see are GE CT scanners and MRI machines.

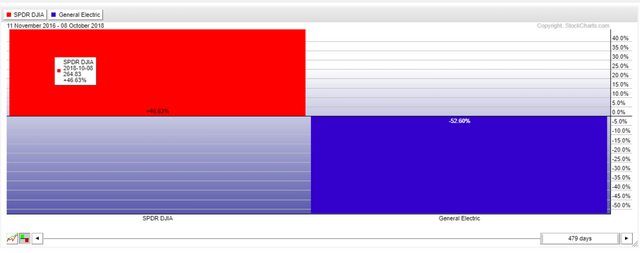

So what happened to GE? Since Donald Trump’s election in November 2016, the DOW is up 50%, but GE is down more than 50%. In additional, in June, GE got bumped from the Dow Jones Industrial Average (the last remaining original component of the Dow).

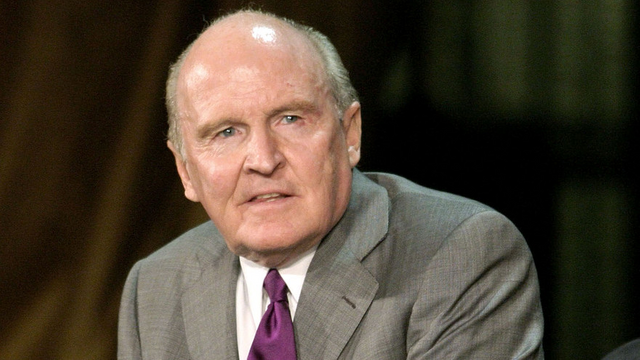

Blame GE’s demise on Jack Welch, who took over as CEO in 1981.

Yes, I realize he is seen as this great business icon and increased GE’s net income from $1.65 billion in 1981 to $12.7 billion in 2000 when he created GE Capital. But GE Capital is a fault for GE’s demise. GE Capital had its hands in a lot of stuff, from credit cards, to insurance, mortgages to airplane leasing. At its peak GE Capital accounted for almost 66% of GE's profits.

But then the Great Recession came and GE Capital nearly crashed GE because it couldn’t get any financing and didn’t differentiate itself from other financial service companies. GE’s profits started fallen short of analyst expectations. GE needed a life line and badly. That’s when Warren Buffet and other investors came to save the day by investing $12 billion in the company. But that wasn’t enough. The government stepped in with a $139 billion bailout. But still, from 2008 to 2014, GE Capital’s revenue shrank.

Do you remember me stating above how GE Capital got into insurance such as long term care insurance? Well, in January 2018, GE took a $7.5 billion after-tax charge, and will have to stash away $15 billion in cash over the next seven years to shore up its insurance business because they badly underestimated customers' longevity and medical needs.

And the woes continue. GE just took a $23 billion noncash charge for its struggling power business and last week, John Flannery was relieved of his duties as chairman and CEO as investors felt his turnaround plan wasn’t working.

Wall Street liked the departure of John, the stock is up 20% since last week. But it takes time to slow down and stop a locomotive and have it travel in the opposite direction. No new CEO is going to change the direction of GE’s down spiral in a day or month, even in a year. The best the new CEO can do is slow down the locomotive.

I believe what we are witnessing is a relief rally and yes, sentiment has changed for the time being. Again when the DOW was up 40%, GE was down over 50%. What do you think is going to happen when the DOW starts to drop for good?

Big Picture

The first real test for GE will be the $16 level, but what do you think, is GE a value at these prices or a value trap?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

It may have to do something similar to GM during the crisis as they divested the Capital piece in a spin off to isolate that business. It has always been said that it is worthbmore than its pieces but some of its pieces are probably insolvent.