P2P money lending. My first experiences with Bondora

Hi Community,

because you get no interest when you leave your money at your bank account i was searching where i can earn interests with not to much risk. I found several platforms where you can lend the money to other private peoples.

Here i will show you how it works and what you are able to earn and how to keep the risk low.

Today i want to write about the platform bondora. You can use the following link to look around there. It is an affiliate link. If you register they give you about 7 $ (5 €) for free. You can use the money for lending money to other people while testing it. So you have no risk. They will pay me also a little bit when you are investing more money within 30 days. So you will earn something and maybe i will earn something later. But you will have no extra costs. So it is a good deal for everyone.

https://bondora.com/ref/s15532

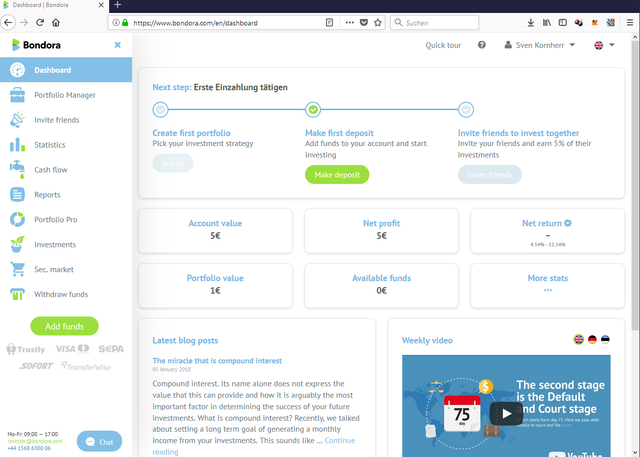

So lets start. After registration it will look like that.

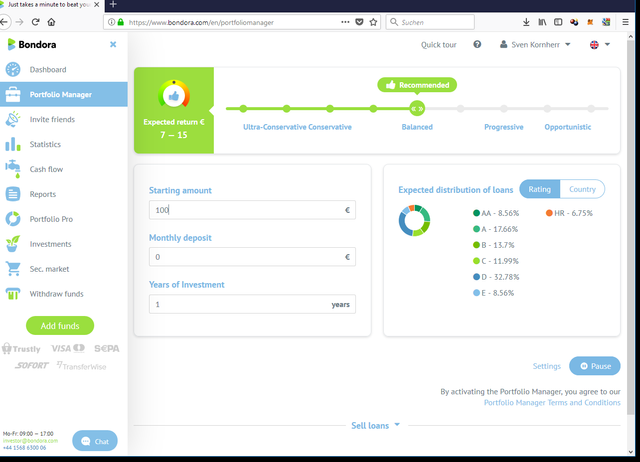

During the registration process you have been asked several questions about your investing experience. Depending on your answers bondora automatically configured the Portfolio Manager. This tool will automatically invest your money distributed over several loans. On the next picture you can see how the tool is configured and how it chooses the loans.

As you can see when you invest for example 100 $ you can expect between 7 € - 15 $ earnings of interests.

But be aware that is not guaranteed. The interest rate for each loan is guaranteed but when someone does not payback the money and the company are not able to collect the money back your profit will decrease. But you can decrease this risk when you distribute the money to as much loans as possible. Means not investing 100 $ for one loan better investing 1 $ in 100 loans. Then it is not a problem when a small amount of loans are not fully paid back.

So now how are the loans choosen by the portfolio manager?

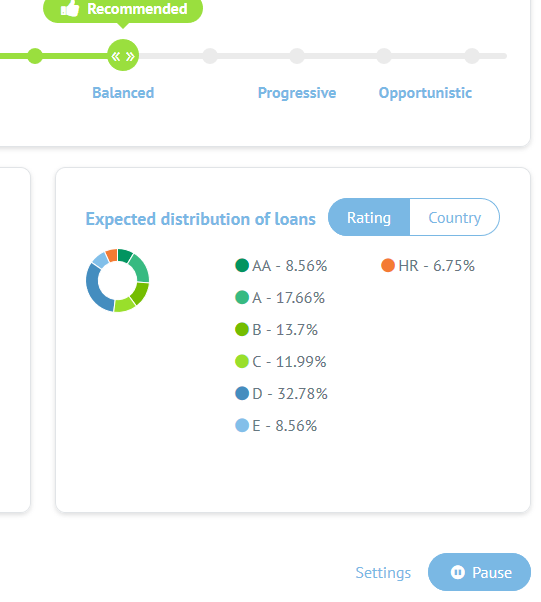

The company is checking the income, did they pay the last loans back in time and several other things of the people who wants to get the loans. The result is a rating of this people. It goes from AA to HR. AA is the best categorie. People with AA are those with the lowest risk but they pay also less interests. People with HR are those with highest risks but they paying much more interests. As far as i know up to 30 % interests a year.

The portfolio manager tries to keep the risk low. In my case he is set to balanced. It distributes all loans between all rating categories means 8,56 % of my loans are with very low risk, 17,66 % with low risk, 13,7 % normal risk and so on. So it achives a good compromise between earnings and risk.

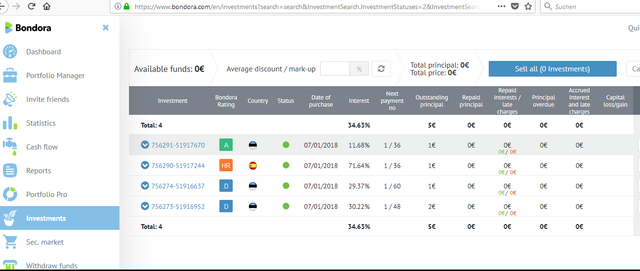

When your money is invested you can see the status of each loan at this site. So you are also up to date and good informed.

When you need your money back before the loan contract ends then you can sell your contract on the secondary market to other investors. Maybe then you have to make a discount to find a buyer.

I hope this was useful for you. It is not an investment advice. Use always only money you can afford to loose. I want only to show where and how you can make your own experience if you want to invest. If you start with those 5 € you get at registration for free you do not have any risk. So have fun and play a little bit and make your own experience.