The Yield Curve Is About To Invert! The Coming Stock Market CRASH And Debt BUBBLE!

First to clarify a yield curve is a curve on a graph in which the yield of fixed-interest securities is plotted against the length of time they have to run to maturity.

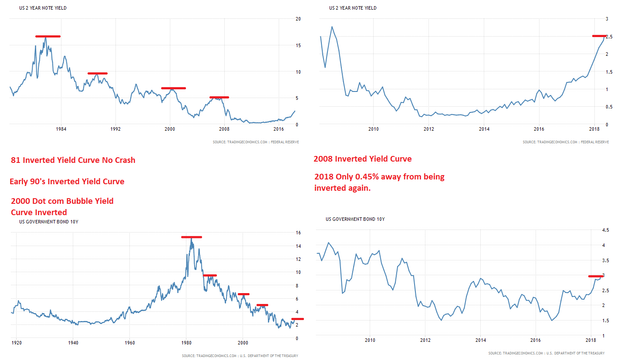

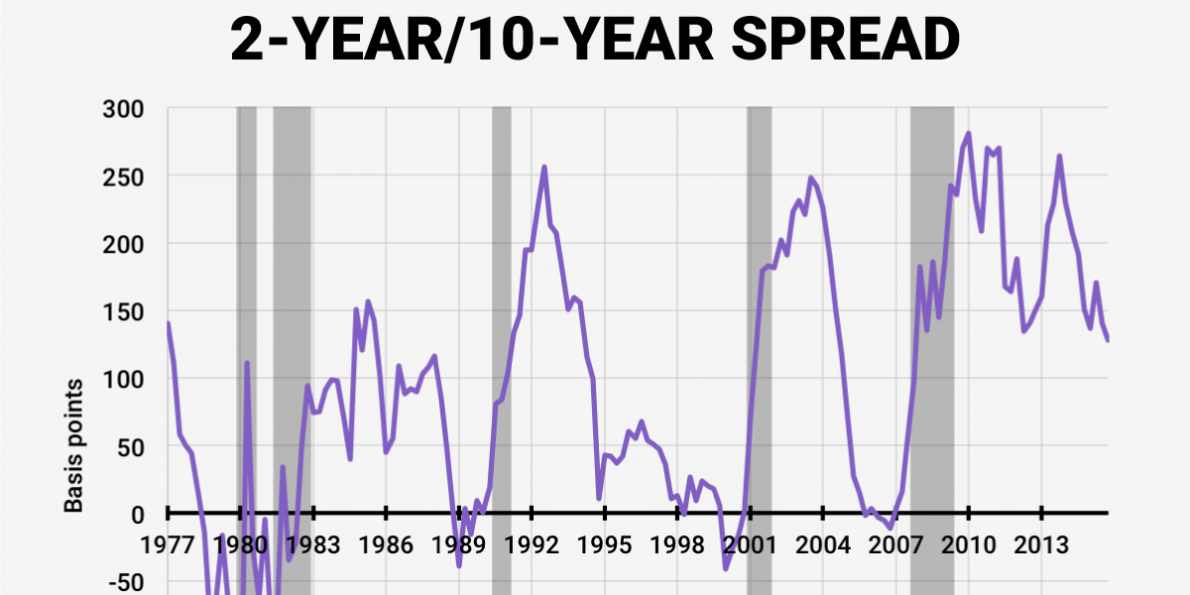

The easiest one to show is the 10-year vs the 2-year US Bond. I have attached a couple of charts that show how the last three times the 2-year note yielded more than the 10-year note the stock market crashes. There has been too much leverage, and debt in the system and the central bank is trying to raise interest rates on the shorter term loans to keep the market from failing, but manipulating the interest rate up and down is what is creating the crisis in the first place.

With governments and central banks desperately trying to manipulate the economy to keep it afloat. I must say they are failing miserably and it seems that most times they create massive boom-bust cycles and the big guys on wall street seems to time it every time as they have the insider info from the FED as they own the FED.

When the next market crash is coming, it will make 2008 look like a fun day at the park. Don't worry though as the governments and banks have big plans to keep their fiat currency empire further afloat.

.jpg)

- Universal Basic Income (Communism)

- Cashless Society

- Negative Interest Rates

- Capital Controls

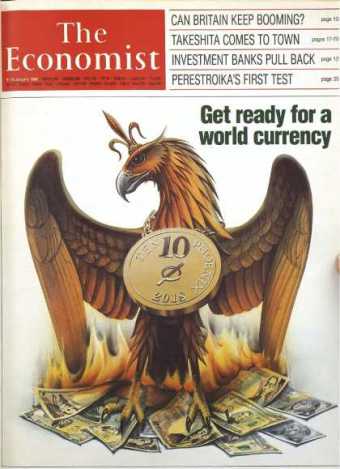

- New Monetary System

Significant changes are coming soon, and some experts like Michael Pento believe that the end is around October when the bond bubble will start to deflate. Together with a massively overvalued stock market with 20% of companies being zombie companies issuing debt to pay off interest or to buy back own shares to force stock prices up using nothing but debt with no value creation.

The financialization game is at the end of the road, and yet another fiat system will beat the dust. The question is if we will have a global one world currency when it is all over. Some people believe cryptos are a way to corral the masses into cashless before the capital control slaughter. Maybe some are, but P2P transactions if made decentralized can remove their dying soon 1000-year-old Ponzi scheme.

.jpg)

The truth about the current system will come out, and with many experts saying and doing a bunch of research on the financial topic of history it is becoming apparent that we are committing the same stupid mistakes all over again. Is Wall Street this stupid or are they working with the FED to blow bubbles and create money out of thin air to own the world?

.jpg)

I think the best antidote to a coming crash like this is wealth insurance like gold and silver, crypto, food, water, guns and shelter might be your best bet as history has been trying to tell me this since humanity was stupid or smart enough to create the fractional reserve system and central banking!

Peace, Love and Voluntaryism,

John

I'm still bullish on the economy but this is cause for concern. I think they may need to lower rates.

Keep monitoring the 2 N 10 yield spread and the 10 N 30 yield spread to see how the yield curve will completely flatten and invert.

Great post and I agree, I think it inverts in Dec.

Let it all wash away and lets start over with decentralized empowerment of humanity. I've been looking at the collapse for a long time as well and came to the conclusion that the only real way to avoid it is to be resiliently self sufficient. They will have "the solution" which is what the cabal will try to lure everyone into to keep us enslaved. Probably by chipping us and getting everyone into a fedcoin of some kind. Maybe scaring the shit outta people with alien craft and stuff like we are being invaded by bad ET's. If they could cross galaxies to get here and rome around they would have already wiped us by now if they were aggressive.