(Video) THIS Indicator Predicted a Recession 7 Times Before. Could THIS Be the 8th?

We have entered a new paradigm. Persistently low volatility. With markets pushed up by the soft and gentle cushion that is central banking, there seems to be no concerns. As a result we have seen a steady climb in the stock market. Algorithms however are anticipating volatility. What we can expect is that if volatility picks up, tech stocks will see a heavy correction.

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

Steemit: https://steemit.com/@themoneygps

MY FREE eCOURSE - Financial Education Taught in Simple Illustrative Videos:

http://themoneygps.com/freeecourse

Sources:

https://goo.gl/UpprQe

In This Episode:

We have entered a new paradigm. Persistently low volatility. With markets pushed up by the soft and gentle cushion that is central banking, there seems to be no concerns. As a result we have seen a steady climb in the stock market. Algorithms however are anticipating volatility. What we can expect is that if volatility picks up, tech stocks will see a heavy correction.

stock market china yuan recession money cash currency credit debt

VIX Quote - Chicago Board Options Exchange SPX Volatility Index - Bloomberg Markets

https://www.bloomberg.com/quote/VIX:IND

Market Volatility Has Vanished Around the World - WSJ

https://www.wsj.com/articles/market-volatility-has-vanished-around-the-world-1497860894

China Yield Curve Slumps To Record Inversion Despite Massive Liquidity Injection | Zero Hedge

http://www.zerohedge.com/news/2017-06-19/china-yield-curve-slumps-record-inversion-despite-massive-liquidity-injection

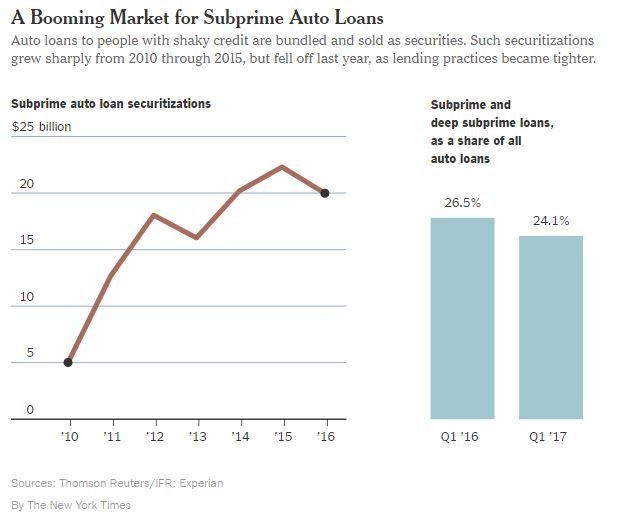

2017.06.19 - Subprime Auto 1.JPG (638×522)

The Car Was Repossessed, but the Debt Remains - The New York Times

https://www.nytimes.com/2017/06/18/business/dealbook/car-loan-subprime.html

20170619_FANG.jpg (512×259)

20170616_EOD7.jpg (959×510)

Cable: 09STATE85588_a

https://wikileaks.org/plusd/cables/09STATE85588_a.html

Miracle heart attack 'vaccine' available in just SIX years to knock cholesterol busting statins off the shelves

https://www.thesun.co.uk/living/3837955/heart-attack-vaccine-available-in-just-six-years-to-knock-cholesterol-busting-statins-off-the-shelves/

All Products | The Mighty Mug

https://themightymug.com/collections/all-products

Let's be prepared and profit from the recession

Cryptocurrency will rise during the economic recession, buy now.

I agree that an inverted yield curve will result in a recession. The question is, what do we do? Buy gold? Or bitcoin and ethereum?

My own take on this is to differenciate as much as possible. Cash, gold, silver, bitcoin, altcoins, real astate, bonds,... because no one can see into the future. But a very important point is, that you should be prepared mentally to coupe with a crisis. You should have an eternal perspective to be able to endure everything that happens in this world. If the people are right about a world crisis, we have other problems as money.

love your stuff

I appreciate your work, but we've been hearing this same mantra for the last 2-3 years.

First, Chinese stock markets are completely different from western stock markets, meaning they are not viewed as a long-term store of value, they are treated more like gambling. And they are dominated by a few quasi commie gov't owned and controlled companies.

Don't get me wrong, I'm not a perma bull on the US stock markts, but market participation rates are still low. People in the US are still historically under-allocated to stocks as their trust hasn't been repaired from the 2008-2009 financial crisis.

And when you say "stock markets" are propped up, you really only mean the US markets, and when you examine further, you mean a few stocks. There is no breadth or volatility. And just because we are at historical lows (volatility), doesn't mean it can't continue for some time. Things don't always immediately revert to the norm. After all, a high water mark (or low water mark) isn't forever.

And your audience on a beta social media based on blockchain will certainly draw people that are skeptical of the broader economy. I've lived around the world, and as bad as things are in the USA economically, it is far worse almost everywhere else. Who wants to and can move to Greece to open a tech start up? Nobody, sorry Greece. They want to go to California.

And the last point I'll make, what is the alternative? TINA, remember that? All that money going to flow into government bonds? Don't think so.

Anyway, keep posting, nothing like healthy debate to make a market! Peace out.

The VXX is at a record low

The VIX is as low as it was in the last crash

P/E ratios are out-of-control

The bond market has been in a bull run for decades

Either get out the markets or short the markets

thanks, big recession seems close. upvoted. followed

Hey David, thanks again for the hard work you do. I always watch your vids all the way through and am excited for the give away! I literally knew nothing about steemit till you mentioned it. So I joined just to be able to continue to follow the Money GPS since you tube is really pissing me off. Thanks again, Peter.

Hey,

sorry, but I am not David. I just reseemt Davids post.

Thorsten

Under normal market conditions, we'd be down significantly. As of now, even bad news is treated as good news.

This post has been ranked within the top 50 most undervalued posts in the first half of Jun 20. We estimate that this post is undervalued by $17.74 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jun 20 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.