BUILDING WEALTH - Buying Silver Coins on a Budget - Part One

Want to Live like a Millionaire? Do what they do. Live on Less than you earn. Invest your savings. Add some 'junk' to your wallet - - - 'junk' silver coins that is.

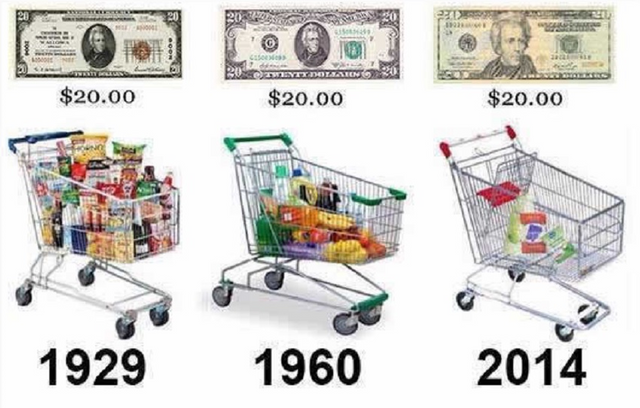

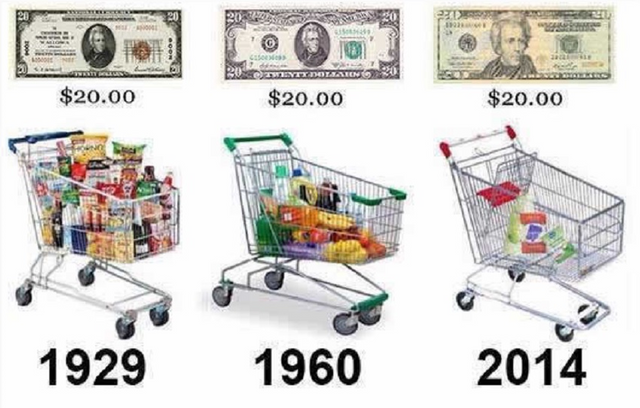

Why? 'Paper' money loses it's purchasing power. With each passing year a paper dollar buys less and less.

With each passing year a silver dollar purchases more and more. If you had 20 silver dollars back in 1929 you could buy the same shopping cart full of groceries as the $20 paper bill. Today those 20 silver dollars could still buy that shopping cart full of groceries plus a few more shopping carts full of groceries.

Okay, so having a few silver coins is a great idea, but how do I buy them on a budget?

How to buy Silver Coins on a Budget

- - - to be continued - - -

BUILDING WEALTH - Buying Silver Coins on a Budget - Part One

Building wealth takes a lot of control and confidence. You have to happy with nothing today and sacrifice for tomorrow. Which is hard when you see everyone else around you enjoying life. Precious metals are always a great vehicle to do this, but their are plenty of others that can produce larger gains for around the same risk-set.

thanks for the reply. Yep, sadly that's why most people retire broke and dependent on the government.

The world's philosophy is 'why put off til tomorrow what you can enjoy today, even if you have to go in debt to do it'.

That's part of the excitement with crypto-coins - now there is a new option in town to invest a little money in - an asset that has very promising ability to appreciate in value that can also be used to purchase goods and services.

Just make sure you do not let it get out of hand. There is a happy medium to saving and investing. There are some people who become obsessed or addicted to saving, you need to learn when enough is enough and as well in the same breath understand that net-worth does always translate into self-worth. I try to enjoy life as much as I can now, but at the same time invest as well. I am single and probably wont ever have kids or a family, so therefore my financial requirements are a lot less than most. Thanks for the reply

The increase in silver value doesn't even come close to the price it should be at if there wasn't so much manipulation of the price. There is more paper silver then actual silver out there. This holds the price down, but also shows the importance of owning physical silver.

Physical silver is a very important inflation guard in protecting your savings. Owning stocks, money in the back, bonds, and your CD's are all dollar based assets which can be devastated by inflation.

Owning only assets tied directly to the US Dollar leaves you very vulnerable and no matter how "diversified" you feel you are your risk factor is much higher then most any financial person will tell you. The reason is they aren't making commissions on you stacking silver.

Sadly most Financial Advisers are Financial Salesmen. There have been several recent cases where the courts have come after the banks for manipulating the price of precious metals. I think the banks plead 'no contest' and paid the fines rather than have it all come out in the trials. > https://www.reuters.com/article/deutsche-bank-lawsuit-metals/deutsche-bank-settles-u-s-gold-silver-price-fixing-litigation-idUSL2N17H1IA

The fines aren't high enough to deter the banks from making billions by printing silver certificates for silver that they can never deliver. Seen estimates as high as 50x more paper silver then physical silver in the world. It's why I am only interested in owning Silver minted by trusted mints vs paper silver or silver "stored" by any other then myself. If it's not in my hands it doesn't actually exist in my opinion.

I still have a bias to "real, tangible'" assets. I was slow on getting into bitcoin because, to me, bitcoin and friends are intangible and am still cautious about how much money I divert to crypto-coins. call me old fashioned.

Completely agree with tangible assets. Wish I had put money into bitcoin when I first really researched it, but as my research was being done is when Mt Gox happened and it freaked me out how that much money could be stolen, how the exchange hid the fact it was stolen, and how quickly the price plunged. Before this I had written it off as nothing more then something geeks did to pass time...after I viewed it with a very tainted eye.

Over time my views changed mainly because the environment of crypto changed. This change told me it was ok to get involved, but still no way all my eggs are going into this basket. Still in the back of my head there is always the looming fear of how easily Governments could regulate and tax crypto out of existence.

:) that basically sums up my crypto travels for the last 3 or 4 years. 2 or 3 friends saying "buy", "just buy it" and I didn't because it looked like vapor investing, no you see it, now you don't.

it didn't help that the friends are very successful network marketers with a rep for hyping whatever was hot at the moment and then moving on to the next hot sell.

I'm not counting the Regulators down and out of the game. if anything their word game battle and new regulation threats and actions of this last month seem to point towards them becoming even more aggressive in trying to stem this game at the entry and exit points.

It's all very interesting to watch the tugs and pulls. In the meantime it seems to me that more and more fiat money is flowing thru the gates and into the clouds.

You got a 17.55% upvote from @upmewhale courtesy of @watertoncafe!

This post has received a 1.06 % upvote from @booster thanks to: @watertoncafe.

Thank you @watertoncafe for making a transfer to me for an upvote of 1.39% on this post! Half of your bid goes to @budgets which funds growth projects for Steem like our top 25 posts on Steem! The other half helps holders of Steem power earn about 60% APR on a delegation to me! For help, will you please visit https://jerrybanfield.com/contact/ because I check my discord server daily? To learn more about Steem, will you please use http://steem.guide/ because this URL forwards to my most recently updated complete Steem tutorial?

This post has received a 1.24 % upvote from @boomerang thanks to: @watertoncafe

You got a 0.92% upvote from @postpromoter courtesy of @watertoncafe! Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!