Rambling On About Why Businesses and People go Bankrupt

The goal of this post is to illustrate my own perspective on markets, and why most people lose in the end. A lot of people might lose their job, or their house, or their business at some point in their life, but even after experiencing financial failure, there's always going to be those that don't know why it happened to them.

So read on if you dare as I ramble on half-mindedly, before eventually getting to some kind of point.

I'm guessing many of us on Steem are familiar with cryptocurrency, and probably quite a few of us have used a large crypto exchange (like Bittrex for example) to trade coins for other coins, or coins for fiat currencies.

There's enough information here on Steemit alone about markets, trading and investing to make anyone an investment expert if they spend enough time digging through it all.

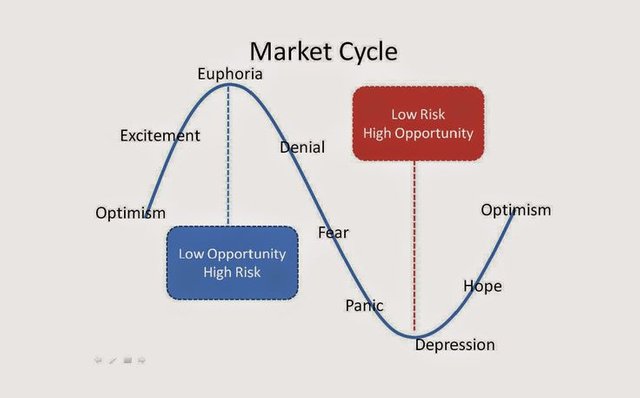

There's one thing that many markets have in common: they have bull market cycles (prices keep going up and up) and bear market cycles (prices keep going down and down). You can replace the words 'bull' and 'bear' with the words 'mania' and 'depression,' because that is generally what people feel during these market cycles.

A full-blown bull market will often last only a fraction of an entire market cycle, which only makes things more insane when a bull market finally comes along after a long period of depression.

But how does this translate into the real world, and with business and personal finance?

Well, as an example, the real estate markets where I live are extremely bullish. In some cities, house prices are 2x or even 3x the price they probably should be worth.

It's a sellers market, and everyone with a house has either sold, are going to be selling, or have at least thought about it. Any why not? Someone sitting on a rural-area house that was worth $175,000 five years ago, can sell now for $350,000-$400,000 and pay off their mortgage/other debts, and still walk away with a couple hundred thousand sitting in their bank account.

Of course, they might not be thinking long term, but they don't care, FOMO (fear of missing out) is one of the strongest impulses a human being can succumb to. These people think they can buy a new house, wait a few years and sell again, believing the prices are never going to stop climbing.

--

You might say that the real estate market where I live is in a bubble.

No one can ever say for certain when that bubble will burst, but for now the real estate market here is in a state of mania. Banks are giving out mortgages to home buyers so fast that bank employees can't stop to catch a breath, while at the same time home sellers are paying off their mortgages with the mortgage the bank just gave out to the buyer. It's a wild game of the left and right hand swapping money all day long.

Have you ever played the game JENGA?

Here's a picture if you never have:

sauce

Here is a Wikipedia link describing the game for those unfortunate enough to have never played or watched JENGA.

It may or may not be obvious, but a real estate bubble operates on the same level of absurdity as a game of JENGA. The crash is inevitable because the foundational support eventually disappears. You cannot keep building up forever when you're borrowing from the foundation to do so.

In an economy, your employer needs to get paid so they can pay you, so that you can then pay someone else for something, so that they can then pay someone else for something, so that that person or business can then pay someone else. This forward moving exchange of currency goes on virtually forever in an endless chain of transactions. There's even a word to describe how fast money moves, it's called 'velocity.'

If at any point in time that chain gets interrupted, like someone doesn't pay their electrician because they had to go on vacation instead, it creates tension in that chain and slows down the velocity of money. Get enough interruptions happening in the chain and eventually it becomes so weak and slow that businesses go under and people lose their jobs, and the people or businesses they owed money to can't be paid, which means even more people can't get money to pay someone else for stuff, and it just becomes one giant snowballing effect that hits everyone. Rich or poor, that giant wave of unpaid debt crushes everyone if it grows big enough.

An economy as a whole may or may not be greatly effected by a single market sector crashing. A big enough market can though; it could be a massive housing market crash like in 2008-2009, or it could be a technology sector crash like at the turn of this century with the dotcom bubble popped.

Could the cryptocurrency market ever get big enough that a crash could damage the real-world economy? I'm betting it will in time, but we're not even 10% there yet in my opinion. We've had cryptocurrency bubbles crash repeatedly for years, but it was only the last crash a few months back that we saw some real world damage. There were people taking out mortgages on their house to buy Bitcoin at $20,000, and people buying $8000 BCash on their credit cards.

To be fair, those people had it coming when the last bubble popped, but you can't blame human beings for being sucked into the FOMO of market mania. If those people who bought at $20,000 just hold for a year or two, they'll probably be fine (as long as they didn't need that money in real life).

So getting to the main point of this post. Why do Businesses and People get run over by an economic crash? You'd think after all this time, with the economy itself going through many recessions and depressions, that someone would learn their lesson and wise up, or at least listen to their cranky grandpa telling them to save their money.

I was watching a video some time ago that ties into this, I believe it was Andreas Antonopoulos musing over an internet streaming service (he didn't mention which one, I'm guessing Netflix) and how they kept their video streaming running 24/7 without fail.

Apparently they have a virus running on their network that randomly shuts down a server somewhere in the world at random intervals. The logic behind doing this, is if they can keep their service running 24/7 despite having these server failures constantly, then they are much better prepared if a real disaster strikes.

In much the same way, businesses that start up during a recession have to deal with a lot of financial strain. Their customer base will be smaller because fewer people can afford the products or services, and banks are far less eager to hand out piles of unsecured credit (like they're doing all the time right now). Less money coming in, less money that can go back out. Employees are spread out thinner, and systems are designed to be as efficient as possible to remove overhead.

Compare that to a business that starts up during a high point in the market. They literally can't fail if they're providing at least a half-assed product or service that people want. Disorganized book-keeping, unnecessary expenses, competition from other, better businesses... it doesn't matter, most businesses can succeed when the money is flowing like water.

Kinda like buying during a bull run. Throw a dart and pick a crypto, it will gain value.

Then things slow down, and the economy takes a dump. Sometimes, it's a big ripe dump that buries people alive.

Those businesses that are used to operating efficiently during the hard times will have a very good chance of surviving. They've cut their teeth during a recession, and facing another recession is child's play. Harvest time's over, and now it's time to ration.

Those businesses that started up during the good times get flattened from every which direction at once, and they don't know how to get out of the way. Their employees may or may not get paid, their suppliers don't get paid, customers can't pay, everything implodes, and in a bad crash millions of people lose their jobs everywhere.

Mortgages don't get paid, possessions get repo'd, families break apart, houses and renovations are left half-completed, highfalutin executives assassin-creed-style jump from their high rise office windows, grundge and/or emo music takes over, Fox news is ironically saying everything is great... yep, it's a right mess when a bubble bursts big enough to take an economy down with it.

So why do people and businesses fail? Because they cannot survive during the bad times, because they didn't save their money wisely when times were good.

Where I live in Ontario, Canada, times are relatively good right now. If a business or a person is just scraping by right now, they might want to trim some fat, because you never know how much the real estate bubble will effect the rest of the economy when it goes POP!

I may be young, but I've seen enough already in my life to know that an ounce of prevention preparation is worth a pound of cure, and nothing will cure you from insolvency except bankruptcy.

Thank you for reading. Try to keep your head attached in these crazy and blood-thirsty crypto markets.

Steem Guides (in reading order):

For Dummies: How Steem Post Payouts Work

Upvote Buying & the Steem Power Snowball Effect

How to Help Clean Up (and Profit From) Steem Abuse

How, When and Why You Need to Plan Your Steem Growth

Want to make money while helping to clean the garbage up on Steem? Report plagiarism, theft, tag abuse, comment spam, post spam, and other Steem abuse that degrades the Steem Platform to @steemcleaners with their reporting tool. If you provide good evidence, they will investigate and deal with the abuser. A week or two later they usually reward you in Steem Power. It's a win-win for everyone, just don't abuse the abuse reporting tool itself.

Want to grow your steem power faster?

try @smartsteem

or @minnowbooster

and @steemfollower

Tip Jar:

Dogecoin DDizpbLrYzFNEZtEVvUXo8kKBKu3K7yLry

As always; good luck, good wealth and good health to everyone on Steemit. Stay positive towards others and help the community grow.

Thank you for this informative article. Knowing the economy is very important. Everyone has a knowledge in this matter right or wrong. But I agree with the determinations you have made ;)

buying home is not a good idea. it is a liability. We have to save money for rainy days. Bad day may come but we should have back up plan

Good point of view, from what i have seen and been through whatever goes up must come down. And with money or any market it's no different. What I don't get is why people don't think of the long term I mean if our world wasn't in turmoil and everybody's perception on thing of value were the same I don't think our world would be suffering. we need to look at at the common sense aspect if you help me in the long run i'll help you. Koodos to a good post keep it up

You had me with the Jenga analogy. Crystal clear!

Good points and explained simply. Thks. Heard similar warnings in the Keiser Report-RT. Crypto is a good place to shift some savings (Like I have savings.) and for those out of jobs maybe some investing also but be informed and be cautious.

Very well said article. Most people nowadays take risks more that if they won the gamble, they will earn a lot but if they lose, they lose almost everything.

Great post!

Thanks for tasting the eden!

Congratulation briggsy! Your post has appeared on the hot page after 22min with 18 votes.

This post has received votes totaling more than $50.00 from the following pay for vote services:

upme upvote in the amount of $90.23 STU, $126.56 USD.

appreciator upvote in the amount of $87.43 STU, $128.33 USD.

smartsteem upvote in the amount of $11.09 STU, $15.56 USD.

buildawhale upvote in the amount of $10.55 STU, $14.80 USD.

upmewhale upvote in the amount of $8.88 STU, $12.46 USD.

upboater upvote in the amount of $3.96 STU, $5.56 USD.

edensgarden upvote in the amount of $2.33 STU, $3.26 USD.

dailyupvotes upvote in the amount of $1.92 STU, $2.70 USD.

For a total calculated value of $216 STU, $309 USD before curation, with a calculated curation of $43 USD.

This information is being presented in the interest of transparency on our platform and is by no means a judgement as to the quality of this post.

so far, bitcoin has not yet in bubble burst,

What happened last December-January is a correction and now bitcoin is good run for more!