Neonexchange Review | SWOT analysis

1 PRODUCT

1.1 WHICH PROBLEMS ARE SOLVED?

Decentralized exchanges are nothing new, but in the past we have seen that these are not matured yet. They have been dealing with problems like volume, transaction speed and do not allow an easy exchange of assets. That’s exactly what NEX is going to solve. They are going to be the next generation of DEX and fusion blockchain technology, decentralization and asset management in a smart way.

1.2 HOW DOES THE EXCHANGE WORK?

The Neonexchange uses a so-called “off-chain matching engine”, which finds the trades off-chain, links them and executes the trades via smart-contract on the blockchain. The off-chain solution enables the platform to be fast, because all matching and trading activities are done off-chain and only the swap of assets is executed on-chain. In addition, it will be possible to make global assets convertible into tokens and thereby also compatible with the exchange.

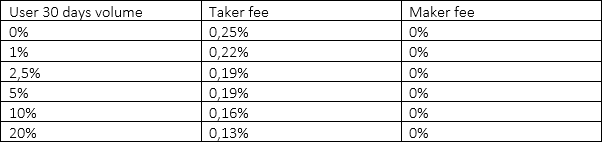

Fee Structure

NEX follows the maker/taker fee structure common to other exchanges. Market makers who place new limit orders on the order books will pay no fee, while takers who place an order at the marketplace or a limit order below the current market price will pay a small fee (Table 1). Fees will be deducted from the taker in the token denomination of their trade. NEX computes a user’s 30 days moving.

1.3 HOW FAR IS THE DEVELOPMENT?

NEX Extension:

In Q1 2018, the team has already released their NEX Browser Extension, with which you are able to manage assets across multiple chains and allow web-based dApps to interact with consistent API. The NEX web extension provides asset management software that can interact with web pages within a user’s browser.

The ICO for the NEX-Token took place in Q2 2018. The MainNet is scheduled to be released in Q3 2018. In parallel, the staking of the NEX token will start.

The advanced trading support and the cross-chain support, especially for Ethereum, is planned for Q4.

1.4 WHY IS NEX GOING TO BE THE NEXT GAME CHANGER IN

DECENTRALIZED EXCHANGES?

Out of the NEX whitepaper:

"In contrast to these approaches, we introduce a new kind of decentralized exchange, NEX, based on a trusted, off-chain matching engine. This matching engine works exactly like its equivalent in a centralized exchange, but only has control over active orders, and commits trades on-chain without access to the full balance of a user account. Like exchanges based on an off-chain relay, NEX orders are matched off-chain and fulfilled on-chain, but NEX's automatic matching engine reduces opportunities for arbitrage and allows for more complex orders. To ensure trust, NEX provides a public record of orders and a deterministic specification of behavior, so that users can verify orders matched off-chain and claim an award in the event of incorrect behavior. Taken together, this makes NEX the first decentralized exchange with performance comparable to today's centralized exchanges."

2 MARKET

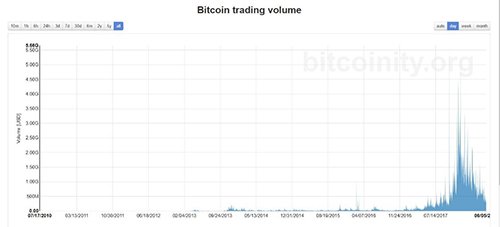

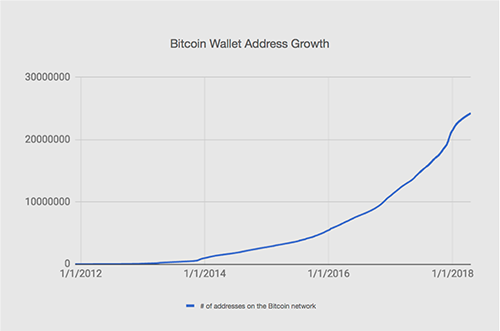

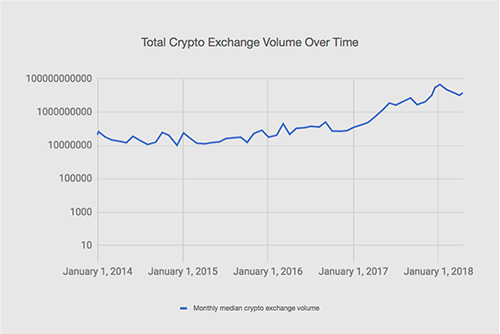

The market has grown strongly over recent years and public attention to cryptocurrencies continues to grow. This growth can also be seen in the volume of cryptocurrency exchanges, see figure 1 and 3. The market exploded with the hype last year, so on 9th January 2018 Binance registered 240000 new users in one day and is now the largest crypto exchange in the world. [figure 4]

If we look at the bitcoin trading volume over the past few years you can see a strong growth. The growth rates of Ethereum and Bitcoin addresses seem to correlate with the growth of trading volume [figure 1 and 3]

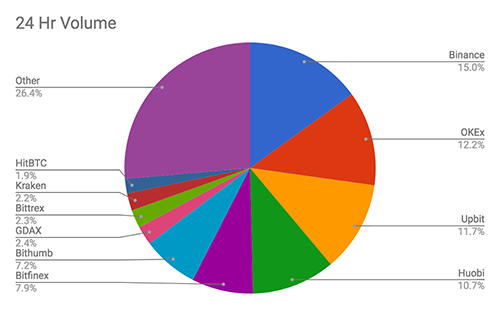

Whereas in the past the trading of crypto assets took place on a few large stock exchanges, today we experience the trading is spread over several stock exchanges [figure 4].

It is striking that in the circle diagram of the top 10 exchanges there is no decentralized exchange that can be found yet. All are central and therefore are managing the assets for their clients who in return need to trust them blindly. In addition to the growth of the entire market for cryptocurrencies, we can also see a shift of volume from centralized to decentralized exchanges and the demands in the community are growing day by day. NEX offers for their customers to have 100% control over their digital assets which is a big selling point currently.

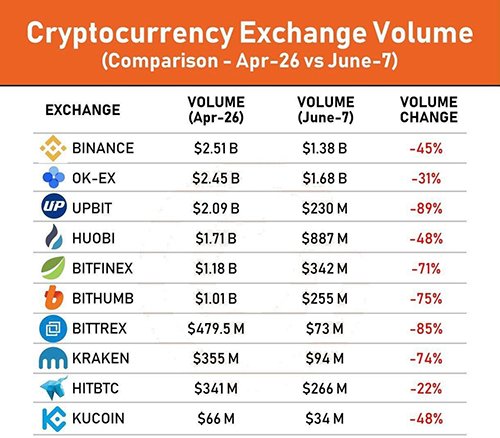

Unfortunately, we are currently facing a bearish market which also affects the volume on every exchange drastically. In figure 5 we can recognize that even Binance had to suffer losses in the volume of 45%. Bittrex even 85%. If the market doesn't stabilize in the upcoming months, NEX will have to face bad market conditions while they are going live with their exchange.

2.2 COMPETITORS

Currently, there are two different types of competitors for the Neonexchange. On the one side you have centralized exchanges and on the other side, the first decentralized exchanges started trading assets recently. These are for example Etherdelta, IDEX, OpenLedger EX, etc..

The biggest competitor according to daily trading volume is Binance with an estimated trading volume of 1.5b/day.[figure 4]

Centralized exchanges operate with lower fees, but have a lack of trust because the owner of your assets is transferred to the provider you are trading on. But on the other hand, this makes it possible to process high trading volume and offer complex trading types.

Most of the current exchanges are operating centralized and have an advantage due to scalability problems. Decentralized exchanges currently trade with very low volume due to some issues on executing market orders on the blockchain, which makes the process very slow and hardly usable. On the other side, they offer more security because customers always have 100% control over their assets. Due to the structure, most DEX only support point-to-point orders that allow tokens to be traded at a fixed price.

3 TEAM

Core team = 14 members

5 CO-FOUNDERS:

- Fabio Cesar Canesin

- Fabian Wahle

- Ethan Fast (Creator of Neon Wallet)

- Luciano Engel (Creator of Neoscan)

- Thomas Saunders (Creator of Neo-python)

7 DEVELOPERS (5 OF THEM ARE ALSO CO-FOUNDERS)

- Evgeny Boxer

- David Schwartz

2 DESIGNERS

- Nathaniel Walpole

- Samuel J. Mansfield

2 MARKETING EXPERTS

- Carla F. de Paiva

- Clare Saunders

3 ADVISORS

- Muzammil Zaveri (Forbes 30 under 30)

- Da Hongfei (Onchain CEO, Founder NEO)

- Erik Zhang (Onchain CTO, Founder NEO)

All co-founders of NEX Exchange are former team members and co-founders/developers of CitiyofZion (www.cityofzion.io).

City of Zion is a global, independent group of open source developers, designers and translators formed to support the NEO core and ecosystem.

Projects of City of Zion so far: Neon Wallet, Neoscan, Neo-python, Neoman etc.

All co-founders have an academic background and are mostly specialized in computational science and mechanical engineering. This Team is highly integrated into Neo’s ecosystem and has a high reputation due to their former work for the NEO community.

4 KEY TEAM MEMBERS

Ethan Fast

Fabian Wahle

Specialized in machine learning and AI

Co-founder Altoida (Top 100 Swiss Start-Ups award)

Currently CTO of Altoida

Fabio Cesar Canesin

Master’s degree in computational science

(Universidade Federal de Rio de Janeiro)

Ethan Fast and Muzzammil Zaveri know each other as they are both founders of Proxino.

Most of the team members know each other from projects before but work on NEX since Nov. 2017.

The team, in general, has fundamental experiences in blockchain and proved themselves on previous projects. If we consider the team, the NEX exchange project seems to be very potent.

Da Hongfei is one of the advisors of this project. He seems to support many blockchain projects built on the NEO platform. He is the CEO of Onchain and founder of NEO. He is probably one of the most active and valuable actors in the blockchain industry.

5 COMMUNITY HYPE

All tokens were distributed through a lottery system in which ca. 125000 people participated. Only 25 thousand were chosen. The token sale was designed as fair as possible, cause there was no private presale and the purchase limit was set to 1000 tokens. This system caused a lot of hype throughout the community and was strategically a good move. It shows the high demand that has already emerged at ICO and once the coin is traded, this might be reflected in the price.

The project has no telegram nor discord channel yet, but on twitter ca. 62k followers.

The Neonexchange is integrated well into the NEO ecosystem and thus has a great networking through projects like CityofZion, NOS and so on.

6 TOKEN

The Token allows holders to claim a share of fees generated by the payment service and exchange.

NEX token operates similarly to GAS on the NEO Network. Due to staking process, the rewards that holders receive depends on the number of fees generated on the exchange. The revenues of holding the token will not be payed out in some kind of new token, token holder rather get a proportion of the tokens trades on Neonexchanges. So if a trade is made in IOTA vs. ETH you will get a portion of fees paid out in IOTA.

Total Supply: 50 million tokens

Circulating supply: 25 million tokens

NEX token is aware of legal aspects and is currently in progress of being registered as security (first in Europe)

The token sale was one of the fairest token sales ever, but there is still uncertainty about the utilization of the locked tokens.

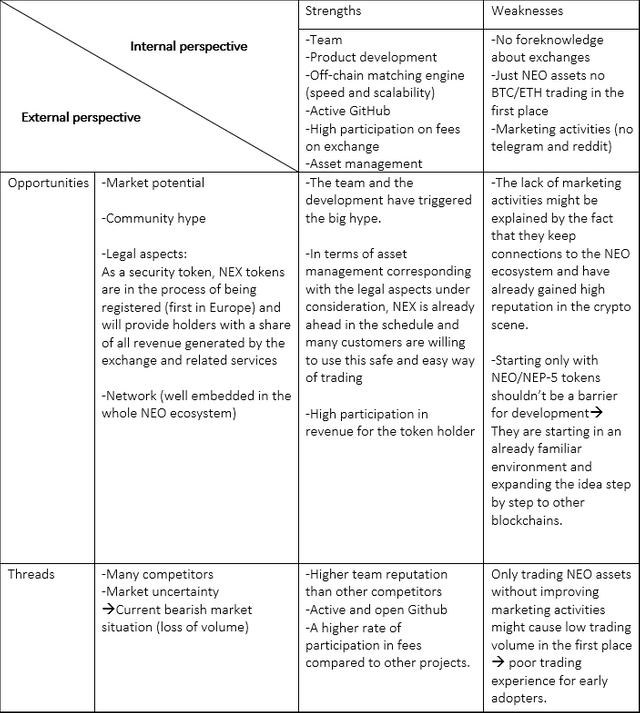

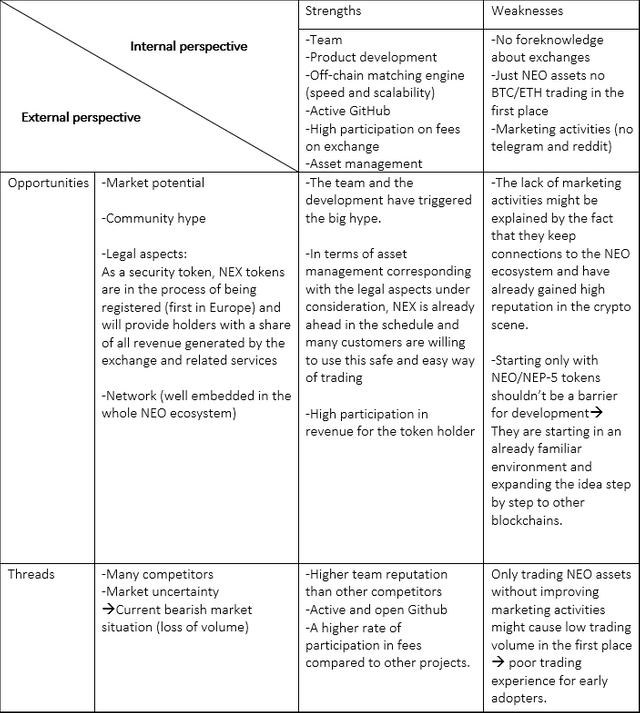

7 SWOT ANALYSIS

8 CONCLUSION

The high fees and the focus on NEO/NEP-5 tokens, in the beginning, might cause low trading volume, but in our opinion, it will be quickly perceived as a safe place to exchange assets with a clear user interface. The fees are not as low as for example on Binance, but they will still be competitive since being in full control of funds is an important aspect, especially in crypto. This service will affect customer’s willingness to pay higher fees.

In favor of many investors, legal aspects are also considered and NEX will be classified as security token which will eliminate uncertainties among traders and attract lots of new clients. Being officially stamped securely has also a negative connotation because the token fits taxation regulations.

Integrating more blockchains into the exchange will raise the recognition and thereby more and more traders will be attracted. The team is also ahead in the schedule by starting the token sale after major developments for the product are finished. Speaking more accurate they already have the NEX web extension finished and the exchange can be expected for Q3 in 2018. The demand for DEX is rising, but no DEX has yet been able to establish a product, which offers a simple user interface and can meet the high demands on security and speed. Right here we see the opportunity for NEX to unfold! With rising volume, the revenues will grow and the demand on tokens will therefore also increase.

Due to the high reputation of the team in the blockchain sector, the marketing team didn’t even need to advertise the ICO actively. This also means that the marketing of the NEX token is actually not necessary so far, because many investors are already expressing their demand on the token actively and are waiting for NEX token to hit exchanges.

The high demand of the token, as well as the position of the team in the NEO ecosystem, promises the token to be one of the most profitable ICO’s of 2018. The risk that could prevent NEX from growing after the ICO could be a stagnating or even shrinking market.

[1] Fast, Ethan: NEX: A High Performance Decentralized Trade and Payment Platform https://neonexchange.org/pdfs/whitepaper_v2.pdf (6/9/2018)

[Fig. 1] https://data.bitcoinity.org/markets/volume/5y?c=e&t=b (6/9/2018)

[Fig. 2-4] McCann, Chris: 12 Graphs That Show Just How Early The Cryptocurrency Market Is. https://medium.com/@mccannatron/12-graphs-that-show-just-how-early-the-cryptocurrency-market-is-653a4b8b2720 (6/9/2018)

[Fig. 5] Telegram Bitcoin India (6/9/2018)