Argentina's Peso is Collapsing Right Now - It's Really Bad. could it be Bullish for Bitcoin?

Argentina's Peso is Collapsing Right Now - It's Really Bad. could it be Bullish for Bitcoin?

Bitcoin, the world’s number one cryptocurrency by market capitalization, has been championed by many as a suitable hedge against the often-reckless and self-serving economic policies of governments. This includes episodes of currency devaluation caused by the very threat of such policies.

Such is happening right now in Argentina. Today, the national currency, the peso, has tanked by almost 25 percent versus the US dollar.

Economic Instability Drives People to Bitcoin?

The Argentine peso dropped by close to 25 percent in some exchange markets as trading opened this morning. News reports claim that the cause of such a plunge is the heavy defeat suffered by President Mauricio Macri in this weekend’s party primary elections.

The Argentine Peso was dropping like a stone. IT was primarily caused by the conservative Argentine President, Mauricio Marci, suffering a shocking defeat in the primary elections on Sunday. This sent waves of fear through the market as the ARS currency fell to record lows against the USD. The most traded stocks within the country had lost up to half their value - in one day!

Although very different, this reminds me of the time when it was announced that the UK had voted to leave the EU which had caused a price drop that had wiped out almost a third of the value of the British Pound. It seems that currencies are starting to show ever-growing weakness around the globe.

The chart shows the Eurostoxx Banking Index reaching a very long term support trend line. This is a very, very LONG trend line that spans as far back as 1988. He is right in saying a breakdown of this support line COULD suggest a potential total collapse of the entire EU banking sector...something which would not be pretty for the entire global economy.

Typically, long term trend lines like this will hold and will require something SIGNFICNATLY serious to break beneath. However, a breakdown of the European Economic Union would certainly be a strong enough catalyst. After the UK leaves will France, Germany, and Italy follow?

Raoul takes his doom and gloom much further by stating that this potential collapse stretches beyond markets and could be “The End Game”. Although this may cause a global financial crisis I am pretty certain we are not at the conclusion of our entire economic system.

Such a sudden drop makes even Bitcoin’s volatility look relatively tame. It also serves as a reminder of the cryptocurrency’s apparent emerging utility as a “safe haven” asset.

Some cryptocurrency proponents have argued that the recent price rallies seen during much of 2019 have been caused by similar instances of capital flight elsewhere. Chinese citizens are thought to be buying up Bitcoin to protect against its government “weaponizing” its currency versus the US dollar in the ongoing trade war.

Others believe that a more extreme form of currency devaluation, like that plaguing Venezuela in recent years, will be the grounds for “hyper-Bitcoinisation” – or the mass rejection of government-issued fiat currency in favor of Bitcoin. The concept of hyper-Bitcoinisation is discussed at length in this 2014 Nakamoto Institute article.

Being immune from the inflationary pressures central banks and governments around the world use to balance their books, Bitcoin’s hard monetary policy, enforced by the most powerful computer network on the planet, is attractive to many as a hedge against their own nations’ currencies. In fact, popular Bitcoin evangelist Andreas Antonopoulos often recounts him persuading his Greek mother to put some of her retirement savings into the cryptocurrency to protect her wealth from the emergency banking restrictions put in place following the collapse of the nation’s banks.

What Are The Consequences Of A EU Banking Breakdown?

Taking away the extreme scenario of an entire economic meltdown, where will the money go? If the market does break below the decade's old trend line this will signal fear throughout the entire European banking system. Typically, this will result in investors removing their money from the EU stock market as they look for “safe haven” assets to put their money in during the turbulent times.

Many safe-haven assets include the US Dollar (if it is a global recession) and commodities such as Gold and Silver. We can expect the majority of funds to flow into these established safe-haven assets, however, we can also expect some of this money to flow into Bitcoin - an asset that has commonly been touted as a store of value.

Even if a small percentage of the money flowing out of the Eurostoxx Banking Index enters into the cryptocurrency space we will see a significant increase in price. It really is a tricky situation - whilst the EU Economy starts to breakdown we will be celebrating as the money starts to pour into our cryptocurrency ecosystem!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

태그 작성 가이드라인 준수는 콘텐츠 관리와 글에 대한 접근성을 높이기 위해 반드시 필요한 절차입니다. ( It is an essential step to adhere tags guideline, manage content and make access better to your postings.)

스팀코인판에서 활용 가능한 태그는 크게 [보상태그 / 언어태그/ 주제태그]로 구분할 수 있습니다. 보상태그와 언어태그는 필수입니다.(Tags that can be largely grouped into [Main Community / Language / Topic] in community. The language and topic tags are required.)

(예) 한국어로 작성한 자유 주제 포스팅((E.g) Posting for free topic in English)

Gave you 2 CTP tokens from my upvote

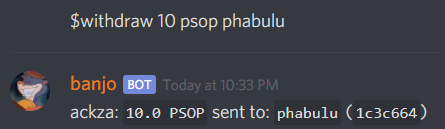

and i sent you 10 Crypto peso to your Steem Account

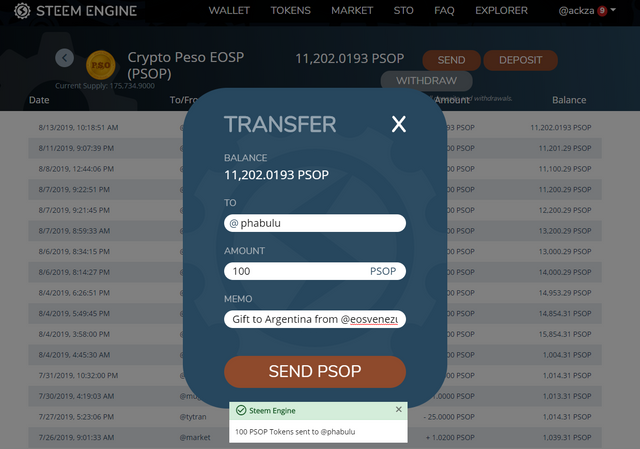

I also just gave you 100 more

and made a post about you

https://www.ctptalk.com/ctptalk/@ackza/i-just-awarded-a-ctptalk-com-member-phabulu-2-ctp-tokens-via-upvote-and-10-psop-crypto-peso-for-an-article-about-argentina-s

Thanks :)