The end of an era? US dollar hegemony starts to perish

Following decades of the USA being able to live well above its means through the status of the US dollar as a world reserve currency, propped up by its use in international trade, a growing number of countries are seeking to bypass the dollar and trade directly among themselves. When the dollar no longer is necessary for countries and companies outside the United States to hold in order to conduct international trade, we can expect its value to drop considerably.

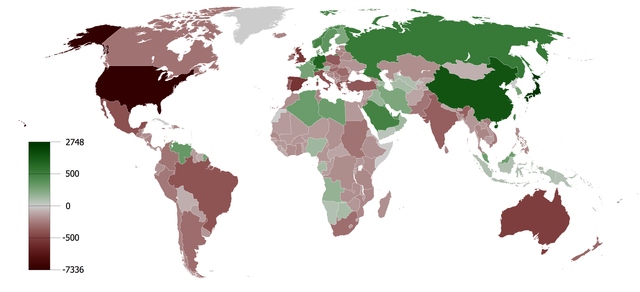

For the world as a whole, this should be a positive thing. After all, why should the United States have the special privilege of importing products from the rest of the world, most notably from China, and exporting debt in return. While holding some yuan will give you the option to purchase a whole plethora of cheap Chinese goods, what is the real benefit for a non-US agent to hold dollars today, should it not be required for settling international trades? In its essence, the United States has for the past several decades been able to buy real goods from the rest of the world using currency created out of thin air. A nice illustration of this is the following image, showing the cumulative current account balance for the world during 1980-2008. As seen, the United States is deeply in the negative.

How has this been possible? Why does the rest of the world accept the now increasingly worthless US treasuries as payment for their actual products? (let’s face it, the United States will never actually pay back all its debts).

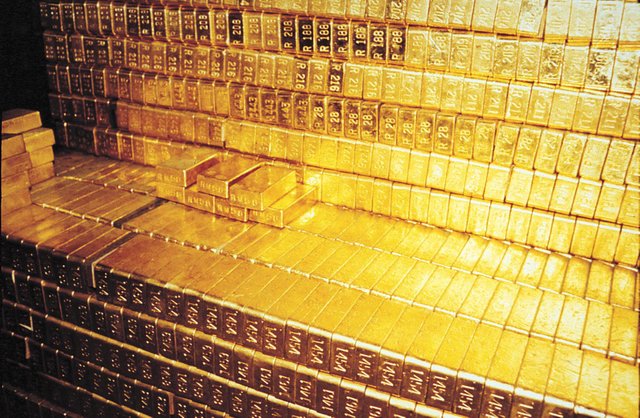

At the end of World war 2, the United States had the world’s largest gold reserves. This made the US dollar, which at the time was backed by gold at a fixed rate of $35 per ounce, the top candidate for being the new world reserve currency. The US dollar was backed by gold and the world’s other currencies were, in turn, pegged to the dollar – the Bretton Woods system. With this system, it was essential for the world’s various nations to hold dollars when engaging in international trade, as these in turn were redeemable in gold from the US government.

And they lived happily ever after, right? Not really. The US government, now very well known for its ever increasing deficits and runaway debts, could of course not constrain itself to spend only what it actually had. Deficit spending was enabled by printing more currency than was actually backed by the gold it held in its reserves, at the set exchange rate of $35/oz. In the years leading up to 1971, more and more countries sought to exchange their dollars for gold, as trust in the currency’s promise of being backed fell. This led to the US government’s physical gold reserves to fall more than 50%. In the end, Nixon ended this drain in 1971 by no longer having the dollar convertible into gold. Ever since, the dollar has been a pure fiat currency.

So why has the US dollar kept its special status in the world? After all, it was no longer backed by any real value and had lost its fundamental use as a medium of exchange for international trade. Well, the United States came up with a new way to prop up the value and demand for the dollar in the world – by turning it into the petrodollar. By making sure that oil trade was always denominated in US dollars, it once again made sense for other countries to hold and use it – not only for oil trade but for most international trade in general. Oil is the biggest commodity market in the world and all nations need it. And in order to trade it, you need dollars. Thus, there is a huge demand for US dollars around the world, even if it is only used as an intermediary.

But then, how is the United States able to make sure that all oil transactions are using dollars? This was achieved in the 1970s by making a deal with Saudi Arabia – the, at least then, most important player in the global oil market. In exchange for protecting the Saudis militarily, they would make sure that all oil trade was settled in US dollars. The vast amount of dollars flowing into Saudi Arabia would then also be used to purchase, among others, military equipment and US treasuries from the United States. And so, the dollar once again achieved a privileged position among all the world’s currencies, in turn allowing the United States to keep printing ever more dollars to purchase real things, without causing the hyperinflation that would normally be expected with the permanent huge deficits it maintains. It allows the United States to both fund the world’s largest military force, which is also deployed to enforce the status quo, and to enjoy a higher standard of living than would otherwise be possible.

That said, remember the petrodollar system the next time you see a US president coddle with the Saudis. And remember what has happened to some of those who dared to step outside the petrodollar system. That’s right, they’re dead. Both Saddam Hussein in Iraq and Muhammar Kaddafi in Libya wanted to sell their oil without using the dollar.

Therefore, it is very interesting to see how China is embarking on a path towards de-dollarization, by setting up an oil market denominated in the yuan. With this new system, the idea is to allow countries to purchase oil futures in yuan, totally bypassing the US dollar, and in turn allow the yuan to be convertible into gold. This essentially allows for oil trade priced in gold, rather than US dollars, and is a real threat to the petrodollar system. If more oil trade is done in yuan, the appeal of the US dollar for other international trade also diminishes. As more and more economic activity moves towards China and developing economies, it makes more and more sense to dump the US dollar. By not using the dollar and the SWIFT system, you also don’t have to worry about economic sanctions imposed by the US government. The more the United States pushes economic sanctions against other countries, the more it makes sense for them to join this alternative system. Russia has already made oil trade deals with China directly, which makes up a very large chunk of the global oil market.

So far, Saudi Arabia maintains the petrodollar system. But even they seem to be taking small steps to come closer to China, which has the most rewarding oil market in the world. Interesting development, indeed. The big question now is, of course, how the US government will react to all this. It seems unlikely they would allow the petrodollar system to fall without a fight.

Some clips to watch:

(note how Nixon mentions the eroding trade balance of the USA – hasn’t really improved now, has it?)

Congratulations @absolutevalue! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP