Bitcoin Struggles to Move Past $4k, $20 Billion Wiped From Market Cap

Cryptoassets have faced another round of punishment across the board, as roughly $20 billion worth of market capitalization fled the crypto markets during the course of Sunday, November 25, before the market regained some ground in the early hours of November 26 (UTC). Overall market capitalization now sits at about $128 billion, down from $138 billion two days ago.

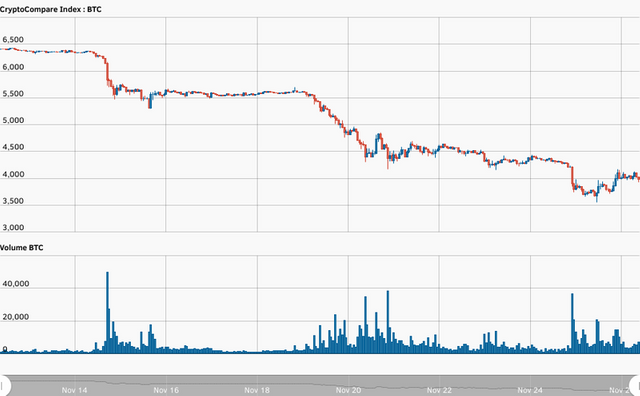

Bitcoin led the rout, failing to maintain stability in the low $4,000 price range, breaking hard in yet another capitulation at about 22:00 UTC, November 24. The benighted cryptocurrency’s price fell as much as sixteen percent at the worst point, before recovering into a new market structure between $3,500 and $4,100. At time of writing, BTC trades at about $3,850 according to cryptocompare.com, and is struggling to trade above $4,000.

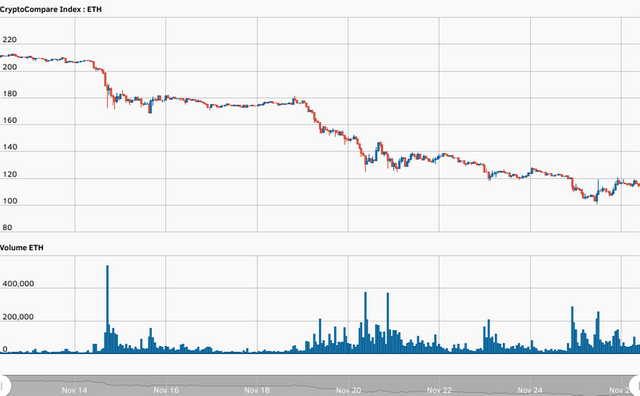

Ethereum/USD followed, with the preeminent altcoin briefly falling from $120 to below the key $100 mark on some exchanges (a $98.20 low was logged on Coinbase), before clawing back most of the losses in early hours of Nov 26 (UTC). At time of writing, ETH trades at about $114 according to cryptocompare.com.

Bitcoin’s dominance is continuing to inflate amid the week of bloody capitulation, sitting now at 54% flat according to coinmarketcap.com, up from about 52% a week ago. Rising bitcoin dominance signals decreased desire for risk-taking in the cryptoasset industry, as investors and traders flee to the backbone of the industry, if staying in the market at all.

Not a hedge?

Some in the mainstream financial press have taken bitcoin’s thrashing as an opportunity to again refute erstwhile speculations that the cryptocurrency could act as a hedge or shelter to downward movements in more traditional stocks and assets; but with those markets likewise plummeting last week, it would seem that so far bitcoin is correlated to traditional markets. Indeed, things are looking rather grim not only for bitcoin and cryptoassets. According to Business Insider, Morgan Stanley has suggested that traders “sell any rallies” against the broad correction of what were recently all time highs in traditional markets. The reasons for this correction, which some are speculating could turn into something more, include an end to the low interest rates of the post-recession era, and the US-China trade war - a war which has also threatened the mining sector of the crypto industry.