MakerDAO DAI Stablecoin Grows By 50% in Two Weeks, Accounts For 1.4% of All ETH

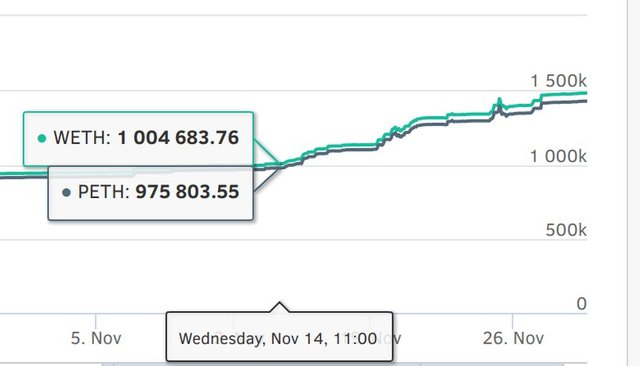

In just the span of less than two weeks, the amount of ether (ETH) tokens locked into the Dai (DAI) stablecoin has risen almost 50% to about 1.4 million ETH - or about 1.4% of the total current supply ether. The stablecoin’s tracking website mkr.tools indicates that roughly $174 million worth of ETH is currently locked into the system, propping up 285% worth of collateral. Speculating as to the reasoning behind the accelerating usage, one can cautiously observe an increased of DAI contract creation around the time bitcoin crashed through its critial price level of $6,000, on November 14.

DAI (“dai” being the Chinese word for “lend”), the stablecoin of the MakerDAO project, is a decentralized alternative to centralized stablecoins. Many stablecoins have been released during 2018, but almost all of them are centrally controlled by the companies or financial institutions which claim to back each coin with one US dollar, with Tether (USDT) being perhaps the most notable example. MakerDAO’s DAI, instead, is backed by ETH tokens, and perhaps in the future more kinds of cryptoassets. (CryptoGlobe produced a two-part writeup on both types.)

How Does It Work?

Although its purpose is very simple - pair one-to-one with the US dollar - the DAI’s mechanism for accomplishing its task is quite complicated. Essentially, a user can buy a DAI token, representing $1, for the equivalent of $1.50 worth of ETH, plus a small fee paid in MKR, MakerDAO’s other token. When the user wants to retrieve this sum, they can repay the DAI token into the smart contract and reclaim $1.50 worth of ETH. This entire process is the called a Collateralized Debt Position (CDP).

The 50% premium paid for the privilege of using DAI is entered into MakerDAO’s insurance scheme, which is used as a hedge in case of rapid changes in the price of ETH tokens. By a combination of market forces and automated smart contract functions, as well as a sort of sell-all 'nuclear' option (voted on by the community), DAI value is meant to be guarded from extreme price movements of its underlying coins. (A more thorough explanation can be found in part two of our stablecoin guide.) Mike McDonald, creator of mkr.tools, has observed that the amount of ETH being locked into the MakerDAO system is outpacing the amount of ETH being created as a result of mining.

MKR can't outspace ETH no matter what it does DAI is the only thing that making MKR float on this bearish market.

MakerDao and DAI is a different thing but they are both related and now that they has added on Kucoin exchange, DAI is having their buy and sell promotion that let's their users to win a big rewards https://news.kucoin.com/en/dai-dai-trading-competition-win-182-mkr/