Russia and India Ditch Dollar in Defense Deals

The World Cup isn’t the only good thing happening in Russia today.

Everyday new avenues of escape from dollar belligerence hit the headlines. Today’s is the announcement that Russia and India finally agreed to conduct military hardware business now under sanctions from the US Office of Foreign Asset Control (OFAC) in bilateral currency swaps — roubles for rupees — versus dollars.

According to a report from Zerohedge, since the newest rounds of sanctions went into effect in April billions in weapons sales have been placed on hold as India and Russia cannot find banks willing to accept fund transfers in dollars for fear of running afoul of the U.S.

So, the answer is, of course, to cut the dollar out of this area of trade between the two countries.

Senior officials told ET that after several rounds of consultations, it has become clear that a rupee-rouble transfer, pegged to the exchange rate of an international currency, is the solution. A top official said that a foreign currency, such as the Singapore dollar, could be used as the benchmark and cont .

Until now, India signed defense contracts with Russia for which payments are made in US dollars. However, as US sanctions making this virtually impossible, contractual payments have been frozen since April.

… With current trade deals between the two countries estimated at around $12 billion, it is imperative for Russia to way to find a loophole to US sanctions. Furthermore, just like Turkey, India is ready to purchase Russia’s state of the art S400 air-defense system in a $5-billion deal.

So, not only have Russia and India just removed up to $12 billion in actual trade from the dollar, they have also raised the legitimacy of another currency by making it the exchange rate stabilizer for international trade.

This is another one of those pesky geopolitical ‘two-fers’ that make U.S. foreign policy wonks see red.

Singapore Slingshot

I’m not at all shocked the Singapore Dollar is being considered since the Monetary Authority of Singapore (MAS) is one of the few truly responsible central banks on the planet, setting monetary policy based not on political needs of the day but rather the state of Singapore’s capital flow, which is to say, the SingDollar’s exchange rate.

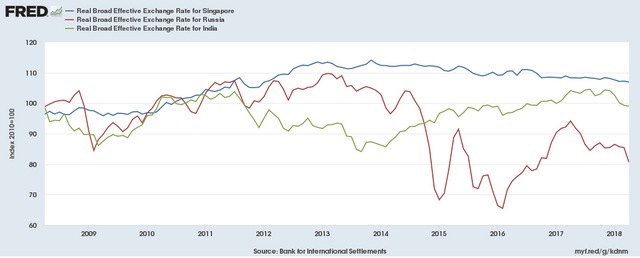

Singapore Dollar’s Relative Stability (REER) versus Russia and India

Singapore Dollar’s Relative Stability (REER) versus Russia and IndiaThe above graph tells you the story as to where Singapore’s comparative advantage lies here. Its REER — Real Effective Exchange Rate (blue line) — is the model of stability since the Federal Reserve announced it was ending it’s QE program back in 2013, the infamous taper tantrum.

This relative stability makes the SingDollar quite attractive as an international benchmark for emerging markets like Russia and India for comparison purposes. And as time goes on more U.S. sanctions-avoiding trade can and will be benchmarked this way if Russia and India continue this practice.

The MAS will then have even more of an incentive to engage in neutral monetary policy.

For a long time now I’ve expected Singapore to rise to become the banking and economic center of Southeast Asia. It was one of the first offshore yuan clearing centers outside of Hong Kong back in 2013, when ICBC opened a branch there.

And the key to that is the lack of pressure on the MAS to deliver certain results for political reasons. And that makes it the complete opposite of the major central banks, like the Fed the Bank of Japan and the ECB.

Pushing India and China Together

While Russia and India’s bilateral trade is small, but growing, it nevertheless indicates the direction countries can and will take to re-route their trade around Trump’s abusive sanctions and tariffs.

To add to this announcement is the latest one which sees India and China announce in conjunction counter-tariffs on U.S. products to Trump’s aluminum and steel tariffs.

India and China have imposed retaliatory barriers equal in value to US tariffs on steel and aluminum. The Trump administration in March signed an order imposing a 25% tariff on steel imports and a 10% tariff on aluminum imports, citing national security as one of the key reasons behind the move.

Luo Zhaohui has assured New Delhi that Beijing will import more sugar, non-basmati rice and high-quality medicines from India to reduce the trade imbalance.

The upshoot here is that Singapore will be used as the clearinghouse for this trade as both countries use it as their local clearing centers. Indian/Chinese trade, just $86 billion in 2017, was up 18.6% last year. And you can bet that they will have no incentive to use dollars going forward unless they need to.

That this move is announced just one week after the first meeting of the Shangahi Cooperation Organization where both India and Pakistan attended as full members for the first time should not be overlooked.

The countries that need to lead the charge in forging the so-called multipolar world have to indeed lead. And each new headline says exactly that, while Europe talks a good game and does nothing of note.

Is it any wonder I’m bearish on Europe and bullish Eurasian Integration?

To support more work like this and get access to exclusive commentary, stock picks and analysis tailored to your needs join my more than 120 Patrons on Patreon and see if I have what it takes to help you navigate a world going slowly mad.

Curated for #informationwar (by @openparadigm)

Relevance: Geopolitics

Our Purpose

let's hope we don't get more 'crazy Russia's allegations before this manifests. Who am I kidding? Expec5 one soon enough

Thank you for your continued support of SteemSilverGold

Interesting. Singapore is one of the 7 cities earmarked to survive and elite hideaway like Canberra, Dubai and I tentively think Astana & Denver? I forget them all but Singapore is one of them.