Top Five Biggest Crypto Mining Areas: Which Farms Are Pushing Forward the New Gold Rush?

The mining industry is probably the oldest activity related to cryptocurrency. It all began in 2009, when Satoshi Nakamoto generated the first block on the Bitcoin network.

Today, mining is an entire industry which spans 114 countries around the world, and restlessly ensures the functioning of the global network of cryptocurrencies. According to Blockchain.info analytics, the total profitability of the market over the past year comprised $4.1 billion. This figure doesn't include the income earned from the sale of mining equipment, which is estimated to reach some $3-4 billion, as is the case of industry giant Bitmain.

Bitcoin network

Along with the popularity of mining, the complexity of the Bitcoin network also grows. Despite the fact that 80 percent of Bitcoin has already been mined, according to experts, the entire supply will be exhausted only by 2140. The situation is explained by the fact that the calculations necessary for the production of cryptocurrency are constantly becoming more complex, and the mining process takes more time and energy.

At the same time, between 30 and 60 percent of the profit gained from mining is spent on energy costs. Figures show that to maintain the entire computer infrastructure working with Bitcoin, it would take 30 nuclear reactors running at full capacity.

.png)

Despite the reduction in the reward for generating blocks, a halving in the mining reward size from 25 Bitcoin to 12.5 Bitcoin and the increasing complexity of mining, miners can still receive up to $20 million per day in transaction confirmations. This staggering number attracts new players to join the ‘digital fever’ — and the equipment manufacturers to invent more efficient ways to extract Bitcoin.

Equipment

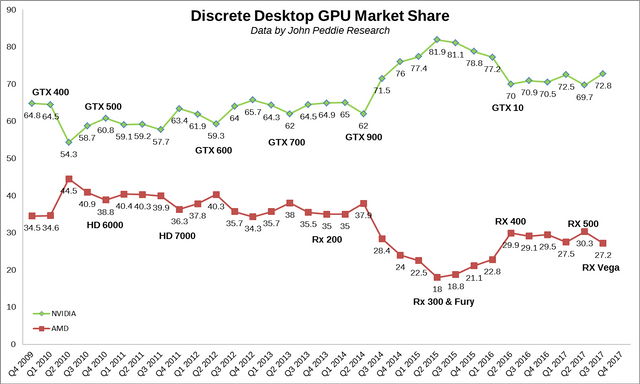

In the summer of 2017, with the growing popularity of cryptocurrencies, market demand grew not only for professional equipment, but also for graphics cards (GPUs). In 2017 alone, more than three million discrete graphics cards were purchased for more than $776 million, Jon Peddie Research states. PC gamers were unable to purchase top model GPUs, which had sold out to miners before they even arrived on shelves, and the manufacturers of AMD and Nvidia cards fixed the growth of profits.

In the second quarter of 2017, Nvidia increased revenues by more than 50 percent, compared to the second quarter of 2016, reaching $251 million. AMD revenue for the same period increased by 18 percent — $1.2 billion. Following the fall of the market, interest in mining also decreased — AMD and Nvidia are both expecting a decrease in revenues in the second quarter of 2018.

At the same time, mining is reaching industrial proportions. Around the world, miners have united and created entire plants and hangars, and thousands of GPU cards are assembled into giant farms with peta hash capacities. Some companies repurpose former plants and invest millions of dollars into building infrastructures for mining. On June 6, the mining company CoinMint announced it plans to open a Bitcoin-mining plant in a former aluminium smelting factory in upstate New York, near the U.S.-Canada border. Supported by the U.S. government, CoinMint aims to create 150 jobs for the next 18 months and allocate $700 million to revamp Alcoa's 1,300 acre plant.

At the same time, large players find more sophisticated methods of reducing energy costs and increasing equipment productivity — from building farms in caves to launching miners to space. Who are these industrial miners? Cointelegraph invites you to visit the five largest farms in the world.

Please upvote: https://steemit.com/free/@bible.com/4qcr2i

Please upvote: https://steemit.com/free/@bible.com/4qcr2iPlease upvote: https://steemit.com/free/@bible.com/4qcr2i