Top 7 major events in the bitcoin and blockchain industry # Weekly Cryptocurrency News 05/02/18 — 11/02/18

The Last Chinese Prelude

On Monday, February 5, the Financial News, controlled by the Central Bank of China, published another material, which announced the intention of the authorities to put the final barrier in the way of crypto-currency trading.

Similar reports about the possible blocking of access to local and foreign platforms for centralized trading came in mid-January. As it was reported at the time, the focus of officials was "online platforms and mobile applications that offer similar services to the exchange."

This time it is claimed that in order to prevent financial risks, China will take additional measures aimed at blocking any domestic and foreign platforms related to trading in virtual currencies or ICO. It can be assumed that the authorities of the country intend to create actually another "Great Chinese firewall", this time aimed at the crypto-currency industry as a whole.

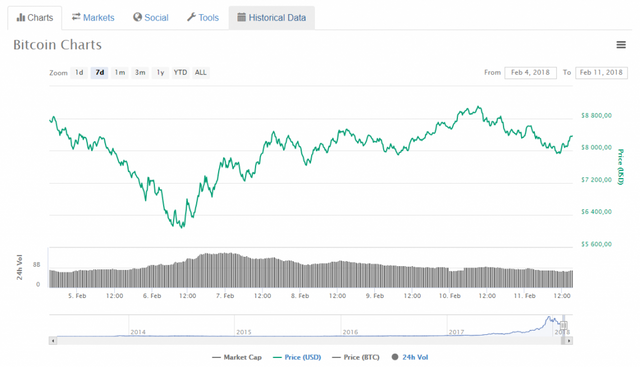

Against the backdrop of this news, the price of bitcoin, the day before, on February 4, reaching almost $ 9,500, confidently went down, reaching by Tuesday, February 6, the lowest level this week at $ 6048

Note that according to some statements, the information was falsified and was the result of the work of an unknown hacker who broke in the mail servers of the People's Bank of China.

BitGrail Bankruptcy

BitGrail, the Italian crypto-exchange, claims theft of 17,000,000 XRBs (Nano / RaiBlocks) as a result of "unauthorized transactions," which is more than $ 170 million at the current market rate. The loss of funds led to the fact that the exchange announced bankruptcy.

At the same time, in social networks, the exchange is accused of fraud and deliberate concealment of the incident, which occurred in December. It is reported that initially the exchange simply stopped Nano output, offering instead a conclusion in bitcoins, and then demanded from all users to pass verification. But even after that, users could not get their money.

Representatives of Nano also issued a statement emphasizing that the theft of funds could not be made as a result of a mistake in the crypto-currency protocol, as claimed by the owner and operator BitGrail Francesco "The Bomber" Firano.

"We have good reasons to believe that for a long time, Firano has misled the Nano Core team about the solvency of BitGrail,"

Nano said in a statement.

Interruptions in the work of Binance

On Thursday, February 8, the fast-growing Binance Exchange reported that it was experiencing a malfunction due to problems with database synchronization. Soon operations on the platform were completely stopped, and the input and output of funds were frozen.

At the same time, Binance CEO Changpeng Jao published a tweet in which he said that the synchronization of the database was delayed because of its huge volume. He also assured users that their data will not be lost.

Despite the fact that technical work on the exchange against the background of rumors of a possible break-in was delayed, and to normal operation it actually returned only on Sunday, it should be noted that the Binance management professionally coped with the situation and constantly informed users about what was happening.

All these days, the OKEx exchange was in the lead in terms of trading volume, but by the moment Binance has risen to the third place, and as you can expect, it will continue to strengthen its positions.

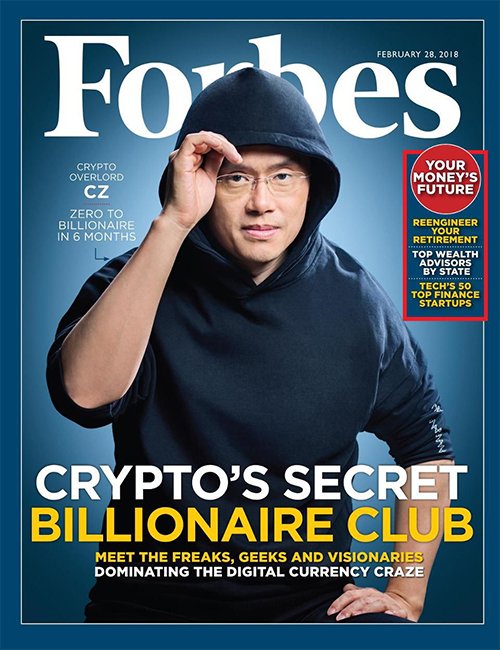

Forbes named the richest representatives of the crypto-currency industry

The American financial and economic magazine Forbes for the first time compiled a list of the richest people in the crypto-currency industry, which included 19 people. According to the publication, the state of each representative of the top ten exceeds $ 1 billion or is close to this mark.

The list is headed by the co-founder and former CEO of Ripple Labs Chris Larsen, who owns 5.2 billion XRP, which, according to the publication, brings its size to $ 7-8 billion, but given the current rate of XRP after the record collapse January 5-6, rather about $ 4 billion.

The second and third places were taken by founder of the blocking company ConsenSys and former CEO of Goldman Sachs Joseph Lubin and Changpeng Jao, creator and CEO of the Binance crypto exchange.

Among the participants of the rating there are also such prominent representatives of the industry as the Winklwosy brothers, Coinbase CEO Brian Armstrong, Galaxy Digital CEO Mike Novograts, EOS project founder Dan Larimer, CEO of Bitfury Valery Vavilov, IOHK CEO Charles Hoskinson, Ethereum founder Vitalik Buterin, venture investor Tim Draper and the head of the Digital Currency Group, Barry Silbert.

Financial regulators of the United States expressed support for crypto and lock-up

One of the most positive news of the outgoing week was the statement by the head of the US Futures Trading Commission (CFTC) Christopher Giancarlo and his colleague from the Securities and Exchange Commission Jay Clayton. Both high-ranking officials spoke on Tuesday, February 6, at a hearing of the Senate Committee on Banking Supervision.

So, Christopher Giancarlo noted the great potential of the detachment for the development of the economic sector, adding that this innovative technology would be impossible without bitcoin and other crypto-currencies.

"We are obliged to respect the enthusiasm of a new generation in relation to virtual currencies and to form a balanced response, rather than disdain," Giancarlo said.

Jay Clayton said in the meantime that blocking technology can be very useful for verifying data and creating distributed storage and record keeping systems.

The transcript of the speeches by Giancarlo and Clayton was published on the eve of the hearings, and one of the notable moments was the call of officials to transfer the regulation of crypto-exchange exchanges to the federal level.

Japan decided to tax large traders

The authorities of Japan have established for large crypto-currency traders a profit tax in the amount of 15% to 55%. The maximum rate will be paid by investors with an annual income of $ 365,000 and above.

Simultaneously, the tax department of the country creates a database of crypto-currency investors, and in Tokyo and Osaka, working groups have been set up, which are charged with closely monitoring crypto-exchange sites.

In 2017, the National Taxation Agency of Japan announced that revenue from operations with digital money is classified as "miscellaneous income". Investors are required to enter information about it in annual tax returns, which must be submitted from February 16 to March 15.

The split among the developers MyEtherWallet

The end of the week was marked by the mixed news that part of the developers MyEtherWallet left the project, launching its own service with similar functions of MyCrypto. At the same time, "as a bonus," they also took a Twitter account with more than 80,000 followers.

It also became known that since December of last year, the founders of MyEtherWallet Kosala Hemachandra and Taylor Monahan are fighting a legal battle that is likely to lead to the appearance of new details of this rather strange story.

A source: forklog.com