Liquidity Network - The Best of a Centralized and Decentralized Exchange

Ever since the introduction of blockchain technology and cryptocurrencies to the global market, users are able to safely exchange any type of assets, rights, goods and services, not requiring the participation of a centralized authority or any intermediaries. The advantages of the blockchain technology created for Bitcoin and other cryptocurrencies have been deemed very attractive as an investment, which explains their rapid growth in the financial market, their popularity even reaching the media and attracting the attention of many companies and investors.

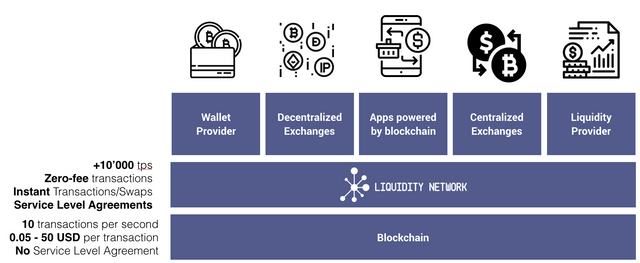

Due to the growing demand for cryptocurrencies, many exchange platforms have emerged on the market, some with more successes than others, however they are not exempt from faults and do not meet the expectations of their users. The decentralized exchanges in the blockchain have a very slow transaction speed, if the volume of transactions exceeds the capacity of the platform, it becomes inefficient, causing inconvenience and losses, since the market is very volatile and the speed in the negotiation is fundamental . Another problem exchange platforms face is their inability to handle large volumes of transactions, currently Bitcoin is only able to handle 10 transactions per second, inefficient compared to traditional centralized exchanges that can handle thousands.

In order to find a solution and offer its users a more efficient cryptocurrency exchange, Liquidity Network presents a platform that fuses the speed of a centralized exchange with the security of a decentralized exchange, supports millions of users and provides scalability to the blockchain; It is secure, fast and gives privacy to its users.

It is a non-custodian financial intermediary, in other words, it is a network designed not to withhold funds while exchanges take place outside the blockchain. Liquidity Network offers payment and exchange services, having been built on the Ethereum blockchain to assure the high quality of its service, its safety and the support of millions of users at the lowest market cost. Its objetive is to achieve a general adoption of the blockchain by the masses, making its use more mainstream due to the many advantages of these services.

Liquidity Network's ecosystem is based on the union of two of its key components:

- The Liquidity Hub NO-CUST

- The Revive

Liquidity Network offers solutions to Blockchain problems.

Problem:

Blockchains such as Bitcoin and Ethereum provide their users with best exchange alternatives through the execution of smart contracts between peers, so that anyone is able to make safe and reliable transactions. However, the blockchain currently presents scalability problems, since it does not solve the scalability performance beyond 10 transactions per second in the case of Bitcoin, which is insufficient for the current demand growth. Solution:

NO-CUST (derived from "Non-Custodial") offers scalability solutions by reducing the load on the blockchain ledger by performing operations outside the blockchain in a secure manner, with absolute guarantee of the funds. This would improve the performance of transactions, since the number of transactions per second will only depend on internet latency and bandwidth.

Problem:

Blockchain channels have been designed for duplex payments and built linked payment networks that allow atomic and trust-free payments without exhausting the resources of the blockchain. However, once the payment channel has been depleted, it needs to be closed and refinanced to allow new transactions, incurring in high cost transactions, which is why it is necessary for users to have multiple payment channels with different entities, so that they are able to take advantage of them in order to rebalance a poorly financed channel. Solution:

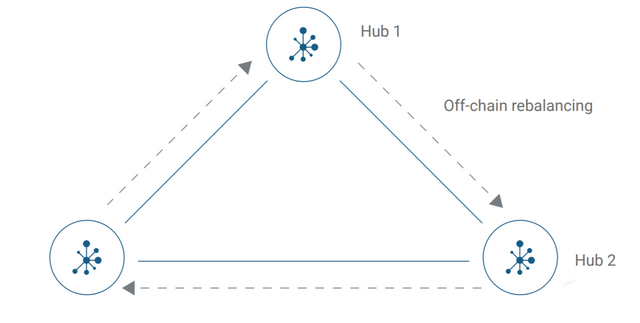

Liquidity Network's Revive presents us with a rebalancing alternative for blockchain payment networks. Instead of closing and opening another channel in the blockchain when the channel has been depleted, the solution presented by Liquidity Network to its users is to revive a channel by reallocating or chaining the funds they have assigned to another payment channel.

Liquidity Network through Revive introduces users to a payment channel network to securely rebalance their channels, not requiring chain transactions, therefore, increasing the scalability of the blockchain.

NO-CUST operates in a decentralized manner and allows a set of users to make transactions through a single payment center. Their funds can be used among the members of the hub. A user who joins a hub (central point of connection in a network in which all types of devices with internet access can be connected) called NO-CUST can make exchanges with a member of the hub, instantly, off-line and at lower costs than the chain transactions. At the same time users can make exchanges with other users within the same hub, both parties are assured to be able to claim their funds in the global blockchain.

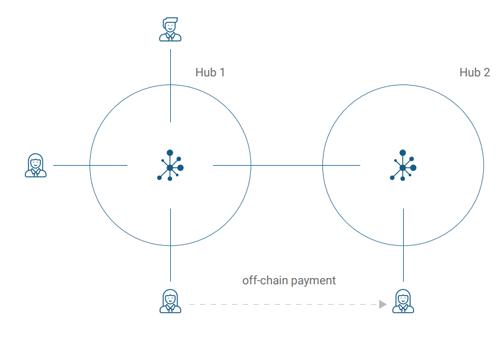

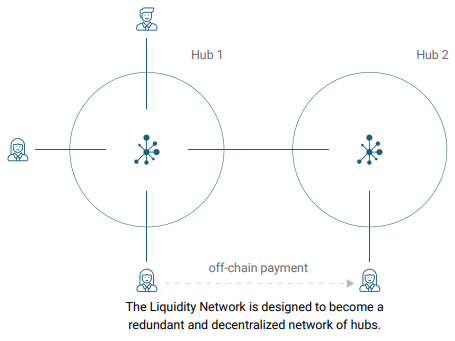

The structure of NO-CUST relieves the load of the network outside the blockchain to speed up payments. Also several NO-CUST hubs can be interconnected, that is to say, two users of different payment centers or hub can make exchanges through interconnected payment centers, similar to traditional payment centers.

Why is the NO-CUST Hub Liquidity Network Decentralized?

Users within the Hub are custodians of their funds through their private keys and not the Hub operator. A user may decide to withdraw funds from the Hub and join another Hub. Liquidity Network is designed so that many centers can be interconnected in a network of Hubs, similar to a network of Lightning peers.

The solution proposed by Liquidity Network is very novel, having a server outside the blockchain that works with a smart contract. Any user can run their own central server, and all the funds of the accounts on these servers are under the user control with their private keys.

One of the main problems of the existing payment channels is the inability to reimburse a payment channel without making transactions in the blockchain. When a payment channel is closed and must be re-funded, it requires two costly transactions in the chain. Before reimbursing a channel, users must first choose more expensive channel routes, which will increase transaction costs.

Revive is an algotithm where members in a hub can rebalance their payment channels, that is to say, relive a channel safely by reassigning or chaining the funds they have assigned to another of their payment channels, all this process taking place outside the blockchain. A user can use any other channel to rebalance a particular channel.

The rebalancing with Revive is free if all the rebalancing participants are honest, this way the scalability of the blockchain transaction is increased reducing the frequency of reimbursement of the channel in the chain. It also reduces the costs of the payment channels because it does not incentivize the routing of payments through expensive payment routes in the chain. Revive is an independent payment channel, in other words, different underlying payment networks can be applied to it.

Transactions outside the chain are divided into two categories:

- 2 party payment channels

- N-party payment hubs

- 2 party payment channels establish direct payment as equals and there are different types of them:

| Type of Channel | How does it work? |

|---|---|

| Unidereccional | Between two parties, one of which deposits an asset. The deposit will travel through the out-of-chain payment channel. Funds can only travel in one direction in a unilateral channel. |

| Bidirectional | Both parties deposit assets, funds are sent in both directions. There may be the risk of theft by one of the parties involved when it invalidates the previous transaction and steals the other party's fund. |

| Linked Payments | They are used when two users are not directly connected within a payment channel or hub, so each member deposits a fund in the network. This option considers search of routes where the funds can be routed through a network of payment channels and also considers maintenance of channels, security of transactions and balancing of congestion. |

| 2-Party Payment Hub | It is an extension of the previous types, which includes more than two people who participate in a transfer of funds. |

- N-party payment hubs:

The N-Party payment hubs reduce the computational work required by the 2-party hubs in relation to the rebalancing of guarantees, so transfers are less expensive, faster and allow more users to participate. Liquidity Network Hub offers free registration of offchain channels and simple routing.

The payment centers or Hub ensure that the funds are only transferred between users and are never retained in the server, the user retains the funds granting greater security. N-Party payment hub reduce the barriers to joining a center, creating more liquidity in the network.

- Zero transaction rates, any member of a payment hub is able to pay any other member of a payment hub for free.

- It operates outside the blockchain in a quick and safe manner, but with guaranteed funds in the chain.

- The funds are not blocked in the payment centers or Hub.

- It has a simple routing design.

- The exchange of liquidity is done instantly and does not incur excessive transaction fees.

- It offers a better exchange service, since it avoids the congestion of blockchain transactions when operating outside of it.

- Higher speed, off-chain swaps are instantaneous and can reach commercial speeds as in traditional centralized exchanges.

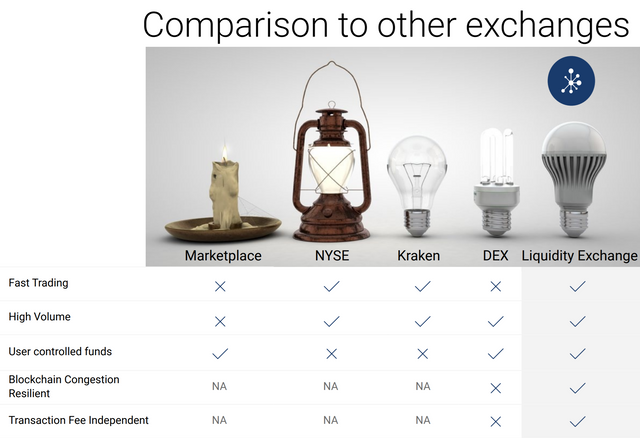

This platform combines the best of centralized and decentralized exchanges. The following describes the differences in characteristics between commonly used exchanges, and how Liquidity Network Exchange is able to offer its users better benefits:

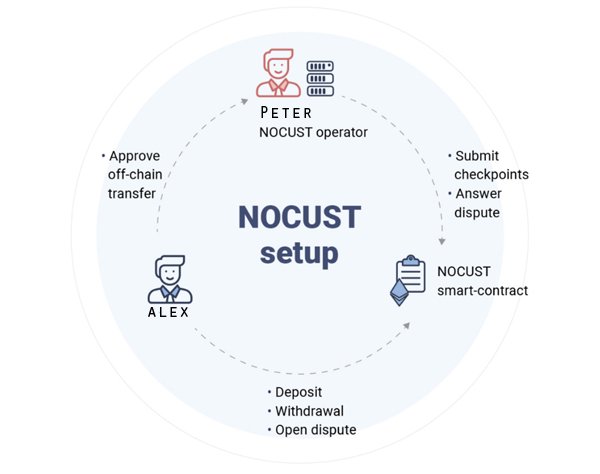

As we have already mentioned, a payment center based on NO-CUST allows users to make transactions outside the chain and without the need of trusted third parties, taking advantage of smart contracts. A payment center or Hub consists of 2 components: a smart contract in the blockchain and a payment hub operator. The operator is the one who runs the server, it can be seen as the non-custodian banker, let's call him Peter.

If Alex wants to use the payment hub he can join by connecting to the server without making any transactions. Alex deposits the funds in the smart contract to have ETH available to make his payments. Now Alex wants to make a payment to Mary, another user of the same payment center. Alex tells Peter the operator of the payment center and as soon as Peter approves the payment it will be done immediately. The transaction was made not requiring any of them to pay any fees.

Users can make deposits and withdraw their funds by interacting with the smart contract, even if Peter disappears he can still recover his funds by requesting a smart contract withdrawal. The smart contract uses checkpoints to know the balance that users can withdraw, since transfers occur outside the blockchain.

In our example, our payment center expects a checkpoint from Peter every 24 hours. Every 24 hours the balances of the accounts of all the users can be updated once in a single operation in the blockchain. If we have 500 users who make 100 transfers in 24 hours using their normal blockchain wallet, it would result in 50000 blockchain transactions, but with NO-CUST it would result in a single transaction.

Users can use the smart contract to open a dispute if they think Peter has not been honest with the checkpoints. Peter must prove his honesty, if the user wins the dispute the last fraudulent checkpoint is canceled and the payment center is closed for everyone.

Applications are being developed for mobile and desktop devices, very easy to use. Liquidity Network's portfolio is available for the two most common operating systems on mobile devices: IOS and Android.

The Liquidity Network Wallet grants benefits to users, among which we can mention:

Zero transaction cost between Liquidity Network wallets.

Security, since users are responsible of their private keys.

The wallet runs on the Ethereum network.

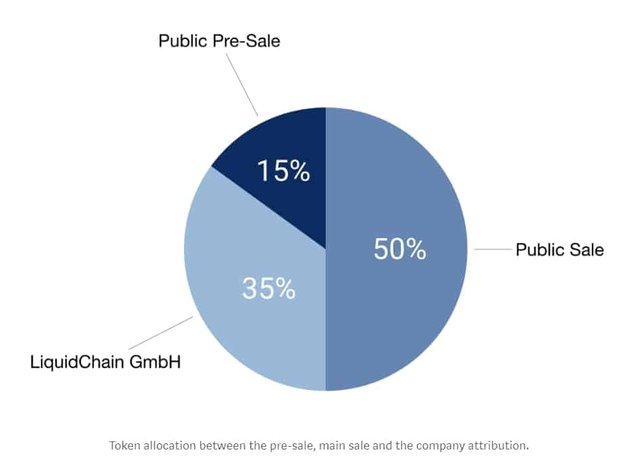

Liquidity Network LQD tokens are already on sale, out of a total of 100 million LQD, 15 percent of the tokens will be delivered for the public presale, while 50 percent will be destined for public sale.

Liquidity Network is an innovative cryptocurrency exchange platform that takes advantage of the benefits of centralized computing power and the advantages of blockhacin to create an exchange with the speed offered by traditional centralized exchanges and the security of a decentralized exchange.

Liquidity Network offers solutions to the scaling problems currently presented by the blockchain in terms of speed of transactions, costs and privacy. Ethereum can only process approximately 10 transactions per second, while traditional payment channels such as Visa can process 50,000 transactions per second. In addition, the experience of the users is not the best and they often have to wait before liquidating a transaction. All of the problems mentioned above will be solved by Liquidity Network through its two key components: NOCUST and Revive. Users can perform their transactions outside the blockchain and without trusted third parties. The confirmation of the transactions is instantaneous and zero fees per transaction.

This exchange platform can handle millions of users per payment center or Hub, and is easy to use. Additionally, it relieves the congestion that occurs in the blockchain when it is saturated by the large number of transactions that need to be executed and can scale to billions of transactions per second.

More Information & Resources:

Liquidity Network Website

Liquidity Network Wallet

Liquidity Network WhitePaper

Liquidity Network NOCUST Paper

Liquidity Network REVIVE Paper

Liquidity Network Apple App Store (IOS)

Liquidity Network Google Play Store (Android)

Liquidity Network Telegram Group

Liquidity Network Telegram Announcement

Liquidity Network Twitter

Liquidity Network Github

Liquidity Network Blog

This post was written for the following contest: Click Here!

lqd2019

lqd twitter

SHARED ON TWITTER: https: https://twitter.com/maeugeniaur/status/1083120570114412544

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!