Which is More Important - BTC Price or BTC Value?

Everyone is talking about the price of STEEM vs the price of BTC vs the price of fiat lately.

So I thought I would revive an old series that I had going documenting the various prices while taking a look at BTC's growth.

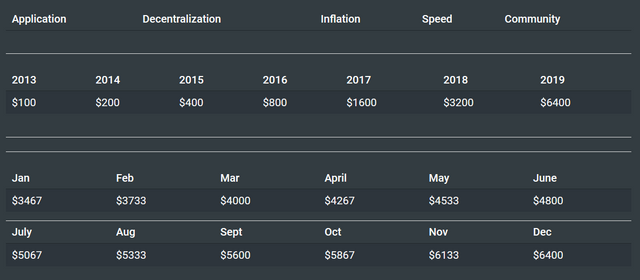

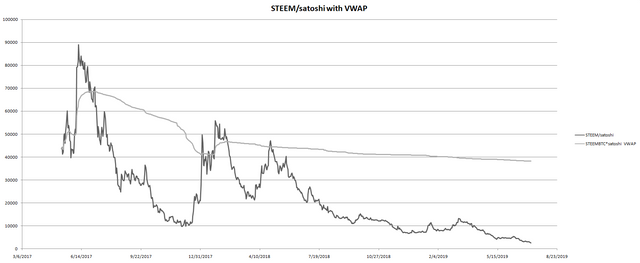

@edicted publishes this chart a lot:

And did so most recently in this post: https://steempeak.com/adoption/@edicted/there-s-no-such-thing-as-a-stable-asset

So that got me thinking.

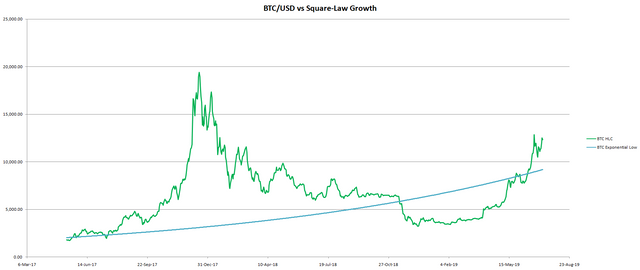

What does that square-law growth actually look like compared to the chart? I fired up coinmarketcap historical data and my spreadsheets and took a look.

It makes for an interesting graph. In the square-law paradigm, BTC was undervalued from Nov 15, 2018 to June 14, 2019 with a couple of blips about fair value towards the end there.

Right now, we are clearly above the growth curve so that makes for speculative territory. The BTC value investor (if there is such a thing) will be buying at prices below 9180 USD.

The thing about value investing versus momentum trading is that you A) have to be right at some point and B) have to be willing to endure the pain until you are right.

Just because something is cheap by whatever metric you come up with does not mean it is going to appreciate in the future. So if you are betting on something going up it has to go up in a reasonable enough timeframe to be useful. That's part A.

Part B is just the horrendous monkey brain trying to get you to make good in the short term. During the undervalued period, I personally wasn't putting any more money into crypto. I was hodling what I had. So that's something. But people smarter than me were loading up.

In the final analysis, if you are one of the true believers like me that crypto is going to revolutionize monetary systems, then you're in good shape. Whether you want to chase momo now or wait for a pullback to fair value is up to you and what kind of investor you are.

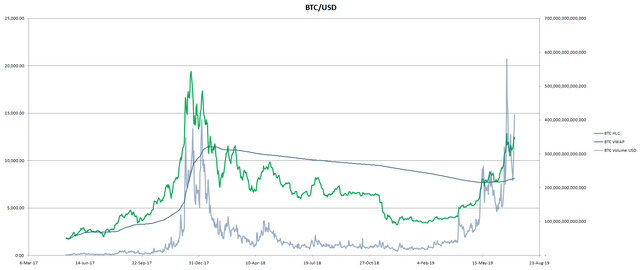

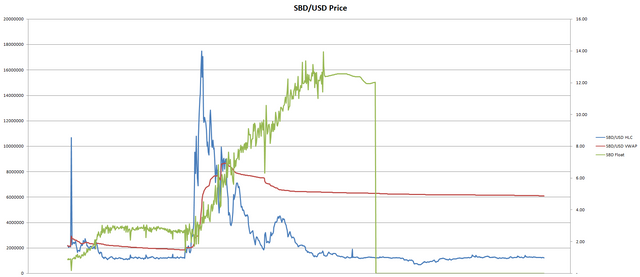

And here are the rest of the charts from my old series, painful as they are to see:

Look at the dollar volume spike. It's bigger than the price peak! Lots of people sold and lots of people bought. And notice how the VWAP formed resistance and support just as expected.

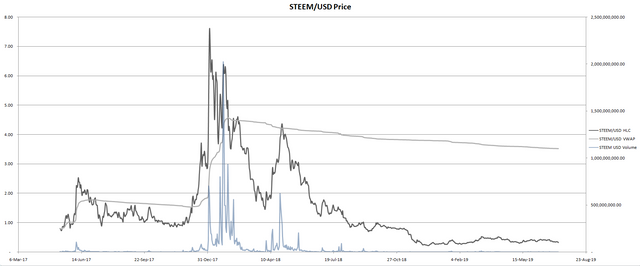

Ugh. Volume has dried up to nothing since the crash.

:cry:

Note: the SBD float drops off because I don't have a source of historical data for it.

Very low SBD/STEEM volatility. I guess that's good?

That is a big part of my investing plan. Yes the USD value is important if you are looking to cash out but if you believe BTC will be $50,000 + in 2020 then perhaps you should instead be looking at BTC/Satoshi value and making your trades based on that.

That being said what scares me about altcoins and steem lately is how far they have dropped on BTC value

Steem at the moment of writing this is at 0.00002458 BTC which to me looks like an all time low ever. At BTC prices of this time in 2017 steem was around 0.00015 or higher.

Yep, it's a massacre.

If the 2^x growth is right, a year from today the price should be 18k and in two years 36k.

That's a lot.