Play2Live in Asia — significant trends in gaming and eSports (part 1)

Play2Live (P2L) is the first decentralized streaming platform for gaming and eSports. Following a very successful ICO where it reached its hard cap goal, Play2Live is now working at rolling out its roadmap.

An important part of this is marketing, and decisions must be made about where to give attention if the goal is to become a global player. Asia seems to be a logical area of focus.

This series of 4 articles article will look at some of the key factors to be taken into account in deciding on the markets in which it will operate. These include

· Significant trends in gaming and eSports in Asia (Part 1)

· Gaming in 12 countries in Asia (Part 2)

· Approaches to cryptocurrencies in Asia (Part 3)

· Approaches to gambling in Asia (Part 4)

They can also be read in conjunction with more general articles on trends in eSports, cryptocurrencies and betting and gambling.

Play2Live overview

P2L has included all aspects of the gaming and eSports environment into its ecosystem. This includes streamers, viewers and tournament organizers on a primary level. It also adds bookmakers, producers and designers of games, suppliers of in-game items, streaming of major tournaments, P2P CDN and cloud storage services.

The platform allows all participants to benefit from monetization of their activities. There are 15 different revenue streams, and 11 of them are shared with participants.

Blockchain technology ensures that Interactions are direct and transparent. The medium of exchange for all transactions on the platform is the LUC utility token.

The business is well positioned in the gaming and eSports arena, that is anticipated to have a turnover of $115 billion in 2018 and an audience growing from 400 million to 600 million by 2020. P2L can benefit from numerous sources of revenue generation:

· eSports and gaming

· Internal items exchange

· Betting

· Live and VOD broadcasting of game content

Trends in gaming and eSports in Asia

Significant trends in Asia include the trend towards mobile, the growth of eSports and the significance of casual gaming and social interaction.

- Trend towards mobile

There are an estimated 2 billion mobile players globally, and revenues are expected to reach close to $100 billion by 2020.

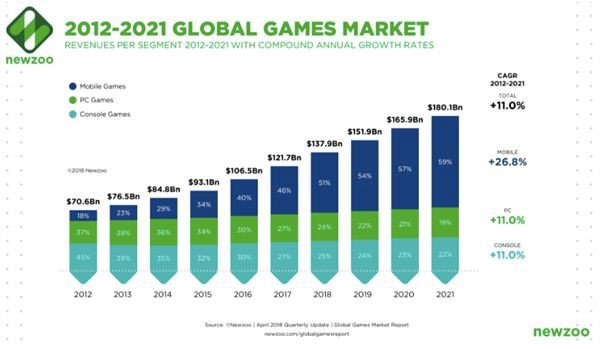

The following figure is taken from the Newzoo Global Games Market Report, April 2018.

This really is quite a remarkable figure, and provides an important overview of global trends in the gaming world:

· The growth in gaming since 2012 has been steady, and it is predicted to continue. The CAGR from 2012 to 2021 is expected to be higher than 11%. Sustaining double-digit growth for a decade is in itself remarkable.

· All types of games will grow during this period. Mobile will grow by nearly 27%, and PC and console by 11% each.

· However, the market share of each will be very different.

o Mobile games have moved from being 12% of the market in 2012 to 46% in 2017, with an expectation that this will reach 59% by 2021. The projected revenue is $100 billion.

o Over the same period, PC and console games are expected to halve — PC’s from 37% to 19% and consoles from 45% to 22%

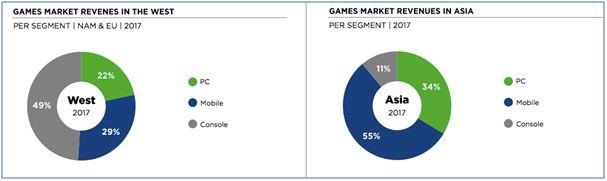

Further analysis shows significant differences between countries in the West and the East.

In the West, PC and console represent 71% of market revenues, with mobile at 29%. In the East, mobile is dominant at 55%.

The development of mobile — both the use of mobile devices and playing games designed for mobile — is driven by Asia’s mobile-first culture. and is supported by companies like Apple, Google and Huawei investing in machine-learning to improve the performance of smartphones.

According to an eMarketer forecast, more than half of internet users in China (ie nearly 430 million people) would be playing digital games by the end of 2017. About 80% of these would be using mobile devices, and nearly 54% of them were expected to be gaming at least once a month. This translates into nearly 180 million people gaming every month.

Similarly, 52% of gamers in Japan and 47% in South Korea favor mobile.

- The growth of eSports

ESports really represents the convergence of telecom, media, sports and entertainment. As for traditional sports, the market is increasingly made up of players who are professionals and of viewers who do not themselves play the game. Newzoo shows that in 2017, “occasional viewers” overtook “eSports enthusiasts” by 303 million to 286 million. And 51% of this viewership is in Asia Pacific. In all, 6.6 billion hours of eSports video content will be viewed in 2018.

It’s important to note that eSports up to now has represented what Newzoo refers to as the “pinnacle” or professional level of competitive gaming. Only 30 of the top 1000 games have been represented here. Mobile viewing of eSports has generally been where there is no option to play. This is likely to change in Asia where the trend towards mobile devices has opened up a mass audience for mobile competitive titles. Now, fans are able to switch from viewing to playing on mobile.

In China, mobile eSports is an official sport, represented by an official eSports body as part of China’s General Administration of Sport. There are 183 million mobile gamers in China, playing mobile games like Clash Royale and Tencent-owned Arena of Valor alongside the more classic titles like League of Legends.

ESports has been included as a demonstration event for the 2018 Asian Games due to be held in Jakarta, Indonesia in August 2018. The selected games are League of Legends, Pro Evolution Soccer, Starcraft II, Hearthstone and the mobile games Arena of Valor and Clash Royale. Success in this event could put eSports onto a faster track for recognition at the Olympic Games.

Alisports has launched AliSports World Electronic Sports Games, which is touted as the world’s highest paying eSports tournament.

A boom in the eSports market is expected in countries such as Vietnam, Thailand, Japan and Indonesia.

Different demographic groups are being added to gaming because of the increasing number of mobile users. This includes older players and those with disabilities. The attraction is that, whatever your skill level, you can immediately be matched to someone at the same level and have a great game.

There is money to be made in pro eSports — media rights, advertising, sponsorships, merchandising and game publisher’s fees netted $660 million in 2017, a year-on-year growth of nearly 34%. Interestingly, despite China’s dominance in viewership, it contributed just 16% of revenue, with North America contributing 36%. South Korea contributed a sizeable 7%.

Play2Live perspective

P2L has been active in the eSports arena. In February it hosted a CS:GO tournament in Belarus, for eight leading international teams. Prize money was in LUC, and worth about $100 000. It was broadcast on P2L TV in 16 languages and had a total viewership of nearly one million. In May it hosted a Hearthstone tournament, with commentary in English and Russian. These competitions are now starting to bring together the online gaming and cryptocurrency communities.

Part of the roadmap for P2L is broadcasting the World Championship in CS:GO. The largest single allocation in the P2L budget — 20% — is to purchase the rights to broadcast eSports tournaments. Q4 of 2018 has been dedicated to active marketing, promotion and purchase of rights to broadcast top eSports and streaming content.

- Trend towards casual and social gaming

Two important trends in Asia are the importance of casual as opposed to competitive games, and strong interactivity or sociability as part of the gaming experience.

There’s a distinction between “eSports players”, sometimes referred to as hardcore players and “casual gamers” — much like in traditional sports. Generally speaking, a casual gamer is a player who just wants to use a game like any other medium for fun. Games are developed, and tournaments set up for both casual and more hardcore or professional groups.

Battle of Balls, a casual game owned by Giant Network, a China-based company, is a good example. Players can play against each other or join teams in a form of an amateur league. There is a point system, and teams can take part in tournaments at increasingly higher levels. Stadium events have been set up in China, with thousands in the live audience, together with mass screenings on live streaming platforms. Further events are being planned in South Korea, Taiwan and Hong Kong. Giant Network has partnered with Alisports, part of the Alibaba group, to optimize these events and eSports content.

In addition, much value is placed on the social function of games. For example, all of Tencent’s mobile games in China can be connected to WeChat or QQ. Gamers can access leaderboards and game updates, and they can play with each other or in teams. There is also a “PC café” or game club culture in many Asian countries with friends getting together to play games.

These two trends are being brought together through “instant gaming”. This is where a game can be played immediately on a social network without having to first download it. Tencent in China, Kakao in South Korea, and LINE in Japan all offer these instant game experiences directly in their apps. There is a benefit to everyone in this approach:

· Casual gamers can try out games immediately

· Social games with friends can be set up because of integration with the network

· Developers have access to and gain exposure to the massive user base of the network

· The networks take on the role of app stores, have increased engagement and have a cut of every transaction

Social media platforms like Facebook and Google are experimenting with this approach, and Facebook has opened its Instant Games to third-party developers.

As an aside, it may be worth noting that casual and mobile titles are more popular on YouTube than on Twitch. In Q1 of 2018, 5 mobile titles were in the top 20 most watched games on YouTube, while Twitch had none.

Play2Live in Asia — considering major trends

If the major trends in Asia are a key factor in Play2Live’s decisions around where to put its marketing money, then Play2Live would be well-advised to strongly consider the Asian market.

The Play2Live platform is well suited to the major trends that have been identified: move to mobile, growth of eSports and the importance of casual and social gaming.

Other factors to be considered include an analysis of gaming in individual countries in Asia, the acceptance of cryptocurrency in these countries, and their general approach to betting and gambling. These are addressed in separate articles in this series.

Stay tuned!