Populous – Now is the Time to Plan!

How many invoices should I bid for, how much shall I allocate to each bid, how do I mitigate my risks, should I go all in or a bit at a time? There is so much to think about because the beta is coming.

It is time to plan, strategise and set your goals.

Planning For Your Own Success

Steve have spent the last few years of his life planning for his success. Now it is your turn to plan for your own success. Take advantage of the time afforded to you before beta is launched and start planning how you intend to buy invoices on the invoice discounting platform.

Start by reviewing the recently released beta screenshots and study them closely, go through the website to glean precious information, read the whitepaper and the business plan, and understand how the liquidity pool work to understand your risks. Read all available information about Populous where ever you can find them, namely here.

To see the beta screenshots, you can download them via the link in the post “Populous – Light at the End of the Tunnel” here or go to Populous’ official twitter account. To review the website and to download other documentation goto https://populous.co/.

Once you have done the above, you can make an attempt at putting together a plan to implement your strategy. Only YOU can plan for your own success!

Read further for things you might have to consider for your plan to succeed.

Alpha Experience

The screenshots shows the Beta to be very similar in functionality with the Alpha. If you have Alpha experience then it is likely that you will find the Beta very easy to use. For more information about the Alpha experience see the post “Populous – What to Expect When Investing on Populous” here.

According to Mark Harrison who had the opportunity to take a sneak peep of the Beta, he reported that the Beta is very intuitive and easy to use, see the post “Populous – Light at the end of the Tunnel”. It would appear that the Beta is even more intuitive than the Alpha.

If you have Alpha experience you will already be ahead of the curve when learning to use the Beta platform.

Understanding How the Liquidity Pool Works

The Liquidity Pool (LP) is accessed only by PPT holder wanting to buy invoices. If you are an invoice buyer using fiat to fund you purchase then you do not need to access the LP.

To access the funds in the Liquidity Pool (LP), you do so by securitising your PPT. When an invoice buyer is successful in his bid to fund an invoice the funds from the LP will be released to the invoice seller and the invoice buyer’s PPT will then be held in escrow as collateral for the funds used.

When the invoice seller settles the invoice, funds are returned to the LP with a small fee and the invoice buyer receives the difference between amount used to buy the invoice and the face value of the invoice minus a small fee for using the LP. The PPT held as collateral is released back to the invoice buyer when the invoice seller settles the invoice.

Example - The invoice seller sells an invoice with a face value of $10,000 and receives (say) $9,000 for the invoice from an invoice buyer. To buy the invoice, the invoice buyer securitises his PPT for the amount of $9,000 to release fiat from the LP. The invoice seller now has immediate liquidity instead of waiting for his customer to settle the invoice in (say) 30 days. On invoice due date, or thereabout, the invoice sellers settles the invoice and pay the invoice buyer $10,000. The invoice buyer receives $1,000 minus fee for accessing the LP as interest and $9,000 is returned to the LP. Once the invoice is settled by the invoice seller, the PPT held in escrow is then released back to the invoice buyer.

The transaction is seamless executed by the proprietary Populous smart contract and all you have to do is bid and wait!

See the post about the Liquidity Pool in “Populous – Swimming in Dough!” here and for more information on “How the Liquidity Pool Works” download the PDF from https://populous.co/.

Limiting Your Risks

Populous have thought it all through when it comes to risks. A unique “protective” structure is put into place to minimise risks to invoice buyers against possible default from invoice sellers. See the analysis in the post “Populous – Safety First!” here for more details.

Notwithstanding the various insurance policies put in place by Populous, the invoice buyer can also further reduce their risk exposure by structuring how bids are placed. Populous allows you bid as an individual or in groups to pool resources. By bidding as an individual you are exposed to greater risks as opposed to bidding in a group with smaller amounts.

If you bid as an individual to win an invoice your PPT exposure to possible default will be larger. In cases of default your PPT will be held in escrow until the funds are reclaimed. Bidding as part of a group with smaller amount mean a smaller portion of your PPT will be exposed to default risks. You can bid smaller amount for more invoices to spread your risks.

The risks to invoice buyers are minimal but nevertheless there are still risks involved.

Invoice Due Dates

The invoice will state a due date duration of 30, 60 or 90 days which applies to the invoice seller’s customer and not the invoice buyer. However from the invoice buyer point of view the duration at which he will hold the invoice if he is the winning bidder is more important. The invoice buyer will not be holding the invoice for 30, 60 or 90 days but instead he will probably be holding the invoice for (say) 27, 56, 88 days or any other length of time.

The reason for this reduced time is that time is required to process the invoice before it is put up for auction. The invoice seller will incur time to issue the invoice to his customer, time required to submit details of the invoice to platform and vetting of the invoice by Populous admin before the invoice is put up for auction etc. This in combination could take a few days.

There may also be a delay in making payment by the invoice seller. The invoice seller might not settle the invoice on invoice due date because he will have received payment on the invoice from his customer on the invoice due date. Thus result in a delay of a day or two to pay back into the platform to settle the invoice.

The longer the duration to due date, the longer the PPT is held in escrow until the invoice is settled by the invoice seller. Therefore there is a risk that you will miss out on PPT price appreciation and compound effect etc. Nevertheless, since the buying of the invoice is based on the auction process, buyers can choose to not bid or bid less that result in higher interest for the invoice in question.

Closing Out Invoice Sale Quickly

There is the risk that you will not “win” invoices when bidding in the auction but you can minimise this risk by being the first individual bidder or group to fill the request of the invoice seller. The bid period is only open for 24 hours so time is limited on each invoice.

You can also increase your chances of winning by joining an open bid group to bid that is closest to the invoice requested sale goal amount. If another group comes in which is closer to the sale goal amount then join that group too before auction period expires because you can bid in more than one bid group for the same invoice to increase your chances of winning. However you will have less funds to bid for other invoices but your funds will only be held for a short duration and will be released back to you once the auction period expires.

If a bid meets the requested sale goal amount before the auction period end, then the auction ends before the 24 hour period expires. Thus, it is advantageous to try and close out these type of bids earlier to win the invoice. However, you might have to compromise by receiving a lower interest rate as a result.

The auction window is only open for 24 hours so time is limited for placing bids for invoices. In event of bids that are unsuccessful, your funds allocated for the unsuccessful invoice are only held for a maximum period of 24 hours after which they will be released back to you.

Taking Advantage of PPT Price Increases

PPT is no ordinary token because PPT is a utility token that is all about financial “leverage”. This is where the Secret Sauce comes into its own. Read more about “Populous – A Plate of PPT with Plenty of Secret Sauce” here. As the market price of PPT increase the amount funds you can access from the LP also increases. However, there is a risk that you will miss out on significant price appreciation because your PPT are held in escrow.

Example – You have 1000 PPT and the current price is $50. You are therefore allowed to securitise your PPT for 1000 x $50 x 0.8 = $40,000. This gives you a buying power of $40,000. However, if the market price of PPT goes up to $75 then your buying power also increases and your securitised PPT is worth $60,000 (= 1000 x 75 x 0.8).

A discount factor of 0.8, which is variable, is applied to take account all sort of factors. See the post “Populous – Who’s Next!” here for an analysis on why this is applied.

To minimise this risk and to take full advantage of “The Secret Sauce”, you can securitise your PPT in smaller amounts on a daily basis or at set times to sort of “cost averaging” your PPT.

Reducing PPT Non-productive Time

It is highly probable that invoices will be released on the platform very frequently and on a daily basis. If a large number of invoices were suddenly uploaded, there may be insufficient time for buyers to submit bid for all the invoices thus giving the seller less competitive rates or invoice remain unsold. The auction period is only 24 hours.

The time of idling PPT should be reduced to maximise interest generation from each PPT. You can securitise all PPT on the first day of beta to buy invoices so your PPT are not idling, however, in doing so you will miss out on opportunity due to price appreciation and leveraging of PPT from “The Secret Sauce”.

You could consider securitising immediately once your PPT are released back to you to buy more invoices. Therefore consider scenarios in which you minimise PPT idling time and benefit from price appreciation.

Compounding Your Interest

Compounding is a very powerful tool used in the financial industry. Rather than drawing down your interest at a very early stage, why not use the generated interest to buy more invoices to generate additional interest. You may be interested in the post “Populous – The Clash of the Titans!” here.

The interest accrued used to buy invoices will not be levied a LP access fee because it is not part of the LP and you can use the maximum amount to buy invoices thereby maximising your buying power.

Drawing Down Your Interest

You may want to make withdraws and spend the interest you have generated buying invoices. However the opportune time to make withdrawals need to be considered. If you are compounding your interest then early withdraw of interest is not recommended because the earlier you start compounding the greater interest you can generate later on.

Withdraws can only be made if you have sufficient Pokens in your account. As a PPT holder using PPT tokens only, no interest is generated in the first period. Interest is only generated when invoices are settle by the seller. Withdrawals can be made usually after the first round of invoice settlement is completed.

By making withdrawals you are also reducing the liquidity on Populous to make funding to invoice sellers. However, the impact maybe small.

In Conclusion

Populous is a fintech startup so making a success of the launch is paramount and the beta may be slightly delayed but with good reasons. It is better to be late then be remembered as the startup with the botched launch. The successful launch of the platform also means success for PPT holders.

The success of Populous does not only depend on Populous but you as PPT holder. All PPT holders must do their part and that means educating yourselves about the platform with information that is readily available like reading and upvoting the 25+ Populous posts here.

Since it is a beta launch invoices on the platform would be slowly introduced with a few at first then gradually ramping up as users become familiar with the platform. If you missed out on bidding today then more invoices will be available the next day and the next. It is not like there will be a day without new invoices being added to the platform.

Populous is relying on the network effect to sell more invoices and to attract more sellers you need buyers and to attract more buyers need more invoices to sell. As PPT holder you can do your part by making sure all invoices are bought.

As a new platform, Populous will want to see results as soon as possible for invoice buyers and I assume the first few invoices on the platform will probably be of very short term nature possibly of duration of 7 to 14 days or even less. The shorter duration will allow Populous to receive feedback from invoice sellers and invoice buyers alike as to how the platform is performing and remediate any bugs there may be at an early stage. The short duration invoices will give Populous early feedback on the performance of the platform and to make improvement.

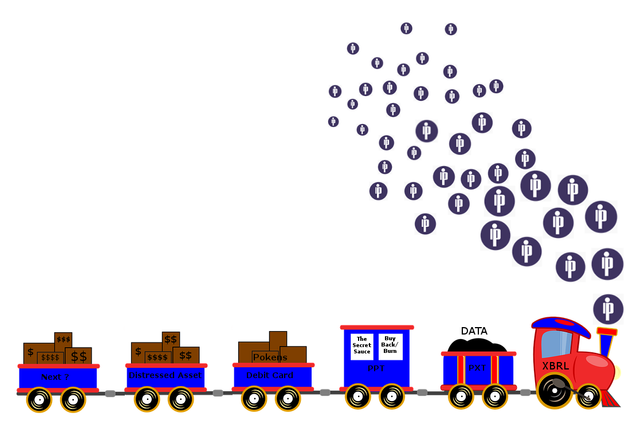

Start planning how you are going to buy invoices to help Populous and at the same time help yourself. Hold on tight because the Populous train is building up steem!

Other Populous Posts

My most recent Populous posts can be read by clicking the links below.

Populous – Light at the End of the Tunnel!

https://steemit.com/populous/@marcusxman/populous-light-at-the-end-of-the-tunnel

Populous – Who’s Next?

https://steemit.com/populous/@marcusxman/populous-who-s-next

Populous – PXT, The Great Equaliser?

https://steemit.com/populous/@marcusxman/populous-pxt-the-great-equaliser

Populous – Safety First!

https://steemit.com/populous/@marcusxman/populous-safety-first

Populous – Through the Looking Glass!

https://steemit.com/populous/@marcusxman/populous-through-the-looking-glass

There are many more Populous post and they can be found here.

Should you have any questions concerning Populous you can ask Populous through Slack, Bitcointalk forum or Twitter Account for answers and clarifications.

However, do bear in mind that Populous are not financial advisers and cannot respond to questions that are of a financial nature. The onus is on you to make that determination and what it means for you as a PPT holder.

This is NOT Financial Advice

In my humble opinion, the risks to the downside are small compared to the potential upside rewards. The contents in this article are for educational purpose only and should not be construed as financial advice. As usual do not invest more than you can afford to lose as these investments can go to zero and always do your own due diligence. If you need financial advice then speak to a licensed financial advisor.

Feel free to comment as you see fit below.

Great article. I'm way behind on my PPT knowledge. You've given me lots of resources to brush up on!

We are all still learning!

Thanks for the Post. I'll be compounding my PPT and HODL!

PPT is the One!

Thanks for the post. I have a technical question. Where is the liquidity pool coming from? It makes sense to me when PPT is being used as a collateral to draw money from the LP to fund the invoice sellers. But to get things started, there has to be some money in the LP to begin with, right? After all, the invoice seller need real money to fund their business, not PPT. This money shouldn't be coming from fiat currency investors since the money they put into LP is 100% used to buy their invoice.

Does that mean the populous team will get banks to provide funding using PPT as collateral? Please let me know if I am getting things correctly. Thanks.

The Liquidity Pool is made up by fiat investors. These investors are wealthy individuals or institutions. Populous does not use banks to provide funding ie. no credit lines are used.

Hi, I'm doing research on Populous, and stumbled upon your blogs. Why do you always write about Populous? Are you like kinda official PPl blogger?

Just think that PPT is an amazing coin. Has a clear plan to succeed and the concept is easy to understand. Not an official PPT blogger in any way.

Oh, I see.

I would read through both these sub-reddits before you make any investment decisions, at least you will be making an informed decision then and have both sides of the PPT story:

https://www.reddit.com/r/populousPPTscam/

https://www.reddit.com/r/populous_platform/

I have read them all and due my own due diligence.