Understanding the Psychology of Cryptocurrencies – My Perspective

I am not an expert in cryptocurrencies, nor have I the ambitions (or the resources tbh) to become one.

Like most people I’ve heard about Bitcoin long time before it became trendy and pumped up on the market. I have to admit that for the past year I’ve been following it’s price chart on a weekly basis; I have visited some open lectures about it, but have never sat down myself to do the research. By doing so, or should I say by not doing so I automatically joined the club of people who felt like they’ve missed a great opportunity to gain some substantial financial benefits, the moment the price jumped to the Moon.

After the rapid pump of Bitcoin’s price I asked myself why did it happen? What makes Bitcoin so valuable? Sure it has unique qualities, which most of you know. But that’s not the real answer to the question. The answer is people. Like anything else created by man, Bitcoin is a product which only has value, because we want so.

Anyway, it was not later than December 2017, when I got introduced to Steemit by @jedy and @xtrex, when my interest about how cryptocurrencies really work was provoked. I was really skeptical about the platform (like most of you I guess :P ), but this time it was different. I did the research about it. For two weeks I was researching how this platform works and why does it exist. By saying this most of you probably are thinking about the the technical part – what is a blockchain, what is ‘decentralized’, what is Steem and how it is generated etc.

Well… not exactly.

Yeah, for the first two hours I read whatever I could find about the technical part. But then I got really bored. I didn’t come here for this. So, I switched my focus to the subject which always interested me – the people.

I realized that I really didn’t care how the platform works, as long as it does. What I cared about though was who are the people behind it and within it. Because if there are no people on this platform I do not give a damn how it works. Like I said - the people are the ones who actually give Steem it’s value.

So, I started researching the human factor in Steemit, more precisely what people value in this platform. What triggers the rewards and interactions between the users. No surprise – the vastness of information was overwhelming.

People here are generating traffic and making profit of all sorts of things. What I expected to be a conservative “all crypto-related” network, was in fact an endless platform of information with a lot of smart and creative people involved.

So far I’ve never had anything even remotely close to a blog page. Not even a Facebook page of some sort. Writing and blogging, especially in English, is enormous challenge for me and I realized I didn’t want my labor to go in vain.

But there I was – at the beginning knowing nothing about what is valued on this platform and how does it work. While I was researching the people on Steemit, I stumbled upon the great community of SteemSTEM – people who create content on various scientific topics, constantly interact and reward others with the same interests. I decided it was the place where I belong and so far it’s great – I have met a lot of interesting people from around the world, who taught me a lot about blogging, crypto and everything else that I’ve asked them about.

When I understood how SBD and Steem currency work, I realized that even though I don’t really want to – I have to understand how other cryptocurrencies work and how they are related.

All these financial terms, calculations and technical parts again bored me to death. Not because I cannot understand them – I really do, but this is not what I care about.

Slowly but surely my attention was again tilted to the people.

What gives crypto so much value?

People.

Why are the prices falling, why are the prices rising ?

People.

Behind every device, there’s a person just like you and me. A person, fundamentally with the same needs and emotions. The question is who is “a better master” of himself? Who is more resistant both to outside and inside influential factors? Who knows better what to do than the other?

Remember, all of us willingly give value to the things around us. Both physical and idealogical. I would argue that there is true objectivism, because this term itself is a man-made concept.

That being said, I wanted to understand the psychological mechanisms behind the cryptocurrencies’ behavior. Because what we see on the market is not a voodoo magic or some sophisticated activity based on a computer algorithm beyond our understanding. No. It’s simply a group of individuals, who know what they are doing and how to interact with other cryptocurrency users.

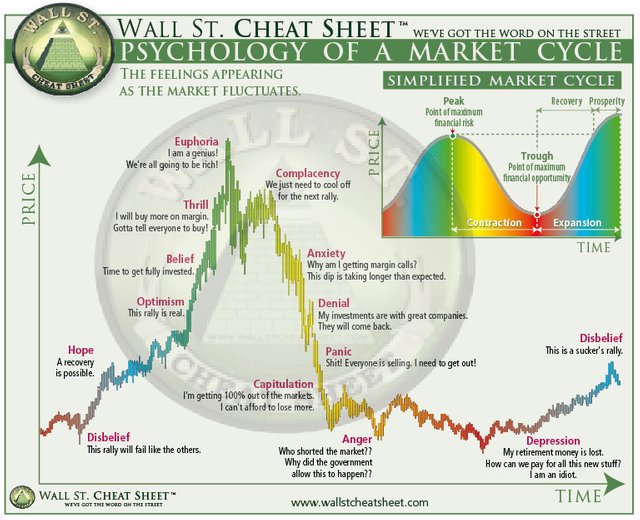

While researching this topic, I stumbled upon various articles related to the human factor behind cryptocurrencies and plenty of hypothesis what triggers the ups and downs in the market. In one of them, the following image was presented.

Perhaps to some of you it is already familiar. To me it wasn’t.

A closer look to this image reveals the emotions behind the market, or as the authors stated “the psychology of a market cycle”.

Today, there is no doubt that humans tend to make more emotional decisions rather than rational ones. In his book “Thinking: Fast and Slow”, D. Kahneman suggests that our thinking is not as rational as we would like it to be. In fact most of our choices are fuelled by irrationality, heuristics, and emotions. This type of thinking could be useful in other aspects of our life, but when it comes to cryptocurrencies, it could be very dangerous and harmful.

Because cryptocurrencies are considered to be tech-related many people do not understand them and are struggling to engage, even if they want to.

So what would such a person do? The thing which kept us alive since the dawn of our time – stay with the group and do whatever everyone else is doing. This is not a rational decision.

This is our need of social proof.

People who are aware of these mechanisms would know how to manipulate another unaware person into deciding whether or not to invest their money in certain currency.

The need of social proof could even harm you more if you relate it straight to a person or group of people, which you know and consider as authorities in this field. By doing so, you automatically grant them the right to control your decisions.

If we look at the picture, you have already passed the “optimism” part – you already see how other people are winning a lot of money, so you decided to join, under their guidance.

As the market grows up, naturally your desire to get the most of it is rising. So this is the point where you get greedy and start to fully invest. You are telling your friends about this great opportunity and together you step into the next phase “thrill”. But that’s not all. As you seem to gain more financial benefits you become more and more invested and afraid that you are gonna miss out on this great opportunity.

This is called the FOMO effect, or fear of missing out. This is the last stage, at the peak of the maximum financial risk and naturally you step into the next stage labeled on this image as “complacency”. Cognitive psychologists call this conformation bias. A widely spread and known phenomenon in our thinking in the core of which is the way of rationalizing events in what ‘fits best the current situation and perspective’. Meaning that every change in the market from now on, positive or negative would be considered as something good, aligning with your current situation.

Fear, uncertainty, doubt

Naturally as the cycle completes, meaning that the prices start to fall down, you would in every case experience negative emotions such as fear, uncertainty and doubt.

In his amazing Wave theory, Ralph Nelson Elliot explains the psychological mechanisms behind trading. He suggests that when it comes to trading, in the core of people’s behavior is the need of social proof. Makes sense, right?

Further, he discovered that collective optimism and pessimism appear in waves.

When the cycle is fully completed, you are left with nothing but your anger and regret that you have not ‘dumped’ the coin earlier.

Conclusion

If this seems like cursed circle to you, it’s because that’s what it actually is. Never forget that the market (stock or crypto) is created by a human. In it’s very core it is based on emotional type of thinking. But that doesn’t mean that you cannot overcome it. People who are benefiting from it are the living proof that you can.

For me, one can only understand the market if he understands the psychological mechanisms behind it. Only then a person would know what naturally follows and how to create tools, working for him or herself in order to make the rational decision. I am not a finacialist or mathematician but as I read more about this topic I am left with the feeling that economics does not play such a big part as psychology, when it comes to trading. Am I right or wrong? Please share your thoughts with me, as this subject is very new to me and I would like to hear other opinions on it !

Sources:

Pictures Pixabay

Great blog! I loved how you elaborated the psychology behind cryptocurrencies. This is definitely a great find.

Since your write-ups are so good it would be great if we see you around engaging a bit more to the steemstem community by commenting on other posts as well... 😉

You are right about the emotions. They rule the markets for centuries. But now new players step in to the arena. The algos. They are not very smart but are extremely fast and do not feel pain or fear when they are wrong. They just execute what they are programmed to do without regret or doubt. At the moment most of the trading volume on the FOREX and Stock markets is automated. When the crypto markets become big the bots will come here too. In few decades non augmented humans will have no chance against any market.

For future viewers: price of bitcoin at the moment of posting is 8525.00USD

Hey, really interesting post. That is one amazing graph, I'm going to have to remember that of for future use. Thanks!

Yeah.... I love the fact that you could find the technical aspect of bitcoin...Nice psychology... Kudos @dysfunctional

Congratulations @dysfunctional! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBeing A SteemStem Member

Hi, I just followed you :-)

Follow back and we can help each other succeed!

Sorry I don't do that :)

Hope to help each other, thank you

You are very kind, happy to be friends with you