What Happened With Bitconnect And OneCoin? Ponzi Schemes In CryptoSphere!

What Are The Signs Of A Crypto Ponzi Scheme?

While there are a few different strategies that scammers have used to entice gullible and naïve investors to hand over their hard-earned dollars a hard-fast rule is “if it’s too good to be true…it is.”

Offers of low risk, high reward investments should always set alarm bells ringing. Scams often make claims that look great on paper, sometimes even the promise of “guaranteed ROIs” are tossed around, but unfortunately that just isn’t really how the financial world works. More often than not high risk equals high reward and low-risk investments get you low returns. Government bonds are low risk with low returns, while lottery tickets are high risk with high returns. Anyone telling you different warrants higher scrutiny.

Another theme that many of these schemes use is consistent returns, often times regardless of market conditions. This just doesn’t make any sense. There is no way that anyone can predict the future of any markets, let alone the highly volatile crypto market. To make promises that ROI will remain steady despite the natural variations inherent in speculative markets is a major red flag.

Other Signs To Look Out For

One thing that any legitimate project will have is a clearly defined explanation of the machinations of the token. A detailed and fully available white paper is standard across the industry with many projects using fully open-source code. Any project that obscures how their token operates, only offering vague promises of functionality, is hiding something and should be avoided. One of the cornerstones of the cryptosphere is transparency and the ability for users to thoroughly investigate new projects.

All legitimate projects should have clear and simple guidelines on how to divest from them and any push back or difficulty in selling out and claiming your cash is almost a sure sign that it is a scam. Unfortunately for most victims of these operations by the time this last red flag is noticed it’s too late to do anything about it. That’s why it is of the utmost importance to properly vet all potential investments and learn from the mistakes of those less scrupulous investors that came before us.

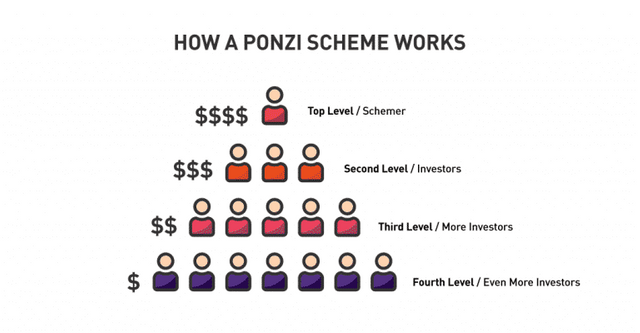

One more indication that a project is not what it appears to be is mention of “referrals” and “new contacts”. These are key words used in Multi-Level Marketing (MLM) scams, also known as Pyramid Schemes. These scams get investors to continuously recruit new members to join while never actually paying out ROI. The money moves back and forth between investors before it inevitably ends up in the pockets of the group perpetrating the grift. This is a model that has been around for ages and—unsurprisingly—has made its way into the cryptosphere.

Now that we have a better understanding of what scams look like and how to avoid them let’s examine two of the most infamous crypto Ponzi schemes in recent memory: BitConnect and OneCoin.

https://kucoinblog.com/crypto-ponzi-schemes-bitconnect-onecoin-sk-st

Now we have Steemit.