The Power of Deflationary Money

The general definition for deflation is "the reduction of level of prices in an economy." However, this only covers one side of the deflation equation.

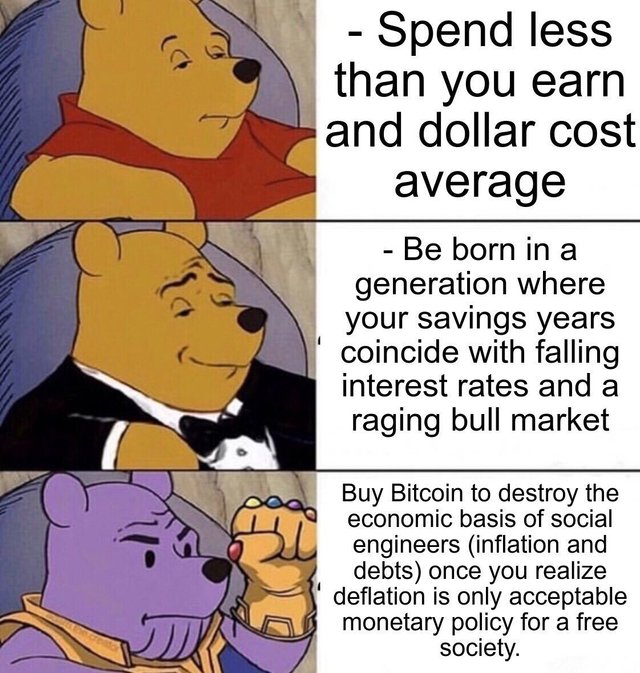

MMT'ers who are hyper focused on fiat currency do not understand that any store of value can be used as a currency as long as there is a mechanism to price goods and services with that store of value. They forget that deflation is not a force that you can turn on or off. It is a natural part of the free market. You cannot prevent it, you can only mask it.

So, while we are in a deflationary spiral in our current economy, it is being masked by the printing of fiat currency. Making it look like prices are rising, while in reality, the economy is slowly falling apart.

Store of value plays such as Bitcoin, Gold, and other cryptos and metals, are typically deflationary money.

Deflationary money is a money with a capped supply or generally decreasing supply. This type of money is near impossible to manipulate for ever. Over time, this money buys you more and more goods and services.

Deflationary money can protect you from fiat, and when real deflation spikes, goods and services drop in value against your money.

So while governments of the world print themselves into a hole, sovereigns like you and I stack our own money and wait them out.

___________________________________________________________

Thanks for reading. I also sell physical silver for crypto if you are interested in stacking silver or would like to support me.

I currently have 100 2021 Silver Eagles Type 2 that I am looking to sell.

I also have silver dollars and 1 oz rounds.

Crush the Banks: Buy Silver