Facebook is a Deeply Inefficient and Parasitic Company & Here is Why

Download Pocketnet Whitepaper Here: https://pocketnet.app/about

When facebooks and twitters of the world censor free speech, they are frequently excused by the fact that those are private companies and so can do whatever they please. On its face it is a reasonable argument. But this argument holds only in a free market. US economy today hardly resembles a free market. Companies like Facebook have access to unending free capital courtesy of the Fed. This capital flows through the banks to the ideologically aligned Silicon Valley companies. This capital is then used to buy up any competitor that might present threat to the dominance of Facebook. That is not a free market! Of course, the reason that anti-trust authorities allowed Facebook to become so large is precisely because it is a surveillance mechanism masquerading as a free service.

But at least Facebook doesn’t charge for its services, right? Wrong. Facebook is not free. Essentially Facebook earns money by making you do work! Check out some of these headlines:

Facebook’s making more money per user in North America than ever before

Facebook made an average of $6.18 off each user in Q4, more than double three years ago

Basically, every time you post something on Facebook, you are acting as a volunteer content creator to enrich Facebook. Every time you read or watch something on Facebook, you are acting a volunteer ad seller to Facebook. It is not like Mark Zuckerberg needs your charity. He probably makes in a milisecond more than most in a year.

But wait? Didn’t he invest all this money into creating this great free service for the society? Well. Yes and no.

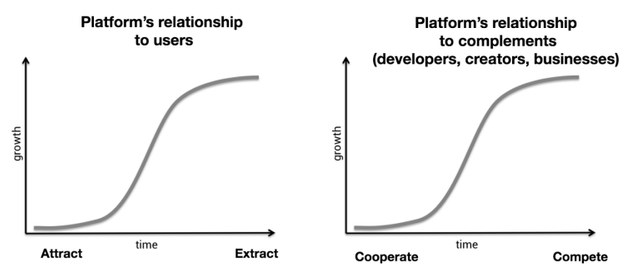

Firstly, whatever money Facebook spent on creating and refining its platform, it is going to get back from its users. No doubt about that. Typically, a picture is worth a thousand words, but the one below is worth tens of billions of dollars. It is a simple illustration of a relationship between Facebook and everyone else. Not that early on it is all give, give, give. And later on it is payback time! And pay back you will. You pay back by being the recipient of the most manipulative advertising that uses every little bit of data about you. If you wrote something in a personal message to a friend, it will be used to sell something to you.

Source: https://medium.com/s/story/why-decentralization-matters-5e3f79f7638e

Human psychology is vulnerable and exploitable. Even one of Facebook founders Sean Parker said that the core of the site’s design is exploitation of weaknesses in human psychology. And Facebook uses every little bit of everything you give it and then some. I used Facebook for advertising few years ago. There is a feature in almost every social network to target advertising to people with certain email addresses. Now, our subscribers were mostly businessmen or senior executives and emails we had were corporate emails mostly. So, for years prior I would shun the idea of advertising on Facebook, because I reasoned that it is a site for personal stuff, so work emails would not be found there. But we hired a new marketing director who had a bit more knowledge about the way of the world and he challenged me to run the list we had through Facebook. To see if we can target those people with corporate emails. To my amazement, Facebook recognized twice as many corporate emails as Linkedin (20K out of 30K total emails versus 10K for Linkedin) did. What? A site made for personal and family connections recognizes more corporate emails then the site for business networking. I did more experiments and came away certain that Facebook doesn’t just use all of your data to throw advertising at you. It also uses data it gets elsewhere. Perhaps it barters for it in exchange for personal that it does have on you. But it won’t stop there.

"Facebook’s push to gain access to users’ banking data and other sensitive financial information could help make online banking more efficient..." (Source)

I will tell you one bank account that will certainly gain some economies of scale and it is not yours or mine. Scandal after scandal exposes how thoroughly merchandised you are when you are on facebook. We are all a storefront good when we are on it. Personal messages, financial life, business life, nothing is off limits. If you don’t think that top hackers of the human brain together with top hackers of computer code can put all that info to use to relieve you of some hard earned dollars, then you are mistaken.

If you are business that spent money growing your Facebook following, the double hockey stick chart above is about to catch up to you (if it didn’t already). Your Facebook ‘fans’ who you’ve spent time and money to acquire are not really yours. You will see more and more articles like this: https://www.kunocreative.com/blog/facebook-reach-in-2018

In the article, an author who spent years building her (but really Facebook’s) following on Facebook observes that ‘fans’ no longer see her content.

“If you’re wondering why you should even bother posting anymore, that’s understandable. But before you give up, know that despite all these changes, Facebook is still one of the best ways for many brands to reach people. With more than 2 billion active users and the average person spending almost an hour a day on the platform, it’s your most captive audience. But to reach them, you’ll have to pay for it.”

I am shocked that someone is actually surprised by Facebook doing that. Can the free market reassert itself. Needless to say that can only happen if Federal Reserve is abolished, because rigging of the markets flows from the lifeblood of today’s financial system, government credit.

But even without abolishing the Fed, economic laws cannot be defied forever. At some point the insane bloating of Fed’s balance sheet has to slow down. No, not stop. The market starts falling (as we saw over the last couple of weeks) not when Fed actually unwinds, but just when it reduces the flow of monetary heroin just a bit.

And that doesn’t bode well for Facebook, because in a free market economy they cannot stand a chance. Facebook lost over 40% of its value in the past few months. And while I believe that the bleeding will stop in the short term, in the long run this business is not viable. And here’s why. The services that Facebook provides to gate all that revenue is very very inexpensive. The functionality of a social network (minus the elaborate surveillance mechanism) could be built for a fraction of a fraction of Facebook’s revenue. There are WordPress plugins that most of it. Facebook really spends most money to extract value from users, not to create any value. And this makes Facebook ripe for a disruption. Just like Uber disrupted taxi business and Airbnb disrupted hotels, so someone will disrupt Facebook by sharing the revenue more equitably. After all, if you are creating content for Facebook and it makes money off of it, it is only logical that you should be compensated for it. If someone pays for a chance to sell to you, would it not be better if they paid you for it in the form of a real discount, say?

Disruption for facebooks of the world (when it comes) will be painful for the market. Much more painful than the 40% drop we have seen. However, the result will be a much healthier economy in the long run. If you are looking at the tech space, I would look at companies that do not make money by creating an inexpensive to build, but very high margin business that exploits its users.

Source: Yahoo Finance

Isn’t it ironic how this chart is sort of a reverse of the hockey sticks in the beginning of the article? Maybe ironic, but not too surprising. It is all about making the world a better place, right?

POCKETNET — first fully decentralized social network No corporation. Open Source. Nobody can take your subscribers away. All advertising revenue goes directly to you as content creator. Owned & self-policed by users like you. Join the revolution today! https://pocketnet.app/about