BITEX - THE FIRST INTEGRATED CRYPTOGRAPHIC BANK

INTRODUCCIÓN

Today, cryptocurrencies are becoming first-class citizens of the digital economy, and the time is fast approaching when it will be necessary to provide financial services to this emerging economy, which will be essential to promote its development.

By that time, Bitex is expected to be ready to become the first locally integrated cryptographic bank. Its main objective is to provide financial services to the cryptocurrency-based digital economy that are relevant and useful to the local customer base in each region in which it operates, while being available globally. Bitex will provide cryptocurrency-based banking services for digital users through a licensed technology platform available to local partners.

Bitex's crypto-banking services include:

- Customer service, user experience and localised government;

- An ERC-20 compatible digital wallet to securely accumulate a customer's cryptocurrency balances in a personal mobile module;

- Possibility to manage the mobile wallet with virtual debit card for payments, exchanges and transfers.

- Various point-of-sale solutions (both hardware and software based) for merchants to accept payments in their local currency from consumers;

- Currency exchange between the G20 trust currencies and various popular cryptocurrencies;

- Personal loans

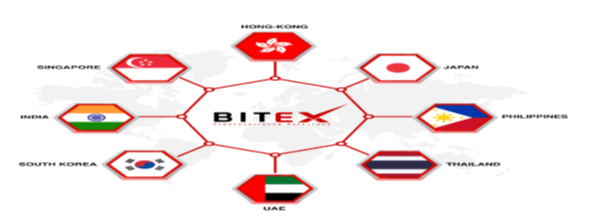

Bitex will start operations in mid 2018 with a subset of banking services offered to customers in 8 countries (Hong Kong, India, Japan, Korea, Philippines, Singapore, Thailand and the United Arab Emirates), with plans to expand its reach in the future.

A payment infrastructure based on ATMs and mobile card readers will be developed for the Bitex platform, which will be located in more than 20,000 locations around the world as services are deployed.

Bitex is conducting an Initial Currency Market of its utility token, the Bitex Currency with the symbol XBX, to promote the use of the Bitex crypto-bank platform.

Bitex will point out the local impact it will have in each of the countries in which it is licensed, promising a package of localized financial services and redefining how financial services can be provided for this new digital economy based on cryptocurrency.

PROBLEM STATEMENT

- Considerations on the cryptobank market

The Rise of Cryptography Exchanges

There is currently no known person who has not heard of cryptocurrencies, although only vaguely and most likely in relation to that sensational cryptocurrency Bitcoin.

Although Bitcoin has been around since 2009, its recent rising valuations and the speculative market around it have motivated many to try to mimic its success by creating and offering alternative cryptocurrencies.

Of these, one in particular stands out - Ether (ETH), the fuel that drives the Ethereum1 blocking chain. Ethereum is the main platform currently managed to create Distributed Applications accessible through the purchase and exchange of a cryptocurrency.

In March 2018, there were about 4597 cryptocurrencies2 listed through various cryptographic exchanges3, with varying degrees of usefulness, liquidity and trading volume.

Many cryptocurrencies provide access to valuable decentralized services (such as storage or computing resources, identity management, etc.). Therefore, as the value and use of decentralized services registered in a block chain grows in popularity, the need for such cryptocurrencies is also expected to increase.

However, cryptographic exchanges only offer the possibility of commodifying one's own holdings of currencies (fiat/crypto and crypto/crypto), which offset only a small part of the financial needs of a growing cryptographic economy.

If trade supported by cryptocurrency is to develop to the point of having these accepted as an appropriate means of exchange for goods and services and to take their place as pairs to fiat currencies, it is imperative to create new institutions that can supply the needs that people have been associating financial operations with. These contain the ability to store currencies, switch between currencies as needed, manage currencies for payment of goods and services, automate bill payment, obtain loans, etc. That is, the services currently provided by commercial banks around the world.

A cryptographic bank, therefore, is the new institution cited for this growing digital economy based on cryptocurrencies. Offering the following a wide variety of services to its consumers.

Motivation for the Bitex Crypto-banking solution

Restoring confidence in the banks

In establishing a crypto-bank solution, Bitex has been motivated by the need to return to the original purpose of a bank, that is, an institution that helps the economy function and grow by providing a way to manage savings, provide means of payment and money transfer, and facilitate lending.Addressing local needs

Bitex has the greatest impact on society by working locally, and certifying that the benefits of this new digital economy based on cryptocurrency can also be felt by those excluded from the current banking system. So, instead of starting immediately as a global bank, Bitex wants to make sure your solution has a local impact.Go to market in Asia and the Middle East

The best way to achieve significant local impact is to focus on regions where mobile connectivity is predominant and where traditional banking/financial services do not work properly for the majority of the population. This gap can only develop when the economy moves towards the use of cryptocurrencies.

In view of this, Bitex is looking to Asia and the Middle East as the regions most likely to need and welcome a robust #1.3 Motivation for a crypto-bank platform based on a block chain.

Use of the Ethereum block chain

Ethereum-based block chain-based solutions using publicly distributed ledgers, cryptographers and intelligent contracts provide users with a means to create value through reliable and transparent interactions on a global scale.Intelligent contracts based on financial theism

A cryptobank account holder can create a smart contract to pay a certain amount of cryptocurrency to another external account at regular intervals (such as paying a utility bill). Another example could be a simple payroll for a small crypto-bank client company, where a contract distributes cryptocurrency to several accounts belonging to its employees.

These contracts are registered in the Ethereum block chain, and are always visible to all users. The smart contract code can be verified as correctly representing an agreement or condition, and cannot be altered or repudiated later.

- Financial services based on chains without intermediaries

Direct financial operations such as deposits, disbursements, etc., can be carried out through Ethereum's block chain in a transparent and automated way directly between users without the need to involve entities outside the system or depend on any centralized entity.

STAKEHOLDERS AND SERVICES ON THE BITEX CRYPTO-BANKING PLATFORM

The following subsections detail the parties interested in participating in the Bitex crypto-banking ecosystem and the service available or provided by each of them. The two main mechanisms of Bitex's crypto-banking platform are:

BitexPay, the next generation payment solution for consumers and merchants.

EZBitex, the exchange and banking infrastructure with a decentralized, distributed and immutable ledger provided by Bitex, which supports the operation of the entire system.

The role of each of them is systematically described in the following sections.

Services for clients

Bitex offers similar services to banking services (payments, currency exchange and transfers, debit cards and personal loans) that will initially be offered in 8 countries.

In particular, consumers will be able to benefit from the following services.

Confidential and Owner. Bitex Global Co. Ltd., BitX Global Pte. Ltd. 12

Payments to Merchants using BitexPay

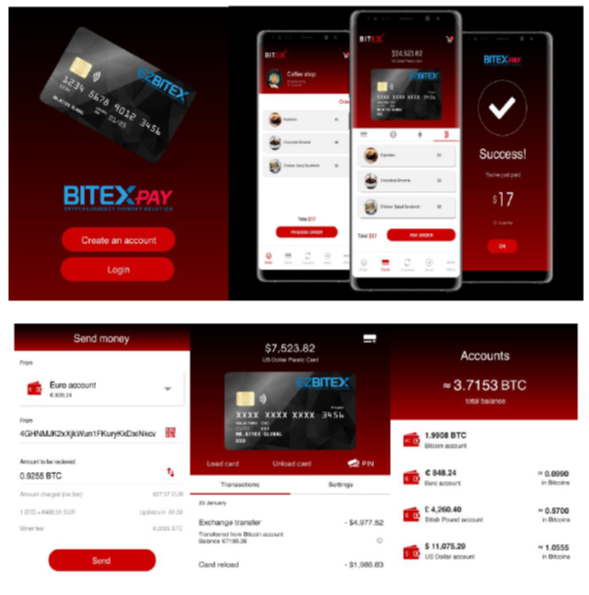

BitexPay represents the service provided by Bitex to consumers and merchants for payment of goods and services using cryptocurrencies.Merchants may accept payments in cryptocurrencies or in any fiduciary currency of their choice.

Users who sign up for the BitexPay solution will receive ERC-20 compliant wallets containing their cryptocurrency holdings. Originally, Bitex will only withstand the following cryptocurrencies: BTC, ETH and LTC and the Bitex currency, XBX. As new currencies are added to the EZBitex stock exchange.

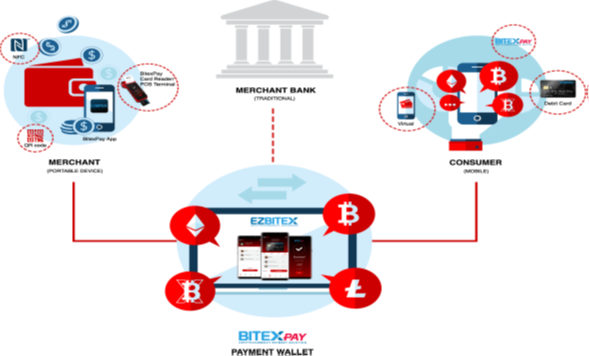

Figure 1: The components in a simple payment scenario.

When a consumer wishes to purchase an item, the merchant presents a payment screen showing the price in multiple cryptographic and fiduciary currencies accepted on the EZBitex platform.

Figure 2 shows the user interface of the BitexPay trading application, which receives information from the EZBitex platform in the background about the latest exchange rates for cryptocurrencies and between crypto and fiat to calculate and display the selling price in the currencies accepted by the merchant.

Figure 2: Vendor application user interface

- Negotiation

Users who wish to use cryptocurrencies using the crypto-exchange services of the EZBitex platform will complete a Trading Portfolio associated with their account. The cryptographic assets in this portfolio can be managed for various orders of margin trading, limit trading, leverage, etc.

Consumers participating in the trading will pay the trading fees denominated in each cryptographic currency they sell, while for the trust currency the fees will be automatically exchanged into XBX chips at the current market price on the EZBitex exchange.

- Currency exchange

EZBitex's all-in-one swap will provide crypto-to-crypt, fiat-to-crypt and vice versa, or fiat-to-fiat conversions.

The cryptographic coins to be listed will be incorporated from time to time, with an announcement made to interested parties via email and social media.

Consumers may complete their Portfolio of Operations in order to buy/sell on cryptocurrency in the following manner:

The transfer of fiduciary currency from your bank accounts to your account on the EZBitex platform, which can be converted into cryptocurrencies of your choice.

Use a credit or debit card to purchase cryptocurrencies offered on the EZBitex platform.

Staking

To promote the use of the Bitex banking platform, consumers will be rewarded for having XBX tokens. The number of XBX tokens held by the consumer on the EZBitex platform will be stored in a Participation Portfolio.

The prize will be in the form of discounts on transaction fees for cryptocurrency changes. Provided the customer has wagered an appropriate amount, the customer will automatically achieve the discount on transaction fees regardless of the profitability or expansion of the EZBitex platform.

- Loans

Customers who wish to obtain loans from Bitex by offering a cryptocurrency as collateral will receive a Loan Portfolio. This portfolio maintains the status of the loan and its repayment.

Loans will be made on XBX tabs, and the amount of the loan will be determined by the collateral offset by the borrower. Initially, the collateral for the loans will be backed by the borrower's bitcoin holdings (or other accepted cryptocurrency) and the amount of the loan will be a percentage of that. The guarantee can be requested after the borrower returns the principal and interest of the XBX tokens to Bitex.

Merchant services

Merchants will have to undergo a Bitex process. Meet your Customer (KYC), Anti-Money Laundering (AML) and Bitex Certified (CBB) before you register for a merchant account. Once registered, the merchant's location will be added to our GPS location server so that customers can find our merchants verified by the CBB for the services offered.In-store or physical purchases

All merchants can provide payment options to purchasers of their goods or services using the BitexPay merchant application on a portable device or, for those customers who present physical cards, through a BitexPay card reader or Point of Sale terminal.

Figure 4: Various Bitex payment terminals for merchants (available and ready to use)

Online shopping

Online merchants will be provided with an API that integrates a payment gateway provided by Bitex that allows the merchant to accept the BitexPay card for purchases. Transactions will be routed through this gateway to the EZBitex platform for approval and payment (from the cardholder's Payment Portfolio).Intercompany payments

The EZBitex platform will provide a payment gateway through which merchants or businesses with Bitex accounts can pay each other for goods and services. This payment service will work worldwide.

Merchants wishing to pay for goods or services may generate an invoice or payment request in the form of a QR code or link that is shared with the payer. The invoice also contains information similar to that used for traditional cross-border bank payments, including the purpose of the payment and the tax and registration data of both parties.

THE BITEX CRYPTO-BANKING PLATFORM - EZBITEX

Bitex's cryptobanking platform allows consumers to process payments, transfers, exchanges and loans in cryptocurrency, all from their smartphone.

The backbone of Bitex's crypto-banking platform is the decentralized exchange called EZBitex. The EZBitex platform will do it:

- Provides conversions from crypto to crypto, from fiat to crypto and from fiat to fiat in this exchange.

- Offer payment gateways (provided by established third parties such as Braintree or Stripe) for the purchase of cryptocurrencies by bringing a credit card, debit card or online banking.

- Host the various types of consumer wallets (Payment, Trading, Participation, Loan) associated with consumer accounts and provide the various services described in the previous sections.

- Provide APIs to access EZBitex features to third parties who want to use EZBitex as their payment platform.

- Provide Bitex brand ATMs at locations where Bitex operates, to allow the use of BitexPay physical and virtual cards, as well as third-party "Powered by Bitex" cards;

- Offer business-to-business payments for goods and services with invoices and receipts.

The EZBitex platform software will be licensed by Bitex to local partners who will obtain all necessary permits from local financial authorities to operate franchises in that location. EZBitex will be projected in mid 2018 with a subset of banking services offered to customers in 8 countries (Hong Kong, India, Japan, Philippines, Singapore, South Korea, Thailand and the United Arab Emirates), with plans to expand its reach in the future.

Figure 5: Initial franchisees of the Bitex Platform

SUPPORT TO THIRD PARTIES

- "Powered by Bitex" brand cards

Merchants can issue their own debit or credit cards (physical and/or virtual) for payments at their online or offline stores. These cards, as shown in Figure 6, will be marked as "Powered by Bitex", as the EZBitex platform will be used as the payment network.

Figure 6: Developed by Bitex Branded Cards

Third-party development for the EZBitex platform

The EZBitex platform will provide APIs to key features of its global platform for approving developers to organize local banking applications. For this purpose, Bitex will provide the following resources:Bitex's open API will allow local merchants to build BitexPay and Powered by Bitex applications that meet local needs.

A Bitex Marketplace where several commercial applications developed through Bitex's open API are available to other merchants.

A Bitex developer program that encourages local developers to work with local merchants to bring new applications to the Bitex market.

Bitex ATMs with the Bitex brand name

Bitex will use third-party hardware to place ATMs that are connected to the EZBitex platform, such as the Lamassu, Genesis and Sumo ATMs, which have gained a market share of over 70% in the ATM market.

These Bitex branded ATMs, which will be available at locations where Bitex offers services, will allow consumers to use their physical or virtual BitexPay debit cards to withdraw, deposit, transfer and perform other finan ial transactions associated with their BitexPay wallets.

Bitex ATMs with the Bitex brand name

Bitex will use third-party hardware to place ATMs that are connected to the EZBitex platform, such as the Lamassu, Genesis and Sumo ATMs, which have gained a market share of over 70% in the ATM market.

These Bitex branded ATMs, which will be available at locations where Bitex offers services, will allow consumers to use their physical or virtual BitexPay debit cards to withdraw, deposit, transfer and perform other financial transactions associated with their BitexPay wallets.

Figure 7 : Bitex ATMs

ROADMAP

Bitex's crypto-banking procedure will take place in several phases and will be established in different countries in the next two years.

- Technical roadmap

- Road map for country deployment

As mentioned above, Bitex's cryptobanking services will be operated by local partners who license the Bitex platform as a franchise and will be registered with the financial authorities of their respective countries.

Figure: National implementation plans for the Bitex platform

Work Team:

Harith Motoshiromizu - Founder Bitex Global CEO

Nicolas Louis Laurent Berthoz - Co-founder of Bitex Global CTO (Director of Technology)

Junjiro Sato - Co-founder of Bitex Global & License Co, License Co-Owner Japan CIO (Chief Investment Officer)

Ryan La France - Co-founder of Bitex Global & License Co, License Co-Owner Philippines CFO (Chief Finance Officer)

Yusuke Asai - CPO (Product Manager)

Pansak Kummalue - Co-owner of the licence of the Kingdom of Thailand

Suparat Damrongsuttipong - Co-owner of the U.A.E. license

Deepak Galani V - Co-owner of Hong Kong License

Devendra Kumar Kothari - Co-owner of the Indian License

Paphatsara Supason - Co-Licensee South Korea

Links of interest.

Website: https://ico.bitex.global

Telegram: https://t.me/joinchat/IV2i4Q6llH7ttm5n9hqT5g

Twitter: https://twitter.com/bitex_global

Facebook: https://www.facebook.com/bitex.global/

LINE: https://line.me/R/ti/p/%40bitex-glb

Whitepaper: https://ico.bitex.global/docs/XBX-Token-WhitePaper.pdf

Made by:

Bitcointalk user: Renault

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=2120156

Myetherwallet: 0x925C0EA42800B24f074741226e20D08D93509Acbb

By: Maestroudo