Chart Of The Day: How Unstable Stablecoins Can Be?

The chart of a stablecoin, in principle, should be deadly boring: simply stable. In an ideal case, a horizontal line. But it isn’t. And that can teach us something for the future. See the charts.

How are they stabilized

There are various types of stablecoins, depending on the stabilizing method. Some are backed by assets like US dollars, euros or gold. Some are stabilized with issuance and withdrawal policies, or credit politics. Asset-backed stablecoins are, in theory, more stable than others.

Because, if you can exchange it always for 1 USD, the price won’t differ very much from 1 dollar. If the market price falls 2 percent, the stablecoin can be bought for 98 cents and exchanged quickly for 100 cents. Two percent profit in a short time, without considerable risks, is a dream of many speculators.

A confidence thing?

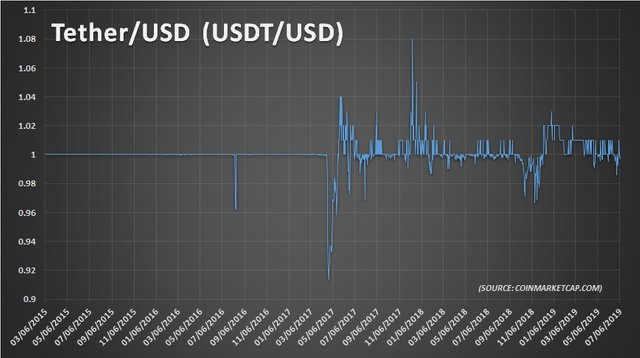

I think that’s why the price of Tether (Tether dollar, USDT) is moving around 1.00, or 100 cents, most part of the time. That is normal. What is not so normal, is, when the price moves away, 4-8 percent lower or higher than 1.00. That means some sudden over-demand or oversupply speculators can’t handle.

(Click for higher resolution.)

Or, some lack of confidence, lack of trust, lack of the underlying assets. Tether, or the company behind it, was accused various times that the assets were not present in reality. The wealth behind the stablecoin backing the value wasn’t considered as audited, data not reliable. Many people had concerns if the assets were present.

Too big to manipulate?

I think if the assets really were missing the price would have fallen a lot more. Insider information used to leak, insiders selling could have pushed the price much more if something was really wrong. Maybe there were minor or major irregularities, failures, but the price tells me that Tether is basically O. K. You can’t manipulate the price of a 3.7 billion dollar asset easily.

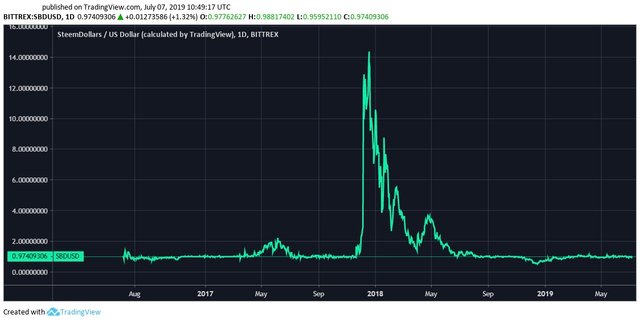

Our Steem Backed Dollars (SBD) are much more volatile. The price swings are huge. End of 2017, the price reached 14 USD. End of 2018, it was only near 50 cents. (It is not backed with external assets, the price is regulated with SBD/Steem conversion and issuance politics.)

(Click for higher resolution. Chart: Tradingview.com)

Will Libra be stable?

Another factor why we should monitor stablecoins is the new Libra coin of Facebook’s Libra Association. Many are saying it will be not a speculation target because all Libra-s will be backed by fiat money and treasury bills. Like Tether? But I’m sure many states, companies, authorities, and analysts will attack Libra, all the time.

Only a fool would trust Facebook with their financial wellbeing. But maybe that’s the point of the Libra currency Joseph Stiglitz

In reality, many are already attacking Libra, like Stiglitz. For example, July 16, Facebook has to answer questions in a hearing in the US Senate. A bunch of countries already declared they will not allow the use of Libra. New attacks can cause price swings in the future when Libra is on the market. Foreign exchange prices can cause other swings. Simple short-term supply and demand swings, and broadening margins can cause other price differences.

Maybe Libra will not be so boring like Tether in the early times, not a horizontal line. And this can offer a speculation opportunity. With low risk, because of the backing assets.

The series

I started a series with the title “Chart Of The Day” because I see every day interesting things on the markets or in the news. Other parts here:

That's one of my favourite pastimes in crypto. Making fun of the purpose and the stableness of stablecoins!

Coincidentally, I think SBD is one of the best stable coins around because it can adjust itself rather well.

We are punching above our weight here.

Posted using Partiko Android

It's the best stable so far

14 USD for 1 SBD? That wasn't really stable. In first line as it fell back

My argument isn't about volatility. It's a stablecoin. Ofcourse it goes nuts ;)

I'm arguing that SBD has an easy and obvious mechanism to stabilize itself with time.

Posted using Partiko Android

@deathcross you are say correct. Actually the main thing is all coin are been handle by big players, who can manipulate the coin anytime for their benifit and earning.

I think they will be stable unless the mechanisms that keep them stable fail. Either way up or down will mean something, but essentially a failure of the purpose.

Yes, I thought as much but let's keep watching...

Libra is huge project. I guess libra must be stable. It's big competitor for tether.

Really enjoyed reading this article! The main difference between any stable coin and any other is that stable coins are backed by large firms. This does not exactly fulfill the main purpose of the decentralization!

Congratulations @deathcross! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!