There Are Far More Inflationary Cryptos In The Jungle Than STEEM

“Such crypto, very money”

Summary

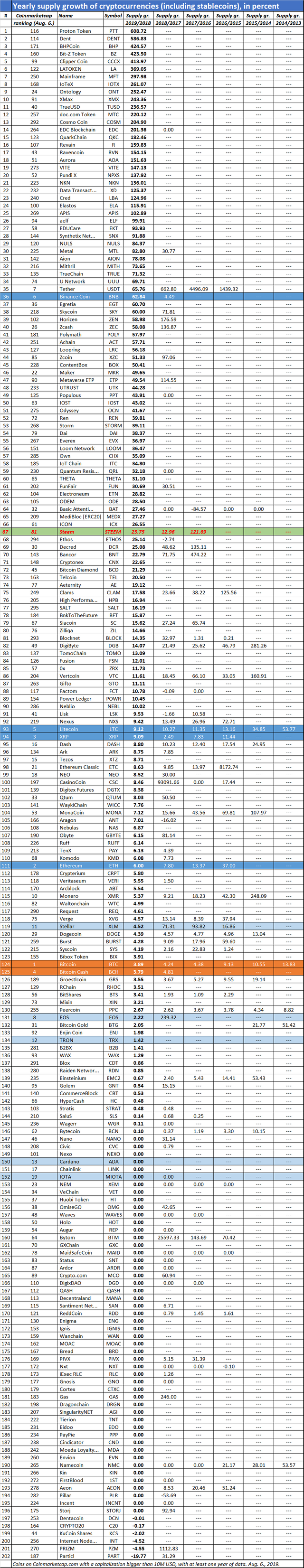

- If we measure the supply growth of cryptocurrencies, many of them are highly “inflationary”. The supply of some of them grew various hundred percent in the last year.

- STEEM is “only” on place 67, with nearly 26 percent p. a.

- Many cryptos don’t even have an own currency code.

- Every case seems to be different, supply alone is not determinative

Measuring supply of all cryptos, made easy?

I wrote before how painfully high is the supply growth (also called “inflation”) of STEEM tokens, and I compared it with other cryptocurrencies. Here Recently I discovered another simple method to measure the supply change of cryptos. With the help of the “market snapshots” on the page Coinmarketcap.com. That allows me to compare the supply of two dates in an easy table – I thought.

Interfering codes

But not so easy. Measuring is not simple because some currencies have not even an own currency code, various are sharing the same. Names sometimes also can change. The stablecoins are mostly naturally changing its supply all the time but that is normal. It means something different than the supply of other coins.

Some interfering codes:

- Fastcoin <> 1irstcoin => FST

- CyberMiles <> Comet => CMT

- KingN Coin <> Kyber Network => KNC

- LBTC => code of various coins

Between 2300 different coins and tokens there were a lot with some data conflict. Finally, I decided to watch only the coins with a market capitalization of more than 10 million USD. And data available at least for one year. The result is also a long list of 200 coins.

There is STEEM

The most “inflated” ones, with the fastest-growing supply, had hundreds of percent more pieces of coins than one year before. We see STEEM on place 67., with a supply growth of 25,75 percent. (Marked with green. Mayor currencies market with colors in the table.) (Post continues after the table.)

Why are some of them so “inflationary”? No idea, let’s research a bit. About the first on the list, Proton Token, I read:

Proton is a public chain that is dedicated to data fusion and collaboration. It builds the fundamental infrastructure for data security and high-efficiency data collaboration processing across various data sources, unleashing the real potential of big data and artificial intelligent applications on different industries. (…) Proton’s team chooses the digital marketing industry Source

Not a stablecoin, though. It has no issues with the currency code, and the price jumped some time ago very high.

Phone calls with crypto?

Let’s see the second most inflated token, DENT. This one is falling and falling more and more ultimately. They claim to “drive the Data Sharing Economy”:

Make calls in 60 Countries using the DENT Apps.

Blockchain-based DENT World Telco launched! (…) DENT Wireless is a company with a mission to tokenize, liberate, and democratize one the most important commodities in our time: mobile data and bandwidth. (…) DENT Tokens are the universal currency for buying and selling of Mobile Data. You can already use DENTs to buy data from the largest operators of the world, such as AT&T, Verizon, Movistar, Telcel and more. Source

Only one more, the BHPCoin. Here, BHP means “Blockchain of Hash Power”. The coin price seems to be relatively stable in a +/– 50 percent range around 1 USD:

a payment system formed by BHP Foundation and 21 hypernodes. It claims to be a mutually dispersed asset network based on the hash power of Bitcoin mining farms. The BHP coin is tied to BTC hash power and is a hybrid of "PoW + PoS". BHP reportedly provides a distributed hash power service to share and distribute 2% to 10% dividend from Bitcoin mined for BHP coin holders. Source

So, that is a token which is paying a dividend and giving a share from mining. Also interesting. Maybe the supply grows with the number of dividend-hungry investors?

I have the impression that every case is different. We can’t generalize, can’t say that “highly inflatory coins fall, low inflation is better”. The question is also, what is behind the token. What purpose does it have, use cases, user base, network?

(Photo: Own Work)

Well thats a point... of course the inflation in the ideal environment for STEEM is a necessity, otherwise nobody would vest their liquid token and it would be highly volatile. But as we see, people can power down. They power-down when either the platform cant be used normal (flags, idiots, censorship, fascists, no communication) OR if the price drops. Both things are interdependent. Idiotic rules and idiotic behavior enhances powerdowns --> price drops --> more powerdowns --> price drops further --> ... and then inflation no matter what rank, is fuel to the fire (because holding liquid STEEM is punished by design)

The problem with using coinmarketcap as a source of data is that it does not take the supply of each coin directly from the blockchain. For example steem's market capitalization is calculated using what they call the "circulating supply". At this moment they show it as being 339 million but the blockchain shows 320 million.

Where are they getting the extra 19 million? It's not the virtual supply (that is 356 million). And this happens accross the board with most of the coins. So you can't trust their data.

How to browse blockchains, statistics? Any tutorial?

Thank you.

To be honest I am not sure if their is an easy way to do it. Do Coingeko, Concap or other rating sites have more accurate data? It's hard to say. Gathering information from thousands of tokens must get very expensive as you need to use some sort of API for each and every one of them.

One thing I am sure of is that coinmarketcap's info is shit.

That's gave me a great insight on the inflation perspective of crypto. I think Grin is most exposed to inflation because it has infinite supply you can as many grin as you need. There is no fixed supply for it. @deathcross

Grin seems to be unserious, then

Yes , But the tech behind it is great(MimbleWimble)

Excuse the noob question, but I am bit confused?

In your opinion, is "monetary supply growth" (inflation) a good thing or a bad thing for a token?

Just trying to understand the post more.

Some supply growth or "inflation" is healthy, it is feeding the reward pool and pays the work of witnesses. (Or miners, in case of Bitcoin.) Too much supply growth can be harmful, I think. Specially if there is no additional demand for the given cryptocurrency.

Bitcoin and crypto news read at https://btcmanager.com/

Join telegram https://t.me/btcmanagernews