Decentralized Token Economy: The World that Blockchain Projects Aim to Build

Value-based 💰, Meritorious, and Decentralized.

The total market cap of 1604 cryptocurrencies (listed on coinmarketcap.com) is around 450 Billion US Dollar at present. The crypto market is sucking in money, talent, and ideas all at once.

Its growth is something that no one can ignore and many equate it with the early days of the Internet. But it is clear from the use cases and existing projects that just like the Internet, Blockchains and Cryptocurrencies are here to stay.

Amidst many speculations on the market and use cases, this blog comes from the collection of my personal notes that I took in last 6 months to understand the Daaps, ideology, solutions they offer, and what’s coming next.

This piece is about rationally exploring what’s happening around the world in the name of cryptocurrency and where this ‘Decentralize’ movement is taking us.

Blog content:

A. Premise

B. Perspective

C. Decentralized Token Economy

D. Growing Ecosystem

Total Cryptocurrency market capitalization: 450 Billion US Dollars

[A] Premise

The technology advances on top of the existing infrastructure, leaving it behind, obsolete but not meaningless.

The fossil fuel put an end to the steam-powered industries and that doesn’t mean that the steam was unnecessary. It is just that the ever-changing world reaches a certain phase from where it naturally adapts to the better.

The metal coins made barter obsolete, the cashless transactions are pushing the cash over the edge. While there is a long way to a truly cashless economy, the change and market adoption is visible.

The stock markets succeded because they brought more liquidity and money to all the economic sectors. And the companies found a new way to increase inflow and take advantage of the free-flowing money in the market.

While the stock market was a revolution in itself to further the world of debt and credit, a new kind of economy emerged on a white paper almost a decade ago; ‘Bitcoin: A Peer to Peer Electronic Cash System’.

[B] Perspective

There are a lot of advocates of Blockchains (Cryptocurrency + Decentralization) out there, from people who talk from the philosophical point of view such as Naval Ravikant to those who make aggressive speculations such as John Mcafee.

This blog will not go much into the philosophy of it, the idea of decentralized networks, sharing economy, organizations without ownership, censorship, ownership etc. The philosophy and speculation sometimes exaggerate the possibilities and we overlook the use cases.

This is about where it is going in the long term, say 5 to 10 years from now. It has a lot of visible use cases in finance, the transaction of value, investments, Dapps, incentivized platforms, open source etc.

In near future, the technology will not only be known for trading but for ownership, transactions, records, assets, immutability that will practically create new currency market.

Traditional banking: Centralized, Terrible Cross Broder Payment, Security issues, limited access, time-consuming…

The major change will happen in the banking sector and that will change everything.

The traditional banks won’t be completely usurped by the crypto anytime soon, but that is one of the reason which led to the creation of cryptocurrency in the first place.

The total fiat currency in the world is around 84 Trillion US Dollar, and this is a conservative figure. On the surface level, this is paper, which is regulated by the National Governments, trusted by people globally and used by markets for trading. If it could be a number on my computer screen backed by the government, then it could also be another number on my computer screen backed by the masses.

The banks served a purpose for a while but their tech will be left behind by the cryptocurrency revolution.

Currently, we are dealing with a traditional system that has no serious utility, terrible cross border payment, and high middleman fees etc. and they governed by the central authorities.

On the contrary, we have 450 Billion US Dollar worth of cryptocurrency market that has utility, easy cross-border payment, immutability on the ledger as long as they have a nice form of consensus, less transfer fee, and security. We have entire protocols which have means of exchange of value, for example, ethereum has gas for the network to process all types of computational functions on a world basis computer.

Coming back to the kind of economy the Blockchain projects are building…

[C] Decentralized Token Economy

From a bird’s eye view, in this new economy, the participants share the value, the developers build the protocols and platforms, nodes run the software (Dapps) and they all have an incentive for doing their part.

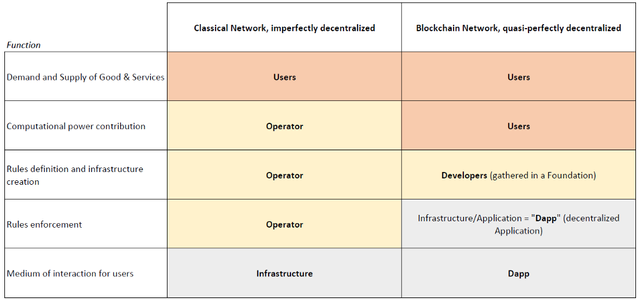

i. Seemingly-perfect Decentralized systems

People also call it Quasi-perfect Decentralized because they are not ideally decentralized but very close to it. There are three main components of this ecosystem.

-Infrastructure

The people who host the nodes on their privately owned computers are incentivized by the tokens. They keep up the network, verify transactions, store a copy of the ledger, and keep the system secure.

The provide the computing power and resources they provide to verify transaction and storage for the data.

-Users

People who use these applications. They either contribute to it for the token incentive or they use the service by paying in tokens.

-Developers

The developers who initiate the Open-Source Decentralized Projects keep a percentage of tokens in reserve before ICO (explained in the later part) to fund the development and fulfill the project requirements.

ii. Removing the Middleman and overhead

Decentralized Applications are not owned by anyone and it is open for everyone to contribute, use or run it on their computer to support the project and benefit from it.

The middleman based systems have a proven business model and they stayed for a fairly long time in the market. But now we have found a better way to transact value, organize networks, make a decision, and keep them meritorious.

Some existing projects to understand the Dapps.

StorJ

It is a Decentralized Cloud Storage, shared by the community.

Storj Share is an open-source Dapp that allows users to rent out their unused hard drive in exchange for STORJ Tokens. The users can also pay in storj tokens to buy cloud storage, the data is shredded, encrypted and stored across many nodes and it cannot excessed by anyone else other than it’s owner.

OpenBazaar

OpenBazaar isn’t a company nor an organization; it’s free open-source software. It was built to provide everyone with the ability to buy and sell freely. There is no transaction fee or restrictions, anyone can join the network to sell and buy products and collect payment in 50+ cryptocurrencies. OpenBazaar costs nothing to download and use. There are no

fees to list items, and no fees when an item is sold. It’s completely free e-commerce.

Steem

Steem is an incentivized content sharing blockchain. Steem provides with open-source Blockchain ecosystem to build incentivized content sharing platform on top of it. They call it Proof-of-Brain community incentive, the valuable content earns Steem Tokens based on the upvotes it receives. Proof-of-Brain is a type of tokens rewards algorithm that encourages people to create and curate content. The first Dapp on Steem is Steemit which is a blogging platform.

And anyone located anywhere in the world can invest in these decentralized startups and profit from them, unlike the traditional startups.

— The Decentralized Startups

This gives us the power to turn entire industries into decentralized industries that don’t have a central authority. Which means a fair distribution of resources and value, the value doesn’t end up only in the hands of a central authority but is distributed among the participants.

“I don’t think Spotify (music), or Netflix (video), or Amazon (books), should be the inspiration for online publishers in search of a new business model.”

— Online Publishing Should Look At Steem, Not Spotify, For Inspiration.

To learn more about Steem Blockchain, read this — All you need to know about STEEM and Blockchains in general.

Blockchains ensures Operator free networks, leaving it to the users, Infrastructure, and contributors.

Token Economy 101, or why Blockchain-powered decentralized networks are important.

iv. Tokens

Local currencies of the decentralized applications.

The tokens are like bloodstream, emitted out of the Dapps and circulated across the value chain to power it up.

It is quite difficult to define tokens under the regulatory terms and that is one of the reasons that many national governments are talking hard on them.

Tokens may fulfill functions of currency, asset, company share, a method of payment and many others, so they are quite difficult to define.

Tokens are broadly classified into two categories:

Security Tokens

Security tokens are defined to be company’s share. Security token allows users to own assets without taking possession. In Security Tokens the eminent promises buyer dividends and profits.

Utility Tokens

Utility Tokens represent access to company’s product or service. These are not designed as an investment but that doesn’t mean that they don’t bring any profit. In case more people demand a particular token, the prices will rise and holders can benefit from selling them on the exchanges.

With tokens we can imagine a world in which you own Google shares and use the same shares to pay for Google products.

This allows us to tokenize ownership or purchasing power in some type of system whether it is utility tokens or security. In a few years, there will be numerous tokens that we’ll be using for the exchange of value.

By removing middlemen and embedding both execution and legality within smart contract code, tokens will augment the ease of divisibility and lower the cost global transfers of ownership. As a result, our ability to trade real-world assets that are currently illiquid should increase by an order of magnitude. The ICO wave, which was a truly global affair, maybe a taste of what’s to come. In the not too distant future, we may live in a world where people from all corners of the globe trade everything from fractional ownership in Cristiano Ronaldo’s future earnings to a Manhattan office building. Any asset will be able to be placed on the spectrum of liquidity and made tradable.

— Tokenization of Everything — How Tokens will create a more liquid world.

Three ways to gain tokens:

Participating in ICO

ICO — acronym for ‘Initial Coin Offering’ is a new way to raise funds. The companies who launch ICO has a Blockchain project and the coins are the local currency to that Blockchain.

The division of tokens is made public before the fundraising. 20/80 percent of division between developers and buyers has become pretty standard.

20% Tokens reserved by developers for advisors, project funding, and developer incentives.

80% Tokens are reserved for ICO, a pre-sale of tokens before listing them on exchanges for public trading. This helps the tokens to gain certain value in the market. At the time of it’s listing on crypto exchanges, the real price discovery happens. The people who purchased those tokens in the ICO either sell them at a speculative price on exchanges against Bitcoin (or Ether and other currency) or hold them to pay for the services of that particular Blockchain.

Purchase from exchanges

Many choose to trade the tokens on exchanges only because the trusted projects make it to the reputed exchanges. You may purchase any crypto token in exchange for Bitcoin, Ether, USDT etc.

By contributing to the network/platform

The relatively complicated way in some cases to earn tokens is by contributing to the platform/network. In case of Bitcoin and Ethereum, the miners provide their compute power and receives a percentage on the total amount of transaction they verify.

The method of contribution varies from platform to platform. On the Steem Blockchain, people earn Steem Dollars for posting valuable content on the Steem based platforms in proportion to the upvotes they receive as well as for running the nodes to varify transactions. In case of the Solar coin, participants earn SLR coin for the amount of solar electricity they produce and contribute to the grid.

v. Open — Easy to participate

One of the problems we have had in tech is that there aren’t large monetary incentives to create and sustain open protocols. If they are open they cannot be easily monetized by traditional means. However, that is changing with the emergence of blockchain technology and crypto-tokens.

— The Golden Age of Open Protocols

The Blockchain projects aim to be as open as possible and make it easy for the developers, contributors, and users participate easily.

The ground reality as of now is not what the whole community and ecosystem is aiming to create. There is development complexity, less documentation, and the technology stack does not look very scalable.

It is like the early days of electricity when one light bulb could only be used for 40 hours without burning out and it looked unscalable to provide electricity in every corner of a country. But with gradual upgrades and improvements, today the electricity is everywhere.

But Blockchains didn’t took that long to show significant market adoption. The first adoption is by the creators, the next is market adoption. Both of these phases are achieved by the Blockchains, the next is wide user adoption and it won’t take more than 5 years for the tech to become mainstream.

In five years, there will be nothing that’s not on the blockchain. This is equivalent to when the internet first came out and companies started getting their own websites. People said, “This is a fad. It’ll never last.” Show me a single company today that doesn’t have a website. It’s going to be the same thing with cryptocurrency, but cryptocurrency, rather than enhancing existing businesses, will totally transform them.

— John McAfee

[D] Growing Ecosystem

Crypto Market Evolution in 80s

— Cryptokita (@cryptokita) May 10, 2018

What pattern do you see?🔬 pic.twitter.com/x9WzPt9SVq

In ICO’s Startups raised more than 5.5 Billion US Dollars in the year 2017. The roadmaps of these projects extend up to 2019, 2020 and even further in some cases.

The Phases of a revolution

First, it starts from the edges, almost ignored by the mainstream.

Second, it catches the attention of money and starts sucking in the capital from the market. Then comes a downturn because a lot of bad projects raised a lot of money during the hype, and it feels like the system will collapse. But the truly valuable projects survive. Just like the Google and Amazon of today survived the Dot Com bubble crash.

Last is the phase of regulations coming in to remove the unfair elements and then it goes mainstream. The regulators will see hard time regulating the cryptocurrency because this is counterintuitive and anti-establishment, but utopian in ideology.

Conclusion…

It is clear that the Blockchain, Decentralization, and Crypto-token forms a trio which works.

If we study the entire course of history, how the nations, companies, and cultures shaped itself globally. They took the path of unification. A more connected world, not limited by the borders, that is what money helps us do.

Still, in the traditional currency system, we are kind of locked in when we try to seamlessly transact value cross-border.

We are unifying the world one step further with the decentralized currencies backed not by the divided governments and nations, but backed by the unified and connected masses. The system which has trust inbuilt and created by the people in an open source repository.

It is not completely here yet, but on the surface level we get the concept, it is going to hit eventually.

With the Internet, we understood that it’ll give us new ways to interact with people and new ways to share data. With Blockchains, we’ll see new economy and ecosystems emerge with new ways value exchange between participants.

➡️ HapRamp is a STEEM Blockchain based social media for the creative communities where people can earn rewards for sharing valuable content on the platform.

If you found this story useful, please upvote it and resteem to help others find it.