"It’s so easy to become a millionaire with Steem" Let's see

Starting with just a $400 initial investment and generating only a meager $2 (½ STEEM) in daily blogging rewards, the total value of your STEEM POWER could be worth more than $1 million within 5 years!

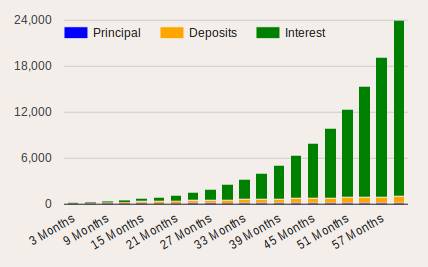

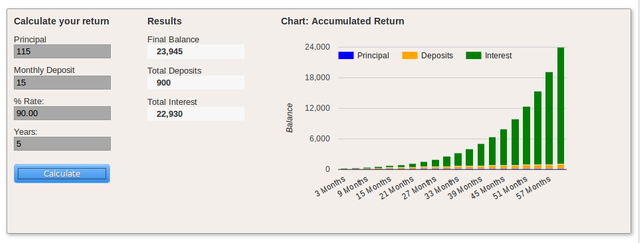

This is the power of compound interest, as exemplified by the following chart.

Specifics

This example presumes you’ve received 10 free STEEM on signup, purchased 90 more STEEM at an exchange price of $4.6, powered up all your STEEM to STEEM POWER, and that the price of STEEM rises from $4.6 to $46 over the next 5 years. The computation is shown below and note that 23,945 STEEM × $46 = $1,101,470.

The expectation of a 10X (1000%) rise in the STEEM price over the next 5 years is not totally unreasonably given the very large market capitalizations of traditional social networking behemoths such as Facebook and Twitter. Even with only a double in the STEEM price over 5 years, the above example would end up worth $220,294.

UPDATE: for those readers who are contemplating that this blog post is shilling or painting too rosy of expections, please note that I explained a scenario when a person invests $400 and a meager $2 a day in blogging effort (which is also probably paying them much more than $2 in terms of a new technology learning and social networking experience), so basically they have risked nearly nothing for the shot at up to a $million in 5 years. Please also read my comment replies for more detailed insight into my reasoning.

Steem’s Eventual 90% Interest Rate

The annual interest rate paid for holding STEEM POWER will eventually stabilize at 90%! That is 0.176% per day¹ and 1.24% per week.

Whereas, no interest is paid for holding STEEM.

Those who power up their STEEM to STEEM POWER gain at least 90% more STEEM POWER every year.

Steem’s Ongoing Stock Split

The payout of the interest in Steem is a forward stock split.

A forward stock split adds to the number of stocks you own, but it does not increase your investment value. When a company issues a stock split, those who already own stock in the company end up with more stock without making additional investments. If a company issues one share for each outstanding share, then the number of shares doubles, and this is called a 2-for-1 stock split. Because nothing has happened to increase the company’s value, the effect of doubling the number of shares reduces the stock price to half and keeps the company’s value the same. In another example, if a company announces two shares per share outstanding in a 3-for-1 stock split, each share value would fall to a third to keep the company’s value the same.

Steem² mints new STEEM tokens every 3 seconds when a new block is created on it’s blockchain, distributed to pay for our blogging rewards and the miners who validate to secure the Steem blockchain.

Additionally, 9 STEEM POWER are minted for every 1 STEEM that is minted; and the newly minted STEEM POWER are distributed to every existing holder of STEEM POWER proportional to each holders’ share of the total STEEM POWER. This is a forward stock split because every holders’ proportion of the total STEEM POWER remains constant.

Given that the total increase of newly minted tokens is 100% per year (i.e. a doubling of Steem’s tokens annually) and the STEEM POWER is 9/10ths of the increase, then 90% of Steem’s market capitalization is paid as interest to STEEM POWER holders every year.

Whereas, STEEM holders are paid nothing while the total supply of tokens is debased by 100% annually. Thus, STEEM holders lose 0.19% per day³, 1.34% per week, and 50% per year of the total Steem market capitalization.

An interesting effect is that if the price of STEEM did not increase, the market exchange value of each STEEM POWER holders’ holdings would still increase by 90%! And even if the price of STEEM decreased by 50%, the market exchange value of each STEEM POWER holders’ holdings would only decline by 5%⁴.

Whereas, in the former case STEEM holders would lose 50% and in the latter 75% of their market exchange value.

Steem’s Funding Model

The reasons someone might hold STEEM instead of STEEM POWER is that STEEM POWER can only be cashed out (i.e. powered down) in 104 equisized weekly withdrawals. Thus for example, a speculator who expects a rapid rise and then decline in the price might prefer the small weekly 1.34% debasement of STEEM’s value in order to cash out a large expected increase in the price before an expected decline. Additionally all transfers must be done in STEEM, i.e. STEEM POWER must be powered down before they can be transferred.

It is hoped that the transfers due to speculation and payments will dwarf the transfers due to entering and exiting STEEM POWER holdings, so that the funding for blogging rewards and mining is paid as a cost of doing transfers, and not effectively paid by the long-term investors. Because if this did not end up being the case, and STEEM POWER investors were paying the lion’s share of the debasement (such as if almost everyone converted their STEEM to STEEM POWER at all times), then Steem would likely be considered an unsustainable long-term investment (without a revenue model and all funding paid by investors) and the price might collapse. This is why it will be very important to develop Steem’s promotion to speculators and the development of Steem’s ecosystem for payments.

Steem is generating revenue for STEEM POWER investors taken from those who hold STEEM instead of STEEM POWER. We need to upgrade our conceptualization of revenue. Revenue is any gain in value not paid by the long-term investors! It is actually quite a clever paradigm-shift innovation on the definition of a revenue generating investment.

Steem’s Inflationary Model

Because Steem is always minting new tokens, then the STEEM market exchange price is unlikely to rise as rapidly as it probably would have if the Steem design had been deflationary. An alternative design for Steem would have been to take STEEM tokens from STEEM holders instead of minting new tokens. The market valuation effects would be the same on STEEM and STEEM POWER holders.

The only difference would be that bullish speculators would have more motivation to hold STEEM. But the psychological differences would be that STEEM holders would see their number of STEEM decreasing and STEEM POWER holders would see their number of STEEM POWER not increasing. Yet the price would hypothetically be rising faster to compensate and typically speculators tend to chase a rising price, so the price might even be rising more than proportionally faster. I can understand the psychological reasons this alternative design choice was not chosen.

Note the proposed alternative deflationary design (which is not the current design of Steem) could reach zero STEEM money supply (not STEEM POWER) which would then necessitate either a switch to the inflationary design until the supply of STEEM was restored or taking STEEM POWER tokens from STEEM POWER holders. The occurrence of such a “bottoming out” condition would indicate insufficient speculation and transactional demand for STEEM, to prevent debasement of the long-term STEEM POWER investors.

¹ Enter 1.9 in your calculator, press the xⁿ exponentiation key, enter (1÷365), and press the = key.

² ‘Steem’ is the name of the DPoS blockchain database and ruleset which powers Steemit.com.

³ Enter 2.0 in your calculator, press the xⁿ exponentiation key, enter (1÷365), and press the = key.

⁴ 50% of 190% = 95%

Congratulations @mahmudovk! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: