Monthly Crypto Portfolio Update (August 2018)

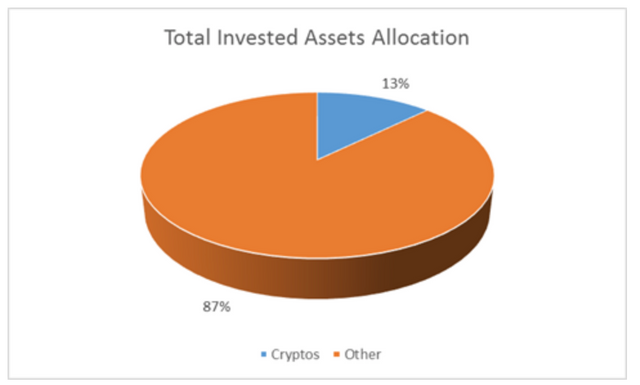

The rollercoaster ride of the cryptocurrency markets continue to thrill and spread fear among all of its participants! August was a tough month as it marked the first month in 2018 that the market actually traded below $200 billion in market capitalization as per CoinMarketCap. This represents a full turnaround from when the exponential increase in prices started in November 2017. Many investors have now completed quit and have the left given the substantial declines we have seen in 2018. Now even those that entered right before the hype are starting to feel the pain as price declines start to eat into their paper profits they once boasted about. However, it does seem that the market continues to consolidate and has begun to be more selective on the assets that are more quality than other. The main proof is that bitcoin continue to hold its low and has continues to gain strength in its dominance in the market. While the cryptocurrency markets were terrorized, stock markets continue to rise despite lots of noise due to trade wars and other geo-political tensions. This made my crypto portfolio shrink in size relative to my total invested assets:

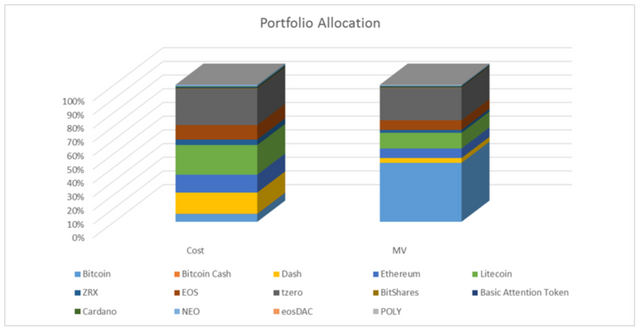

As I saw this trend and continue to be positive on blockchain technology, I added fiat to the portfolio and add to some existing positions. Despite the depressing price chart, I continue to like Litecoin because I feel it will be the best cryptocurrency to use for transactions once adoption is achieved. I also foresee it being my go-to asset for exchange transfers given its speed and low transaction costs. I also added to my Ethereum position in order to be ready to use for some purchases of smaller assets. During the lows of the month, I also continued to add to my #STEEM position which served to continue my power up goals in the long run. Lastly, while reviewing my position mid-month, I realized that I had received some GAS from my NEO stake. I was excited to see how these dividends came into my wallet with no effort. As the market continues to consolidate, I have begun to think about increasing exposure to some of these assets that provide income by staking. I added to my NEO position because of this and also added to my BAT position during the steep declines. Here is an updated view of the portfolio:

I have a decent amount of fiat on the sidelines waiting to continue to deploy in some of these assets as the market continues to consolidate. I often find myself tempted to buy bigger bulks of some given some of the prices we have seen but I still believe that dollar cost averaging continues to be the best strategy until we start to see more healthy price action on a technical perspective. However, #STEEM continues to be at the top of my list and I continue to buy every two weeks, no matter the price. At this rate, I may potential reach my 2018 goal in September which is great as I continue to find great projects worthy of delegation which continue to broaden my engagement with the community.

How has your portfolio faired this month with the new lows? I continue to see many assets at great prices but have not pulled the trigger, have you added any new positions lately? What is your investment thesis for the coming weeks? I look forward to seeing your thoughts and feedback in the comments below!

Follow me on Twitter: @NAICrypto

If you are like me and interested in continued personal growth, invest in yourself and lets help each other out by leveraging the resources they provide by using my referral link:

https://www.minnowbooster.com/referral/530636

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.

Diversification is definitely a key in investing in any asset class!

Posted using Partiko iOS

Not sure how I missed this post @newageinv, I may have unfollowed you do to my clear out last week. I have decided to follow fewer people so I could engage better with those that I do follow!

I am still very optimistic on Cardano. It has the best credentials of any of the projects I have come across. The problem with Cardano is that their technology is so advanced, very few understand what makes it so good.

Some call it the Japanese Ethereum, because of its smart contract abilities and possibly the link with Ethereums ex-CEO and co-founder, Charles Hoskinson.

Others talk about how it's different because it uses Proof of Stake, rather than proof of work like Bitcoin and Ethereum.

Some think it's like EOS, as a possible PoS platform, for running dapps or tokens.

What a lot of people are missing is the complete rewrite off all the code, from new, in the most secure programming language possible.

It's about doing more than showing a technology can do something or have a use case. It's about making sure that what ever it is designed to do, it does every single time without any flaws. That is a very high bar and that quality of work takes time.

The smart contract layer has a totally new VM being built that will be able to convert smart contracts written in a variety of languages to its native language. The test net allowes anything that can be written in Solidity (Ethereums smart contract programming language), to be ported into Cardano.

The system is being built from the ground up to allow side chains, which could then have custom features, allowing the whole Cardano system to have TPS faster than anything we've seen on any other platform.

I could talk about Cardano for hours lol

@kabir88

Great to see you back! I understand as I also go through some cleaning every now and then. Thanks for the thoughts on Cardano! I still have my eye on it as I think it has potential although the market seems to be rough to those projects that are not yet launched. Will be great to see them meet their roadmap objectives and deploy to demonstrate the power of their technology.