Analyzing Steem Basic Income ROI

As I mentioned before I’m very enthusiastic about the principle of a universal basic income in general and @steembasicincome in particular. Since I now have some experience in the program I thought it would be nice to dive a bit deeper in the data behind it.

Steem Basic Income

Steem Basic Income is a social experiment to bring a basic income to as many Steemians as possible. Members join by sponsoring others into the program. Steem Basic Income is delivered through providing regular upvotes to member content.

Source: Pixabay

My personal SBI data

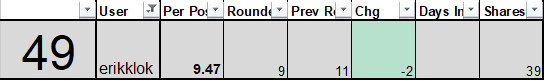

At the moment I own 39 SBI shares. These consist of 19 shares I bought myself (sponsoring others) and 20 shares that I got sponsored from other Steemians. I bought my shares with STEEM that I bought with fiat for about $1.72 each. This means that, in total, I “invested” about $33 in 39 SBI-shares.

Source: SBI Spreadsheet

My personal SBI ROI

Based on data from last week, I get on average an author reward of 0.167 SDB and 0.046 SP for the upvotes by @steembasicincome. With the current prices (STEEM: $2.95; SBD: $2.46) this is equal to $0.55. That means that, when all prices stay the same, I would need 60 upvotes to earn back my own investment. Given that I post 4 to 5 blogs a week that would take 12 to 15 weeks.

Measuring Return on Investment (ROI) is usually done on a yearly basis. Given my personal SBI data and the current prices I could earn about $109 a year (based on 50 weeks a year and 4 posts per week). The ROI for the first year would then be 234%. For a five year period that would even grow to 314%, since I only have to buy the shares once.

Source: Pixabay

Measuring ROI in STEEM

Since STEEM and SBI prices are highly volatile it would be better to calculate the Return on Investment not in dollars but in STEEM. However, since the price of the Steem Dollar (SBD) is not always equal to the price of STEEM and most rewards are paid out in SBD, we also have to make an assumption here. To make sure I’m not too positive I assume the price of SBD to be at 0.85 STEEM on average.

Aspects to take into account

The ROI highly depends on your activeness on Steemit and the percentage of SBI-shares you aid for yourself. Obviously when you didn’t buy any of them yourself your ROI is infinite, since there is no investment. You could also argue that when you don’t buy STEEM with fiat your ROI should also be infinite. However, since you also could use the STEEM you buy SBI-shares with for other actions that make you earn money - e.g. increasing SP and curating posts – I do not take that into account.

Results

Now it’s time to show the outcome of the analysis based on a 5 year period. In the table below the ROI for different types of people is shown. Depending on the number of posts per week and the percentage of shares that you bought yourself the ROI differs. Obviously, the higher your activity and the less shares you bought yourself lead to a higher ROI. The good thing is that, even if you are very inactive (1 post a week) and you bought all your shares yourself the ROI is still 4% over this 5 year period.

In general the average participant will buy about 50% of his/her shares (since you always buy one for yourself and sponsor someone else). Given that, ROI for a moderately active Steemian would be between 75% and 200% yearly. That means that you would have gained 3.75 to 10 STEEM for every STEEM that you used to buy your SBI share. Sounds like a good deal to me!

Roundup

To round up, here are the main findings for my data analysis:

- I earn my SBI-investments back in 12 to 15 weeks;

- My 5-year annualized ROI should be around 200% to 300% (when STEEM and SBD prices stay the same);

- Even inactive people can make a return on their SBI “investments”;

- The ROI for an average Steemian should be between 75% and 200%.

But, most prominently:

Steem Basic Income has a very high Return on Investment

Questions?

Just let me know if you have any questions or whether you think I missed come crucial aspects of the calculation. I’m happy to share my calculation sheet, so don’t hesitate to ask me for that.

Thanks for the write-up! Our own calculations show about 80% ROI on average right now, but that does not include the bonus members can receive for upvoting our posts.

I would like to make one small correction. We calculate member upvote weight on a weekly basis, and then adjust for individual posting frequency. So while posting frequency might impact ROI a little bit from rounding differences, over time it should have no impact (as long as the member is posting at least once per week).

We designed it this way so that members can maintain the posting frequency they are most comfortable with, instead of feeling pressure to at least get out something every day.

Great that your comment on my post. It is very much appreciated!

Thanks also for the correction. I wasn't aware that this was part of the calculation. Good to know for my future posts.

80% ROI already is very high. And I very much like the idea of a bonus for upvoting your posts.

You are doing a great job. Keep up the good work!

Thanks for your support! We try to keep a balance between sustainability and attractive ROI. At present the ROI is actually in decline; it was over 100% when SBD price was high.

You mean 80%/year?

Yes, that's per year.

@steembasicincome So, you make back your investment in the first quarter of the second year, double it in 2 and a half years. It doesn't afford you compound interest, but it does afford you an income, which is nice!

We do have some members with enough shares that they can effectively compound. That's much harder to do from a single share base.

I use my upvotes to reinvest in the sbi plateform. Its a great way to compound your investment. However I do currently have 390 shares woth 100% upvote bonus. So it takes a good investment before you can do this.

Really interesting article! I always wondered what the ROI was but never thought about calculating this myself!

Thanks!

I like to do this kind of data crunching, so it was nice to dive in this a bit deeper.

Do you have any other ideas or upcoming analysis?

Maybe we could do something together?

Now it seems we still need to calculate. Or just trust the 80% mentioned by the project itself.

I wonder if Erik will do a new calculation? I planned to do it myself, but that was already 2 months ago.

I also wonder if these calculations took the curation fee into account?

Hi @crypto-econom1st. I was indeed planning to do a new calculation based on the feedback from the project. I expect that I won't have time till next weekend, so I'll probably do it then.

Besides that I don't have ideas yet for new analyses, but I'm happy to cooperate on new ideas.

I'm very new to the steemonian community. I don't understand a lot of the above, but I'm visiting a friend tomorrow and we will discuss it. Thanks man.