Steemit price decreasing

irtual currencies with good return, STEEM can be a bad, high-risk 1-year investment option. Steem price equal to 0.397 USD at 2019-01-22, but your current investment may be devalued in the future.

Current Price: 0.397 USD

7 Days Forecast

Get It Now!

1-Year Forecast *

▼ 0.000001 USD

Get Crypto Loan: Get cash using crypto as collateral without selling it.

Steem Forecast, Short-Term STEEM/USD Price Prediction for Next Days and Weeks

Steem prediction details

Steem (STEEM) forecast & cryptocurrency price prediction for next days, Steem future priceWalletinvestor.com

Steem Forecast, Long-Term Price Predictions for Next Months and Year: 2019, 2020

Steem prediction details

Steem (STEEM) price forecast, prediction, Steem future priceWalletinvestor.com

Detailed Trend Components of the Steem Forecast & Prognosis

Steem prediction details

Steem (STEEM) price forecast, cryptocurrency prediction components, Steem future price

SEARCH

Hacked: Hacking Finance

Hacked: Hacking Finance

Login Join

ALTCOINSSTEEM Price Surges 31% Ahead of Steemit Velocity HardforkPublished 4 months ago on September 24, 2018 By Greg Thomson

.jpeg)

The value of Steem (STEEM) surged over 31% on the afternoon of Monday, September 24th, as the team prepare to implement ‘Hardfork 20’ – codenamed Velocity – tomorrow on the 25th. The hardfork will make multiple changes to the blockchain that underpins the Steemit social media platform, and full details can be read on the official Steemit blog.

STEEM Price Jumps 31%

Whether the flurry of activity in STEEM markets can be interpreted as a sign of faith in the upcoming updates is up for debate. The STEEM price has been climbing steadily since September 12th since falling to the $0.65 range. Today’s peak of $1.12 puts STEEM on over 70% growth in the last twelve days, outpacing the majority of altcoins with the exception of recent headline-grabbers like XRP and Stellar.

On Monday afternoon the coin price surged 31%, climbing from a price of $0.852111. The majority of those gains came in less than an hour, between 16:00 and 16:30 UTC. The highest single concentration of trades comes in the form of STEEM/USDT on Huobi, while the rest of the market is shared predominantly between STEEM/BTC and STEEM/KRW.

KRW (Korean won) trades make up 33% of the day’s total, continuing the trend from the last few days where the majority of the market pump could be attributed to eastern markets, and KRW in particular.

Steemit Velocity Hardfork

The Steemit social media platform utilizes three currencies in its operation, including a perpetually dollar-pegged coin in the form of SBD, and an internal ‘weighting’ currency called Steem Power that denotes influence and cannot be quickly liquidated.

More details can be read on Steemit’s currencies here, but the point is that Steemit’s internal economy is a finely-tuned machine with lots of moving parts. The upcoming Velocity hardfork will further adjust those moving parts, addressing the community’s pooled funds, new user account creation, the percentage of a post’s payout to authors and curators, and much more. According to the Steemit blog:

“The changes in the Velocity Hardfork are dependent on the approval of a super-majority (17/21) of the witnesses voting in favor of the Hardfork.”

The team also released this short primer for new users and witnesses to the Steemit blockchain ahead of the hardfork on Tuesday, noting the decision-making process:

“Witnesses should review the changes in the hardfork release. If they agree with the changes, they should run the new version of Steem at their earliest convenience. By running the new version of Steem, they are casting their vote for the changes. By choosing not to run the new version of Steem they are casting their vote not to hardfork.”

Stay tuned for more developments tomorrow when the hardfork is implemented at 15:00 UTC.

Featured image courtesy of Shutterstock.

Important: Never invest (trade with) money you can't afford to comfortably lose. Always do your own research and due diligence before placing a trade. Read our Terms & Conditions here. Trade recommendations and analysis are written by our analysts which might have different opinions. Read my 6 Golden Steps to Financial Freedom here. Best regards, Jonas Borchgrevink.

Rate this post:

Important for improving the service. Please add a comment in the comment field below explaining what you rated and why you gave it that rate. Failed Trade Recommendations should not be rated as that is considered a failure either way.

0 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 5 (0 votes, average: 0.00 out of 5)

You need to be a registered member to rate this.

Greg Thomson

4.5 stars on average, based on 125 rated posts

Greg Thomson is a full-time crypto writer and digital nomad. He eats ICOs for breakfast and bleeds altcoins. Wherever he lays his public key is his home.

Feedback or Requests?

RELATED TOPICS:SBDSTEEM COIN PRICESTEEM POWERSTEEM/BTCSTEEM/USDSTEEMIT

UP NEXTCrypto Exchanges: Looking For Guaranteed Results

DON'T MISSSelling Pressure Hits Bitcoin, Altcoins Following Large Rally YOU MAY LIKE

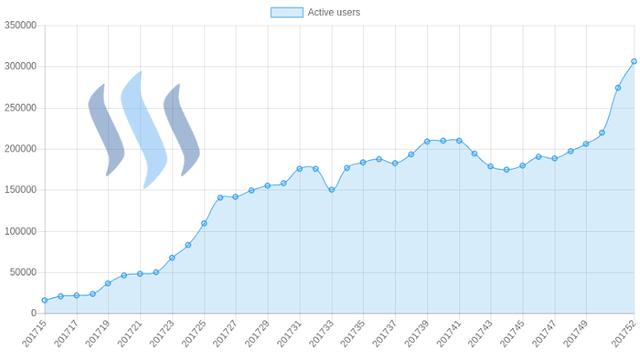

STEEM Coin on the Move While Steemit Loses 20 Million Visitors in Six Months

Trade Recommendation: Steem

Why Investors Should Pay Attention to Steem

Steemit Hardfork Hiccup Fix In Works; STEEM Loses Recent Gains

Coordinated Pump Pushes Steem Coin Price Up 25%

Trade Recommendation: STEEM

CLICK TO COMMENT

ALTCOINSBlockchain Goes Mobile: The First Crypto MVNO Announces Loyalty Rewards ProgramPublished 11 hours ago on January 22, 2019 By Daniel Mitchell

This week, Miracle Tele (blockchain based Mobile Virtual Network Operator / MVNO) announced the public launch of a loyalty rewards program which has been available to token-holders and investors since last October.

The rewards are distributed in the form of an exchangeable crypto token, compared to the non-fungible ‘points’ systems more commonly known (redeemable only for products created by the points distributor).

In this scenario, the customer is afforded full freedom with how they choose to spend their rewards. As far as this writer is aware, the scheme is the first of its type to be offered by any MVNO provider, although it wouldn’t be the first for an MNO.

MNOs and MVNOs

‘Mobile network operators’ (or MNOs) is the term used to describe most of the best known mobile network service providers, such as T-Mobile and O2.

MNOs are wireless cellular providers which possess whole ownership of all the necessary operational components required for the sale of mobile telecom services.

‘Mobile virtual network operators’ (or MVNOs) are companies that enter into a service agreement with the aforementioned MNOs in order to rent their services at a business or wholesale rate.

These companies subsequently apply their own business ideologies, as well as market offerings (unique service packages and value-lines) ideally to contribute to bringing a greater level of competition and choice in the mobile telecom marketplace.

Blockchain in the Mobile Space

Miracle Tele isn’t the first blockchain based company operating in the mobile phones area, and it most likely won’t be the last!

Last year, popular blockchain trading-game ‘Crypto Kitties’ hit the news yet again for being integrated into all factory-setting HTC U12+ devices (the flagship smartphone for the company in 2018).

It wouldn’t be the first time HTC has flirted with crypto either, like when they controversially sold that ‘HTC Exodus 1‘ phone exclusively in exchange for cryptocurrency.

Additional examples of blockchain-based product developers or service providers within the mobile space include providers of token wallets and mobile-apps for exchange. In addition to SBI-backed mobile payments token ‘S Coin’.

Blockchain MVNOs Viable?

There is very little competition of note that is bridging the gap between blockchain and MVNOs, suggesting that the companies we do see will be representative of whether such partnerships will build or bust in the following year(s).

For those interested in learning more about MVNOs in the blockchain space as well as / enjoying my prose, I recommend that you check out an article I wrote here at Hacked.com about how an underrated star in crypto (Electroneum) recently partnered with such a company, growing its portfolio of real-world use cases for p2p financial transaction in line with its mission statement.

Another company in the space, however with less legitimate coverage is one by the name of ‘YOVO’.

Disclaimer: The author owns small quantities of Bitcoin and Ethereum. He holds investment positions in the coins, but does not engage in short-term or day-trading.

Featured image courtesy of Shutterstock.

Important: Never invest (trade with) money you can't afford to comfortably lose. Always do your own research and due diligence before placing a trade. Read our Terms & Conditions here. Trade recommendations and analysis are written by our analysts which might have different opinions. Read my 6 Golden Steps to Financial Freedom here. Best regards, Jonas Borchgrevink.

Rate this post:

Important for improving the service. Please add a comment in the comment field below explaining what you rated and why you gave it that rate. Failed Trade Recommendations should not be rated as that is considered a failure either way.

0 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 5 (0 votes, average: 0.00 out of 5)

You need to be a registered member to rate this.

Daniel Mitchell

4.5 stars on average, based on 12 rated posts

Feedback or Requests?

CONTINUE READING ALTCOINSGBP/USD Price Prediction: Bulls Reclaim 1.2900, Eyes Locked on Another Retest of 1.3000Published 14 hours ago on January 21, 2019 By Ken Chigbo

GBP/USD bulls pick up momentum to the upside, following generally positive tone to Theresa May’s Plan B statement.

Next upside targets for the bulls should they firmly breakdown 1.2900 again, will be the psychological 1.3000 mark.

GBP/USD throughout the session on Monday remained very much elevated. This came as market participants were somewhat maintaining an optimistic view. All of which heading into the British Prime Minister Theresa May’s speech to the House of Commons, on her Brexit plan b. Of course, this had to be drafted again, given her humiliating defeat at the vote last week, on the initial EU withdrawal plan.

Theresa May Plan B

In terms of her details this time round, she will be going back to Brussels, to seek some amendments to her initial agreement. This needs to be done in order to get a plan through another vote in the commons. Looking at some of the GBP bullish takeaways from this statement; she guaranteed rights for EU citizens at several angles, scraping the application fee EU nationals registering in Britain, discussing the backstop with the DUP this week.

To conclude, PM May appears keen in her language to ensure of a soft-Brexit, rather than one that is hard. All of which supported GBP in its push to session highs, at the time, briefly moving back above 1.2900. The price had given up this area on 18th January, when the bears were reversing the run observed on 17th, where GBP/USD touched to big psychological 1.3000 mark again.

Technical Review – GBP/USD

GBP/USD 60-minute chart. Near-term resistance eyed at 1.2900, with bulls locked in on a retest of 1.3000.

GBP/USD at the time of writing continues to trade around the 1.2900 territory. This price did see a brief period cooling, on touted profit-taking post the statement. Near-term resistance can be seen within this price region, but if convincingly broken down again, then there is decent upside potential. Aside from the supply observed here, there isn’t much in the way of the 1.3000 price region.

Given the renewed optimism around Brexit now, this has assisted in maintaining momentum to the upside for GBP. In terms of support to the downside, a strong area of demand should be noted at 1.2850-25 price region. As can be seen via the 60-minute chart view, this has supported the price since 15th January.

Featured image courtesy of Shutterstock.

Important: Never invest (trade with) money you can't afford to comfortably lose. Always do your own research and due diligence before placing a trade. Read our Terms & Conditions here. Trade recommendations and analysis are written by our analysts which might have different opinions. Read my 6 Golden Steps to Financial Freedom here. Best regards, Jonas Borchgrevink.

Rate this post:

Important for improving the service. Please add a comment in the comment field below explaining what you rated and why you gave it that rate. Failed Trade Recommendations should not be rated as that is considered a failure either way.

0 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 5 (0 votes, average: 0.00 out of 5)

You need to be a registered member to rate this.

Ken Chigbo

4.6 stars on average, based on 112 rated posts

Ken has over 8 years exposure to the financial markets. During a large part of his career, he worked as an analyst, covering a variety of asset classes; forex, fixed income, commodities, equities and cryptocurrencies. Ken has gone on to become a regular contributor across several large news and analysis outlets.

Feedback or Requests?

CONTINUE READING ALTCOINSBitcoin Cash Price Analysis: BCH/USD Rejected Again by Long-running Descending Trend LinePublished 23 hours ago on January 21, 2019 By Ken Chigbo

BCH/USD bulls attempted moving above vital descending trend line capping upside; however , they were dealt another rejection.

A recent study suggest Bitcoin Cash is not using anywhere near its full block capacity.

Bitcoin Cash Bulls Fails to Break Big Resistance

Bitcoin Cash price on Monday is trading in minor negative territory, nursing losses of just some 0.5%, at the time of writing. Over the past three sessions, BCH/USD has traded very closely to a descending trend line. The price continues to face rejection when attempting to break above the aforementioned line; however, the bulls do not have enough momentum. This trend line has been in play since 6th November, right at the start of the pick up in downside, at the back end of 2018.

While BCH/USD was confined below the above-mentioned resistance, it fell a chunky 88%. It had dropped from around $650, down to a low of $73.50 on 15th December. Given the current failure to press ahead and break above, the price once again could be knocked back south.

Bitcoin Cash Block Capacity Failure of Use

There is now 500 days’ worth of data to analyze the capacity of Bitcoin Cash when looking at its block size. A recent study conducted by LongHash suggests that the Bitcoin (BTC) blocks on average have been 30x larger than Bitcoin Cash.

Looking at the figures, in terms of Bitcoin Cash, the block size on average has reported to have been just 171 KB since the fork back in August 2017. In real terms, this represents just 2.1% of the total block capacity for BCH. On just one day there the BCH blocks have been more than half full. Back on 15th January 2018, the blocks were able to average 59% of their total capacity, as covered by the recent study.

The study from LongHash further goes on to say, that some will believe that the BCH blocks not nearing their full capacity is a potential positive sign. However, this can also be seen as a lack of interest in Bitcoin Cash, which is somewhat concerning. Most recently, over the past 30 days, the blocks of BCH have averaged just a small 34 KB, which is just around 3.7% of the roughly 923 KB blocks of Bitcoin over that same period.

Technical Review – BCH/USD

BCH/USD daily chart.

Keeping in mind the earlier described rejections for the price, eyes should now note the coming key areas support. Firstly, just ahead of the big psychological $100 mark, at $105, which is an important daily support. The price had last traded around this level between 6-10th December, as it sought comfort at the time, before resuming its move south. If this fails to hold, then a retest of the December low and 2018 low at $73.50 would likely be on the cards.

Disclaimer: The author owns Bitcoin, Ethereum and other cryptocurrencies. He holds investment positions in the coins, but does not engage in short-term or day-trading.

Featured image courtesy of Shutterstock.

Important: Never invest (trade with) money you can't afford to comfortably lose. Always do your own research and due diligence before placing a trade. Read our Terms & Conditions here. Trade recommendations and analysis are written by our analysts which might have different opinions. Read my 6 Golden Steps to Financial Freedom here. Best regards, Jonas Borchgrevink.

Rate this post:

Important for improving the service. Please add a comment in the comment field below explaining what you rated and why you gave it that rate. Failed Trade Recommendations should not be rated as that is considered a failure either way.

0 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 50 votes, average: 0.00 out of 5 (0 votes, average: 0.00 out of 5)

You need to be a registered member to rate this.

Ken Chigbo

4.6 stars on average, based on 112 rated posts

Ken has over 8 years exposure to the financial markets. During a large part of his career, he worked as an analyst, covering a variety of asset classes; forex, fixed income, commodities, equities and cryptocurrencies. Ken has gone on to become a regular contributor across several large news and analysis outlets.

Feedback or Requests?

CONTINUE READING

Crypto Update: 5 Altcoins to Watch This Week

Crypto Update: 5 Altcoins to Watch This Week

Blockchain Goes Mobile: The First Crypto MVNO Announces Loyalty Rewards Program

Blockchain Goes Mobile: The First Crypto MVNO Anno...

ICO Analysis: BitTorrent Token

ICO Analysis: BitTorrent Token

U.S. Stock Futures Fall on Brexit, China Growth Woes; Lifeless Crypto Market Drift Sideways

U.S. Stock Futures Fall on Brexit, China Growth Wo...

Bitcoin Turns Defensive Following Sunday Slide; Binance Euro PlatformCopyrigt

hotchedmothe.club is a rogue website (very similar to cliksource.cool, defpush.com, sociatemethio.club, and a number of others) designed to cause redirects to other dubious sites. Users often arrive at this site unintentionally, since potentially unwanted applications (PUAs) force redirects to it. Furthermore, users often install PUAs accidentally or inadvertently. When installed, these apps feed users with intrusive advertisements and collect browsing-related (and other) data.