Why don't you mind your business!

Many of us hear friends, family, and associates talk about starting businesses all the time. The photography thing, the bakery, the marketing company, and so many others.... Some times, you hear much more talk than you see any actual action. Have you ever heard the greatest idea but it was never put into motion? And you ask, "what ever happened to that 1 plan you had? Did you ever do anything with that?". And sadly, more times than not, it's usually a no, compounded with another excuse for their procrastination or fear that has plagued the blossoming of many brilliant ideas. We all deal with this and at some point, you have to ask,

"What the heck are you waiting for?"

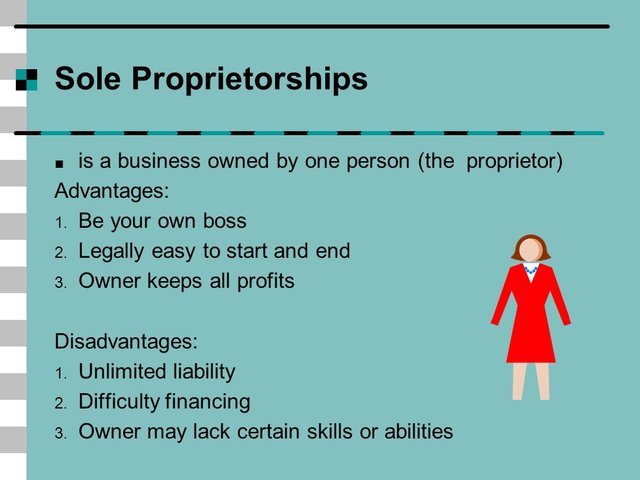

In most cases, many feel the process of starting a business is really complicated. "I don't want to go through all that stuff" I hear, "unless I'm absolutely sure my idea is perfect." Like a lot of would-be entrepreneurs, stalling because they're intimidated by the apparent complexity of the administrative and legal tasks involved in starting a business.

Would you believe that most of the necessary tasks needed can be done in less than 3 hours?

Keep in mind, I'm only talking about setting yourself up to do business: I'm not talking about writing a business plan (although if that's what you want to do, you should take your time, look up tips if need be).

The goal is to get off square one and get on to the fun stuff.

Here's how:

- Get over the company-name thing.

Many people agonize endlessly over dreaming up the perfect company name. Don't. If you're waiting until you come up with the perfect name, you're also waiting to start making money.

Instead, at least for now, forget branding and unique selling propositions and all the business-identity stuff. And don't worry about finding the perfect URL or website design or promotional literature. Bring those horses out the stable a little bit later.

Just pick a name so you can get the administrative ball rolling.

Remember, your business can operate under a different name than your company name. (A "doing business as" form takes minutes to complete.) And you can change your company name later, if you like.

- Get your Employer Identification number (EIN).

An EIN is the federal tax number used to identify your business. You don't need an EIN unless you will have employees or plan to form a partnership, LLC, or corporation.

But even if you don't need an EIN, get one anyway: It's FREE, takes minutes, and you can keep your Social Security number private and reduce the chance of identity theft, because if you don't have an EIN, your SSN identifies your business for tax purposes.

Note: If you're using an online legal service to set up an LLC or corporation, don't use it to get your EIN. Instead, apply online at the IRS website. You'll have your EIN in minutes.

Now it's time to head to your locality's administrative offices.

- Register your trade name.

If you won't operate under your own name, your locality may require you to register a trade name. In most cases, you'll get approved on the spot.

- Get your business license.

Your county or city will require a business license. The form takes minutes to fill out. Use your EIN instead of your Social Security number to identify your business (for privacy reasons if nothing else).

- Complete a business personal-property tax form (if necessary).

Businesses are taxed on "personal" property, just like individuals. Where I live, no form is required for the year the business is established.

If you are required to file a business personal-property tax form and you plan to work from home using computers, tools, etc., that you already own, you won't need to list those items.

If you purchase tangible personal property during your first year in business, you will list those items when you file your business personal-property tax form the following year.

- Ask your locality about other permits.

Every locality has different requirements. In my area, for example, a "home occupation permit" is required to verify that a business based in a home meets zoning requirements.

Your locality may require other permits. Ask. They'll tell you.

- Get a certificate of resale (if necessary).

A certificate of resale, also known as a seller's permit, allows you to collect state sales tax on products sold. (There is no sales tax on services.)

If you will sell products, you need a seller's permit. Your state department of taxation's website has complete details, forms, etc., if you decide to apply online, but most localities have forms you can complete while you're at their administrative offices.

- Get a business bank account.

One of the easiest ways to screw up your business accounting and possibly get you a date with the IRS is to commingle personal and business funds (and transactions). Using a business account for all business transactions eliminates that possibility.

Get a business account using your business name and EIN, and only use that account for all business-related deposits, withdrawals, and transactions.

Pick a bank or credit union that is convenient. Check out your local credit unions; often they provide better deals than banks.

- Set up a simple accounting spreadsheet.

Worry about business accounting software like QuickBooks later. For now, just create a spreadsheet on which you can enter money you spend and money you receive.

Bookkeeping is simple, at least at first. All you need are Revenue and Expenses columns; you can add line items as you go.

Instead of spending hours playing with accounting software, dreaming up potential expense and income categories, and creating fancy reports with no data, spend that time generating revenue. As long as you record everything you do now, creating a more formal system later will be fairly easy. It will also be more fun, because then you'll have real data to enter.

Now you're an entrepreneur! With all the documents to prove it.

If you think someone can benefit from this information, please like, comment, tag, share, and resteem!! Good luck Steemians!! Don't forget to follow for more content.

Follow to Facebook, Instagram, Twitter:Mickeybreeze83

wow. when i get out of the military im planning on opening a yoga studio for my wife so that she can do her little practice! and i think it would be extremely fun, especially to watch her :P do you have your own business?

Sure do! I recently starting a marketing company. We provide commercials, jingles, event promo, photos, and more! Now coordinating all of these can be tricky but getting started wasn't as hard as I thought. And DEFINITELY, that Yoga studio sounds like a great idea! Keeps the wife actively busy and with the right business plan, that can be very profitable for you as well. Start working on it now.