Seven Financial Lessons We can Learn from the Chinese

Chinese in the Forbes List

When Forbes’ magazine came out with the richest Filipinos’, eight out of the top 10 are of Chinese descent. How is it possible that in a foreign land, these Chinese were able to make so much fortune? But even those not in this league, how could the Chinese, in general, overcome language barriers and become richer than most?

The Chinese were not rich to begin with. But if there is one thing we pride ourselves more than anything else is that we work hard to the best of our abilities. Each one of us grew up following financial lessons our parents and even grandparents constantly practiced throughout generations.

.jpeg)

1.) Save as much as you possibly can

Long before financial planning harped about saving 10 to 20 percent of your income, or even came up with the commandment, “pay yourself first”, the Chinese have been doing that at an even bigger percentage. When I was starting out, my mother asked me how much I was saving. Since I just learned of this rule, this is what I told her. She turned furious and labelled me as ‘maluho’. Apparently, she saves at least half of what she earns. And because the Chinese save a lot, they can easily raise capital for business and investments.

The Chinese propensity to save stems from their long term vision. They know at one point, they would be needing access to a huge amount of funds. They just don’t know when. So before that even happens, they save up for it as early and as much as possible.

.jpeg)

2.) Reinvest profits

In financial planning, we were taught the power of compounding interest. That is, your interest earning additional interest. The Chinese also applies the same principle in business and in their other investments. Rather than cashing in on the profits, they plough it back into the business for expansion so that the profits would grow exponentially.

John Gokongwei, Jr. did exactly just that. For the longest time, he confessed that they were just renting their home because he would prefer to reinvest the profits rather than using them to buy their own property. His move paid huge dividends (no pun intended) for him.

.jpeg)

3.) Practice delayed gratification

The richest Chinese are the first and second generation Chinese. They are the ones who have overcome tremendous odds to reach this level of wealth. And throughout the accumulation stage, they have disciplined themselves not to spend on unnecessary expenses. But once they are contented with what they have, that is when they are willing to splurge on luxuries. That is why most Chinese are financially free by the time they reach their golden years.

Case in point, my mother have scrimped and saved for the past 30 years. Living a simple life and not really spending on much wants. That means, we, her kids, also lived a simple life. Today, she could live on interest (and still leave a nice legacy to us) if she wants to; and travel the world using only her earnings.

.jpeg)

4.) Pay in cash

Despite the ability to pay for the whole amount, the Chinese still take advantage of discounts, no matter how small they are. For business owners, this means opting to pay in cash instead of credit. And because they were given discounts by their suppliers, they can also pass on the reduced price to their customers. More customers mean more profits.

The same principle applies in other purchases. When we were buying furniture for our new home, my mother bought everything in cash, or straight charged to avail of the discount. She then used whatever savings to buy other items.

.jpeg)

5.) Be debt free

The Chinese, in general, pride themselves in being debt free. However, that doesn’t mean they do not carry any debt at all. What they have is good debt; debt that they can leverage on to expand their businesses. And even if they have to borrow money, they keep it to minimum.

The Chinese understand that they are making others rich by paying interest—and they don’t like that. My cousin who works as a relationship manager once told me, “Hirap bentahan ng loans ang mga Chinese. Ni piso ayaw kaming pakitain.”

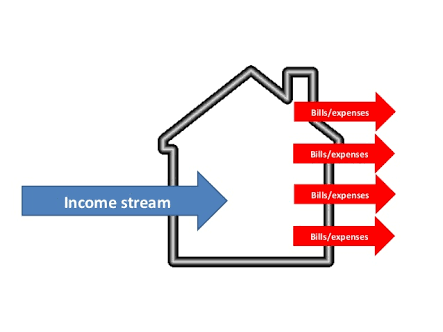

6.) Create multiple sources of revenues

Another reason why the Chinese earn a lot is because they know how to create multiple sources of income. They are realists. They know that not all the time a particular business will fare well. As early as possible, they engage in other activities or businesses that will provide additional income for them. Additional income means more savings; and more savings mean more money to invest.

My mother has been running a tutorial business for the past 30 years. Aside from tutoring, she decided to rent out her center to other teachers and charge them for every student that they tutor (rental income). Since she is adept in the school’s curriculum, she makes her own test papers, then sells these to other teachers or parents (royalty income).

.jpeg)

7.) Be reasonable

The Chinese didn’t become financially free by being too selfless. That doesn’t mean the Chinese are selfish either. What the Chinese practice is reasonable selfishness. They are willing to help or even support others but only to a certain limit. In contrast, and this is the only time I’ll make a comparison, the Filipinos will go out of their way to help others, even if it they will be burdened by it. I should know. I saw my students do this. However, this generosity is not repaid all the time, which leads to rift friendships among them.

I remember one time my father’s friend approached him to borrow some money. He relented. The second time, my father had to turn him away. When I asked him why, he replied that he will keep on coming back if he continues lending him money. He never saw him again—and the money he initially lent him.

The seven lessons I thought of stems from my own personal experience. I do not represent the entire Chinese population, but I am confident these are what we practice more or less. If you find these lessons valuable, there is no reason not to emulate what we do.

Thanks for sharing! Andami kong natutunan.. I also took down notes because your tips are really helpful. Thanks again!

your welcome emdesan! It's time for us Filipinos to change mindset . . .

Wow I think this is the best post I have read so far. Now I know why. Huhu. Even if I came from Chinese descent I don't think my grandpa taught his kids the Chinese way of thinking. :(

I am only practicing the value of saving the past year or so. It is so sad that I am late to doing this. Ah life.

What's the Chinese take on life insurance though? Like VUL?