Selling Short Strangles and Straddles - Does it work and what can you expect?

Dear trading community,

I have seen a lot of discussions on Twitter lately about the issue if selling naked strangles or straddles is a great strategy or a recipe for disaster.

If you have read my books or if you are following my sample portfolio, you know that I'm a huge fan of selling short strangles and straddles.

But with undefined risk strategies comes theoretical unlimited risk.

Therefore it is crucial that you follow the rules I pointed out in my books and which are mentioned about almost every day on tastytrade

Rules:

- do not use more than 40 - 50% of your available capital on your overall portfolio

- do not use more leverage than 3x notional of your net liq (if you have a $100k account, don't go over $300k notional)

- manage at 21 DTE to avoid gamma risk

- manage your strangles at 50% of max profit and your straddles at 25% of max profit.

- spread your risk among lots of uncorrelated underlyings

- commit capital based on IVR or the VIX (high VIX risk up to 50% on your overall portfolio, if VIX is low, risk less)

Now let's have a look at what you can expect in profit if you sell different type of strangles/straddles:

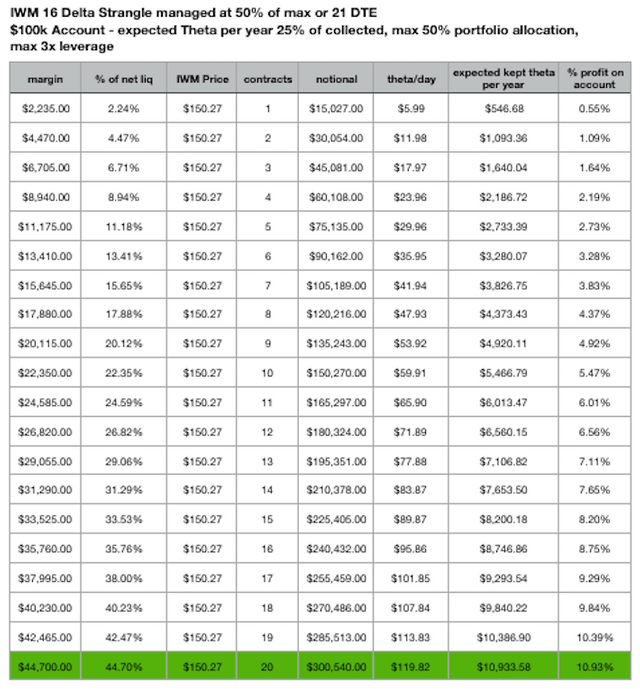

16 Delta Short Strangles:

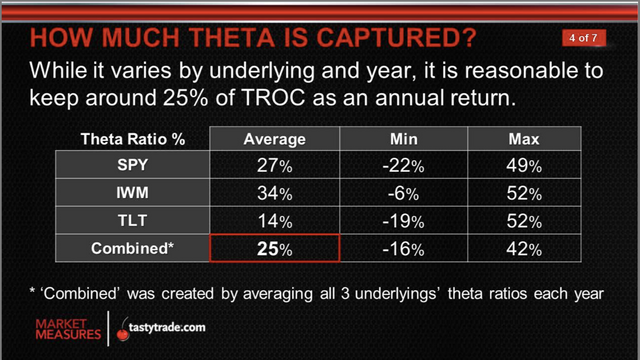

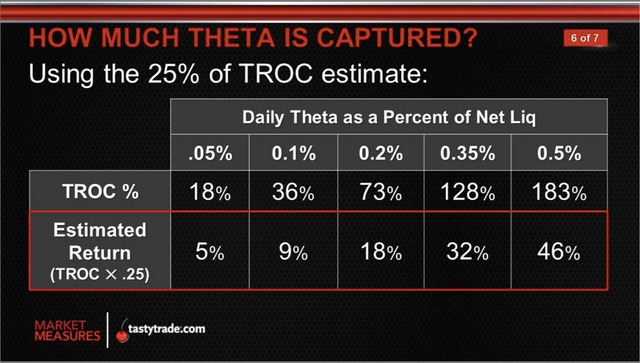

tastytrade has shown in a study that you can expect to keep 25% of the daily theta if you sell 16 delta short strangles in SPY, IWM and TLT.

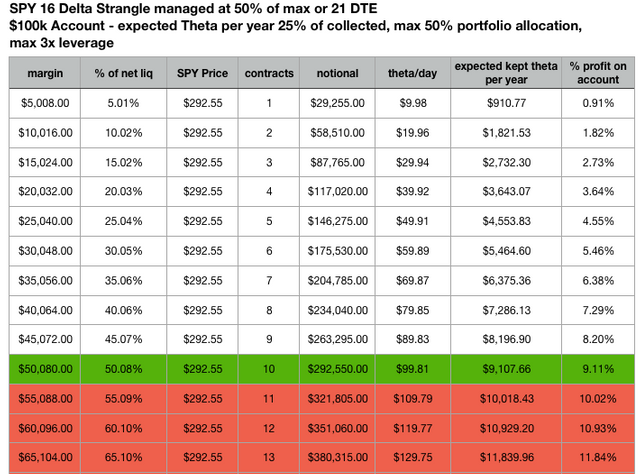

Let's have a look at how much contracts you could sell, until you exceed 50% of your capital in margin requirement and/or 3x notional leverage and how much money you would make in a full year.

For the study I was using August 13th 2019 closing prices.

Although the percentage of theta you can expect to keep is higher than 25% in SPY and IWM, I was using the 25% number, to be more conservative.

SPY 16 Delta Strangles

As you can see, if you just sell 16 delta short strangles in SPY, you can expect to make 9.11% in profit, if you go up to 3x notional leverage.

IWM 16 Delta Short Strangles

As you can see, if you just sell 16 delta short strangles in IWM, you can expect to make 10.93% in profit, if you commit 50% of your buying power.

Now let's have a look at short straddles.

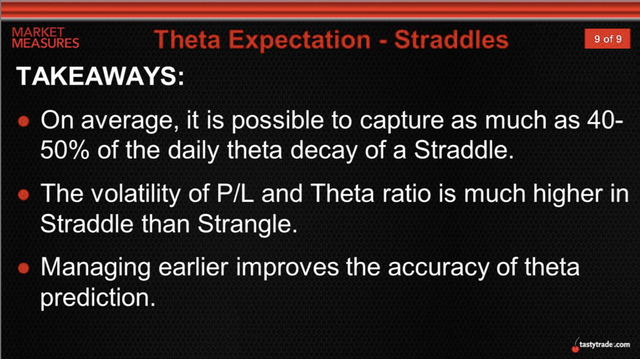

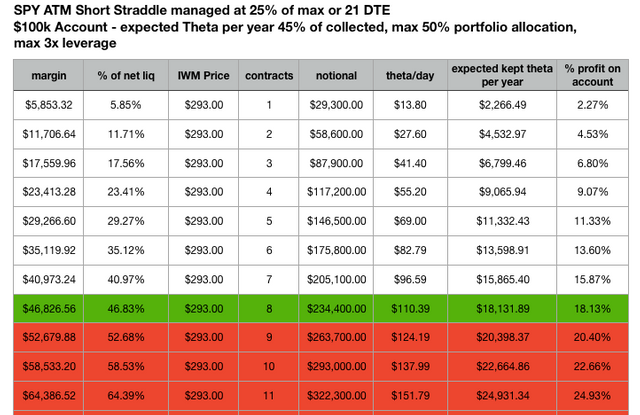

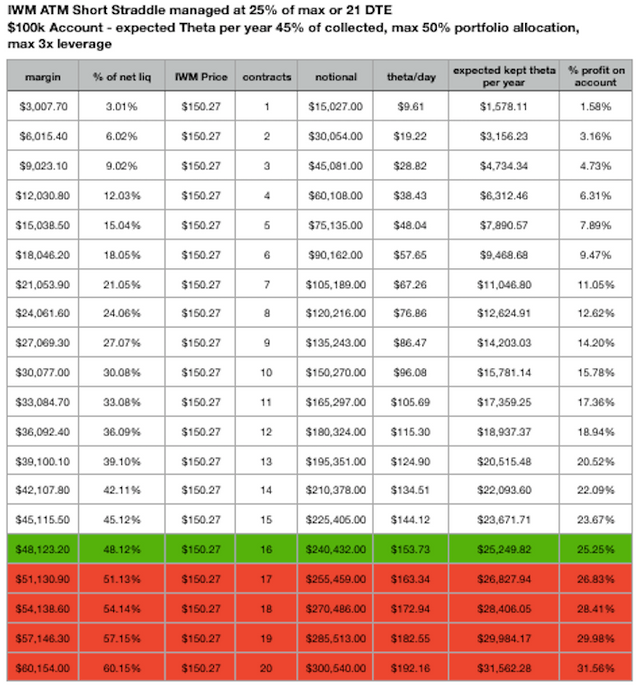

tastytrade has shown in a study that you can expect to keep 40-50 % of the daily theta if you sell atm short straddles in SPY.

Let's have a look at how much contracts you could sell, until you exceed 50% of your capital in margin requirement and/or 3x notional leverage and how much money you would make in a full year.

For the study I was using August 13th 2019 closing prices.

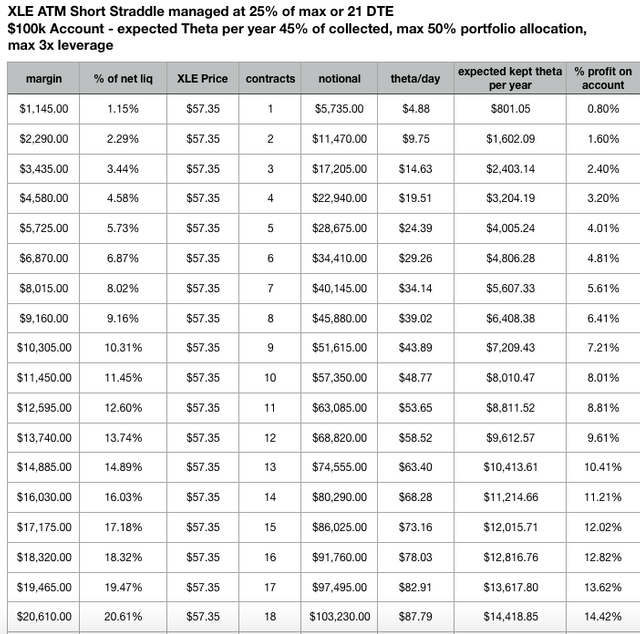

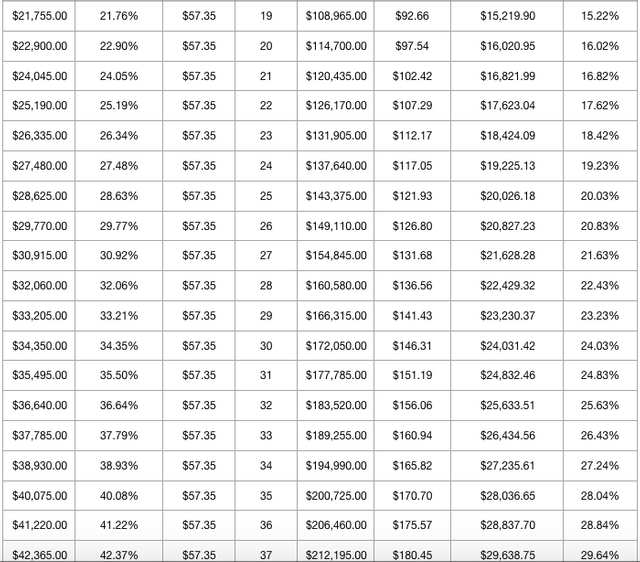

For the daily theta you can expect to keep, I was using 45% as the tastytrade suggested.

SPY Short Straddles

As you can see, if you just sell atm short straddles in SPY, you can expect to make 18.13% in profit, if you commit 46.83% of your buying power.

IWM Short Straddles

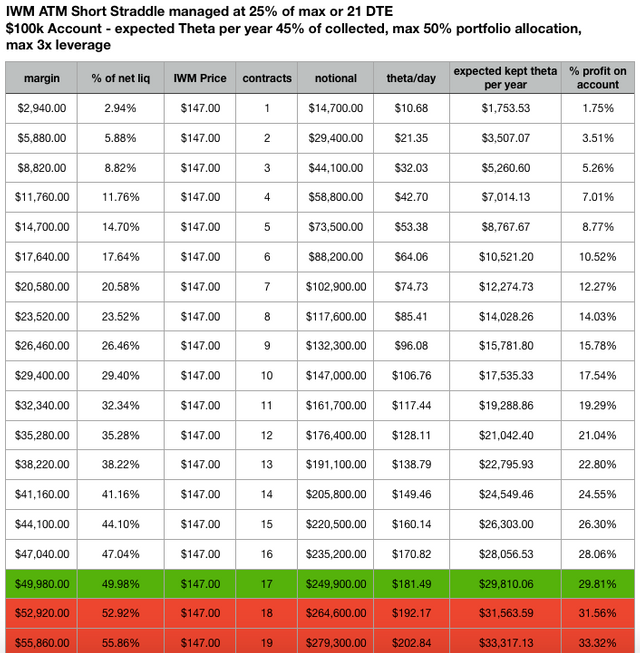

As you can see, if you just sell atm short straddles in SPY, you can expect to make 25.25% in profit, if you commit 48.12% of your buying power.

Since we want to diversify our portfolio, let's have a look at the 5 most uncorrelated underlyings, which I showed in my first book.

For these examples I was using today's (August 14 2019) prices right at the open.

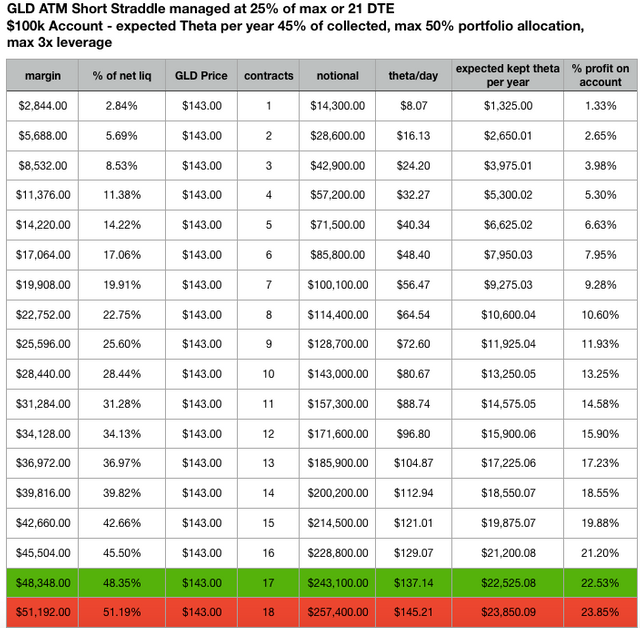

GLD Short Straddles

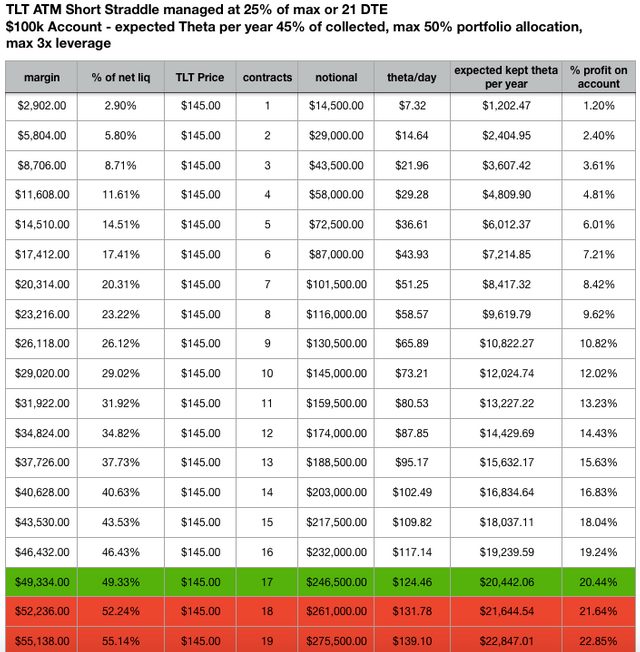

TLT Short Straddles

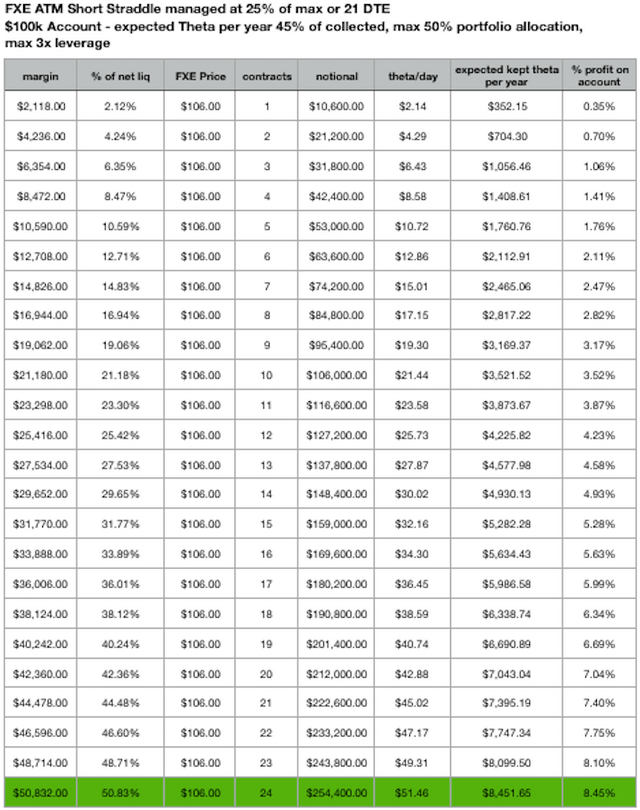

FXE Short Straddles

IWM Short Straddles

XLE Short Straddles

In the next article I will show you how to build a portfolio with these five underlyings and how to commit your capital based on the VIX, so that you don't get wiped out in a move we experience at the moment.

If you want to learn more about options trading, please check out my books:

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great trading day,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.